The Main Principles Of Self-Employed 401(k) Contributions Calculator - AARP

from web site

The 3-Minute Rule for SEP vs Solo 401(k): What Plan is a Better Choice - Iryna

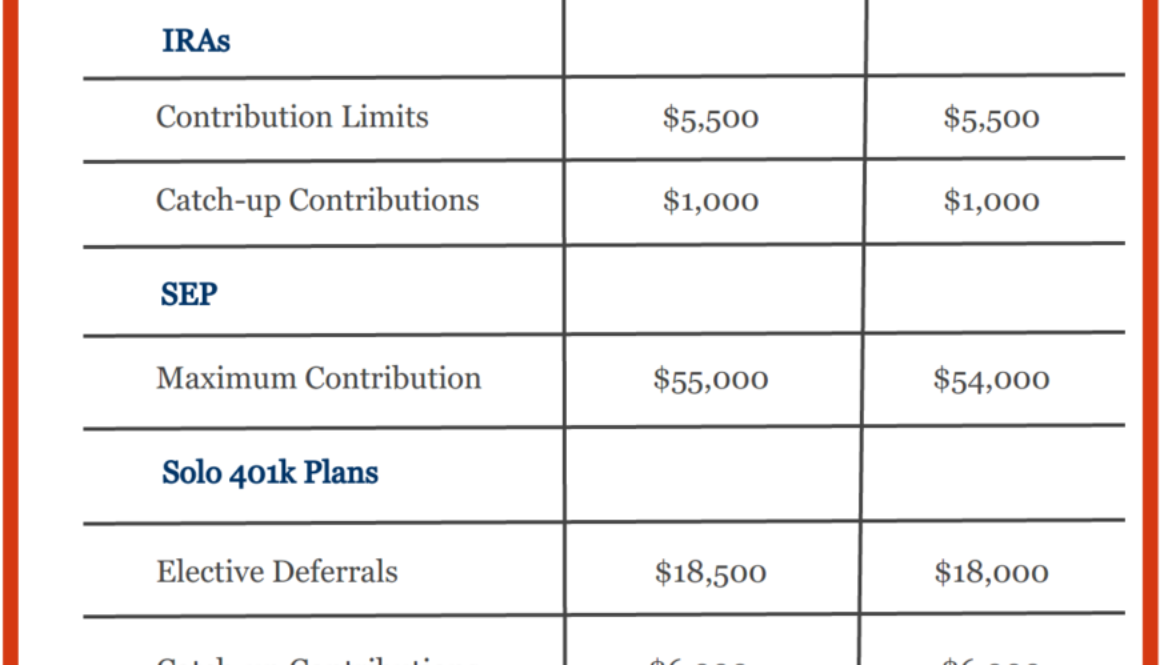

To make the most of contributions to a Solo 401(k) plan you must comprehend your limits as an employee and company, as well as contributions allowed on behalf of a spouse if appropriate. When contributing as the worker, you are allowed as much as $19,500 or 100% of payment (whichever is less) in income deferrals for tax year 2021 and $20,500 or 100% of compensation (whichever is less) for tax year 2022.

This is the type of contribution that can be made as pre-tax/tax-deferred or Roth deferral or a mix of both. In addition, as the company, you can make a profit-sharing contribution as much as 25% of your payment from business approximately $58,000 for tax year 2021 and the optimum 2022 solo 401k contribution is $61,000.

If you are age 50 and older and make catch-up contributions, the limitation is increased by these catch-ups to $64,500 for 2021 and $67,500 for 2022. Settlement from your company can be a bit challenging. Additional Info is computed as your organization net profit minus half of your self-employment tax and the employer strategy contributions you made for yourself (and other company owner and any taking part partners who are also in your Solo 401(k) plan).

The Basic Principles Of 401(k) Contribution Limits

A Solo 401(k) can only be utilized by service owners who have no workers qualified to get involved in the plan. You will set up your plan eligibility requirements in the Solo 401(k) plan files utilized to develop your plan lawfully. The internal revenue service has set limits on when workers should be included in your strategy, so make certain to follow the rules.

The one exception to the no-employee rule for a Solo 401(k) is for a spouse who makes earnings from your service. In 2021, your partner can contribute as much as $19,500 as an employee (plus the catch-up arrangement if 50 or older), and you can make the same percentage of employer contribution that you made for yourself (approximately 25% of compensation).

This exception efficiently enables you to double the quantity you can contribute as a household.

Solo 401k Contribution Limits for 2020 & 2022 - Millennial for Dummies

By: Mark Nolan, October 16, 2014Last Updated: February 04, 2022IRS records reveal that, in Tax Year 2014, an estimated 53 million taxpayers contributed almost $255 billion to tax-qualified delayed compensation strategies. A popular form of postponed payment strategies, known as a solo 401(k) plans, permits employees to save for retirement on a tax-favored basis.