What You Must Learn About Regards To A Payday Advance

from web site

If you are looking for an easy method of acquiring cash easily, payday loans can be your answer. You will love this particular write-up when you are within a jam and you are thinking about a paycheck progress financial loan. Before making a payday advance selection, take advantage of the tips shared in this article.

These lending options are designed to be paid back in all around fourteen days. Sometimes, issues appear in our way of life, and in case you find you can't pay back a loan soon enough, you don't need to bother about defaulting. A lot of loan providers give a roll-more than option to enable you to acquire more time and energy to pay the bank loan away. However, you will need to pay extra charges.

In the event you have to have a loan from your cash advance representative, browse around for the best package. You are probably stressed relating to your condition and in a rush to obtain the funds. Should you seek out several different companies you can get the best deal on interest. This will save you considerable time in the end on greater interest rates that you just could have needed to pay out.

Look for different bank loan programs which may be more effective for your personal personal situation. Because payday cash loans are becoming more popular, creditors are indicating to offer a little more mobility within their loan programs. Some companies provide 30-day time repayments as opposed to 1 to 2 several weeks, and you might be entitled to a staggered repayment plan that will make the loan less difficult to repay.

The easiest way to deal with online payday loans is not to have to take them. Do your greatest to save a little bit dollars weekly, allowing you to have a one thing to slip rear on in desperate situations. If you can save the amount of money for the emergency, you are going to remove the requirement for by using a pay day loan assistance.

Usually do not frequently use cash advance and pay day loans. When you have persistent monetary crisis situations, it will be a great idea to get the assistance of CCCS or on the internet budgeting tools. Many people have been compelled into bankruptcy with paycheck and money advance lending options. Make an effort to refrain from these loans just as much as it is possible to, unless of course the circumstance is serious.

Anytime applying for a cash advance, make certain that all the details you offer is exact. Sometimes, things like your job historical past, and home could be approved. Make certain that your information and facts are correct. It is possible to avoid getting declined to your payday loan, allowing you helpless.

Keep away from payday loans that happen to be too much so that you can repay. There are many firms that might choose to offer you a lot more than the quantity you want so you will go into default and incur charges. Don't give in and mat the lender's pockets with cash. Do what's right for you plus your situation.

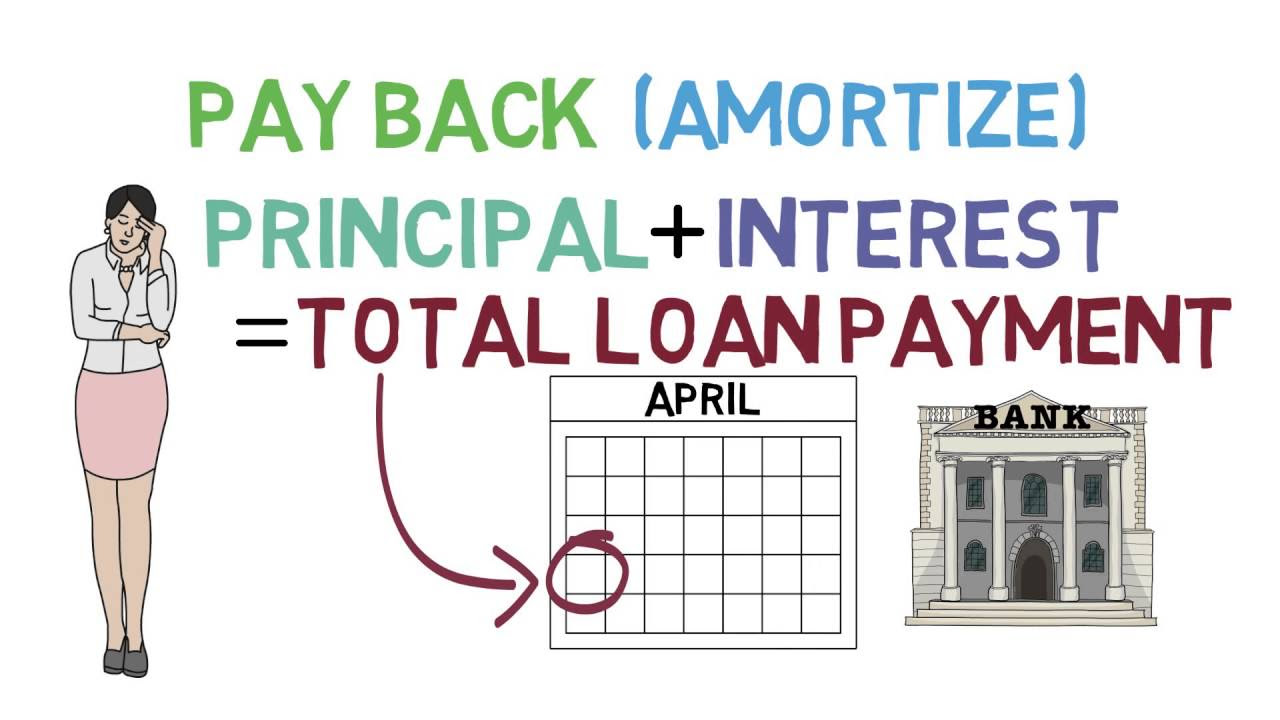

Request precisely what the rate of interest of your pay day loan is going to be. This is important, since this is the quantity you will have to pay along with the sum of money you are credit. You might even desire to look around and obtain the best interest rate you can. The low level you find, the less your full settlement will probably be.

Don't report untrue information on any cash advance forms. False info will never allow you to and may really lead to much more issues. At the conclusion of the morning, being untruthful in your software is going to prevent your ability to get loans in the foreseeable future.

A fantastic facet of payday loans is that you do not have to have a credit history check out or have equity to get a loan. Many pay day loan firms do not need any qualifications other than your proof of job. Be sure to provide your spend stubs along when you visit sign up for the loan.

Online payday loans usually are not federally controlled. Therefore, the principles, fees and interest rates change from state to state. New York City, Arizona along with other says have outlawed online payday loans so you need to make sure one of these simple financial loans is even a choice to suit your needs. You also need to calculate the exact amount you will have to reimburse before accepting a cash advance.

If your paycheck loan provider is located far away, be sure they do not demand documents to become faxed. It is likely you lack a fax device, and a few companies want physical records. This may indicate that you need to search for a independent company simply to fax the paperwork you will need, and this can be avoided if the financial institution is not going to use fax.

You need to be careful in relation to scammers which are associated with the pay day loan market online. Often, these con artists could possibly be recognized as a result of possessing similar titles to companies that are honest. They are often providing financial loans through the telephone saying that they can https://pozyczka-online.info/szybkie-pozyczki-ratalne/ don't are about very low credit ranking. They simply want your information for many different deceitful good reasons.

In case you have a decent credit rating, obtain a lower fee pay day loan. This particular bank loan usually has reduced interest levels, without any invisible service fees. The lending company will need to check your credit score. This should not get over one day and must be your best choice, if your credit history is not as well low.

Some online payday loans remove a lot of the documentation, which ultimately ends up charging you a lot more. However these financial loans are refined a lot more quickly, they could grow to be more pricey long term. Are you able to afford to pay off such a personal loan?

When you are considering utilizing a payday loan assistance, keep in mind how the organization costs their fees. Most of the loan cost is provided as being a smooth amount. Nonetheless, when you calculate it as a a share level, it may well go beyond the percent amount that you are simply being charged on your own credit cards. A flat charge might sound cost-effective, but could set you back up to 30% in the original personal loan in some instances.

Pay day loans enable you to get quick money when you need it. Take into account whatever you have read through in this article when you get a payday loan. Most of these recommendations have been created to assist you from the appropriate direction.