What Does Contributions to Self-Employed Retirement Plans - CCH Mean?

from web site

/401k-retirement-plan-beginners-357115_FINAL2-430f125e634544fe80440a1cf026eafe.png)

Some Known Incorrect Statements About 6 Ways to Save for Retirement When You're Self-Employed

Page Last Reviewed or Upgraded: 15-Nov-2021.

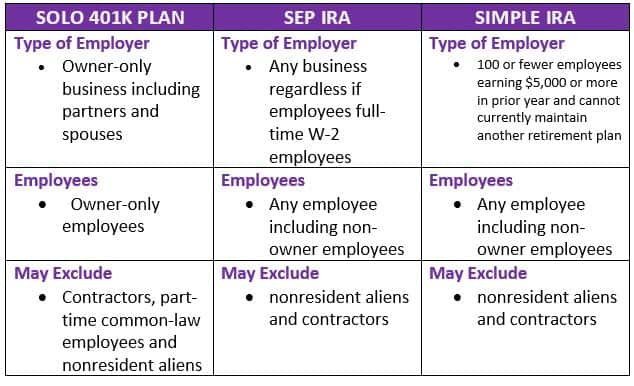

A variety of retirement strategies are readily available to organization owners, independent specialists, and individuals who work for themselves beyond traditional employment. These strategies supply tax benefits for contributions, however each has various guidelines, requirements, and contribution limits. It is essential for the self-employed and those operating in the gig economy to select the type (or types) most suitable for their requirements and follow internal revenue service guidelines for contributions.

1. SEP-IRAsSEP- Need More Info? , or Streamlined Employee Pension IRAs, offer a low administrative burden and high contribution limitations. Since of those high limits, they have mostly replaced Keogh prepares, which were typical prior to 2001 but are now referred to as qualified plans and have actually mainly fallen out of favor. Self-employed people can contribute to SEP-IRA plans, as can service owners-- however, company owner should make contributions for all employees at the very same set portion of worker pay.

2. Solo 401(k)sSolo 401(k)s are comparable to employer-provided plans and use high contribution limitations, however there's also a reasonably high administrative burden, and some brokerage companies charge costs for solo 401(k)s. You can not add to these accounts if you have staff members other than your partner. However, you can choose whether to decide for a standard 401(k) that you add to with pre-tax dollars or a Roth IRA that you contribute to with after-tax dollars (but which permits tax-free withdrawals in retirement).

The Facts About Self-Employed Retirement Plans - Valley Financial Solutions Revealed

Those aged 50 or over are eligible for an extra $6,500 catch-up contribution, bringing the total contribution limit to $63,500 in 2020 and $64,500 in 2021. The contributions break down as follows: Approximately $19,500 as an employee. Catch-up contributions are likewise made as a staff member. These are the limits for both 2020 and 2021.

Net self-employment earnings amount to net earnings minus your SEP contribution (excluding any catch-up contribution) and half of self-employment taxes. If you have a spouse who is used by and makes income from this business in some capacity, you can make the same contributions for each of you. 3.

You are qualified for an EASY IRA as a self-employed employee or if you have a business with up to 100 staff members. Both staff members and companies can contribute to a person's SIMPLE INDIVIDUAL RETIREMENT ACCOUNT: Staff member contributions are restricted to 100% of wage or $13,500 in 2021, whichever is less. The limit increases in 2022 to $14,000.