Getting My Division of Insurance Group Health Insurance - South Dakota To Work

from web site

The Only Guide for State Group Health Insurance - Human Resources

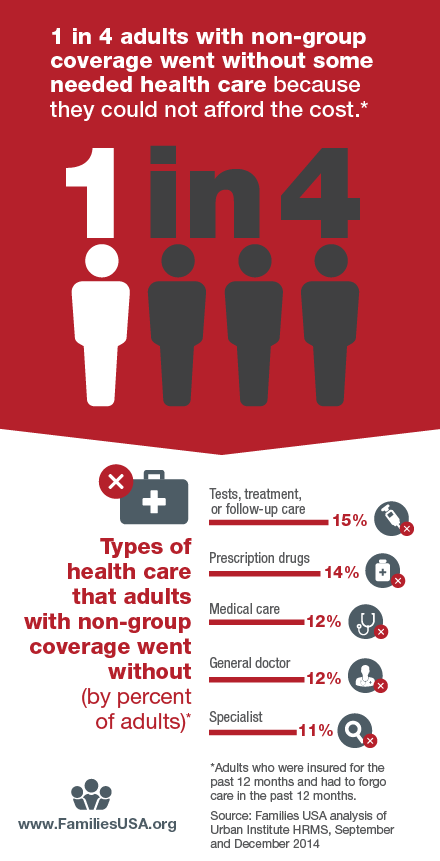

Group medical insurance coverage plans typically require a 70% involvement rate Members have the choice of enrolling in or decreasing health coverage Premiums are shared between the business and its staff members Household members and dependents can be added to group strategies at extra expense Normal group health strategies include health maintenance organization (HMO) strategies and chosen provider organization (PPO) strategies.

PPO plans have greater flexibility and options for seeing medical professionals and specialists at the expenditure of greater premiums. What's the distinction between a group health insurance and group medical insurance? Basically, a group medical insurance plan is a group health insurance, however a group health plan is not always a group health insurance coverage plan.

Employers need to ensure your group health insurance consists of either a group health insurance plan, self-insured health insurance, or repayment strategy so your workers have access to full health benefits. For staff members who ordinarily would not be able to afford private medical insurance, a group health plan is an appealing advantage.

Our Group Health Insurance Plans & Benefits for Employers - Aetna Ideas

Getting a group health insurance of any kind is beneficial for both you and your staff members. Take some time to research your health insurance coverage choices to learn what will work best for your company. If you're interested in an HRA for your organization, Individuals, Keep can help!. This article was originally released on March 13, 2020.

A "Group Health Plan" (GHP) is medical insurance offered by an employer, union or association to its members while they are still working. GHP protection is based upon. Employers with 20 or more staff members are required by law to provide current workers and their spouses who are age 65 (or older) the very same GHP health benefits that are offered to more youthful staff members.

Include: Little or large employer-sponsored prepare for its present staff members, Self-insured strategies, Employee organizational strategies (i. e., union strategies or hours banks), National health insurance in foreign countries. Do not consist of: This Author that only cover self-employed individuals, Consolidated Omnibus Budget Plan Reconciliation Act (COBRA) coverage, Retiree protection, Continued coverage based on severance pay, Health savings accounts, Veterans Affairs (VA) coverage.