Obtaining The Very best Rates On Payday Loans

from web site

A lot more individuals are finding that they are in challenging economic situations. With unemployment nevertheless substantial and prices increasing, folks are confronted with difficult options. In case you are going through a monetary emergency and can't wait until your upcoming paycheck, a cash advance could be the right selection for you. On this page you can find some advice on pay day loans.

There are times in life when a pay day loan is the only selection a person has to purchase an costs. Prevent taking out one of these simple financial loans if you do not definitely have to. If you know a colleague or a family member that you might use from, it is https://pozyczka-online.info/szybkie-pozyczki-online/ best to inquire further initially just before resorting to acquiring a pay day loan.

Analysis various pay day loan businesses well before deciding on a single. There are various firms out there. Most of which can charge you critical costs, and fees in comparison to other alternatives. The truth is, some might have short-term specials, that truly make any difference inside the sum total. Do your persistence, and make sure you are receiving the best deal possible.

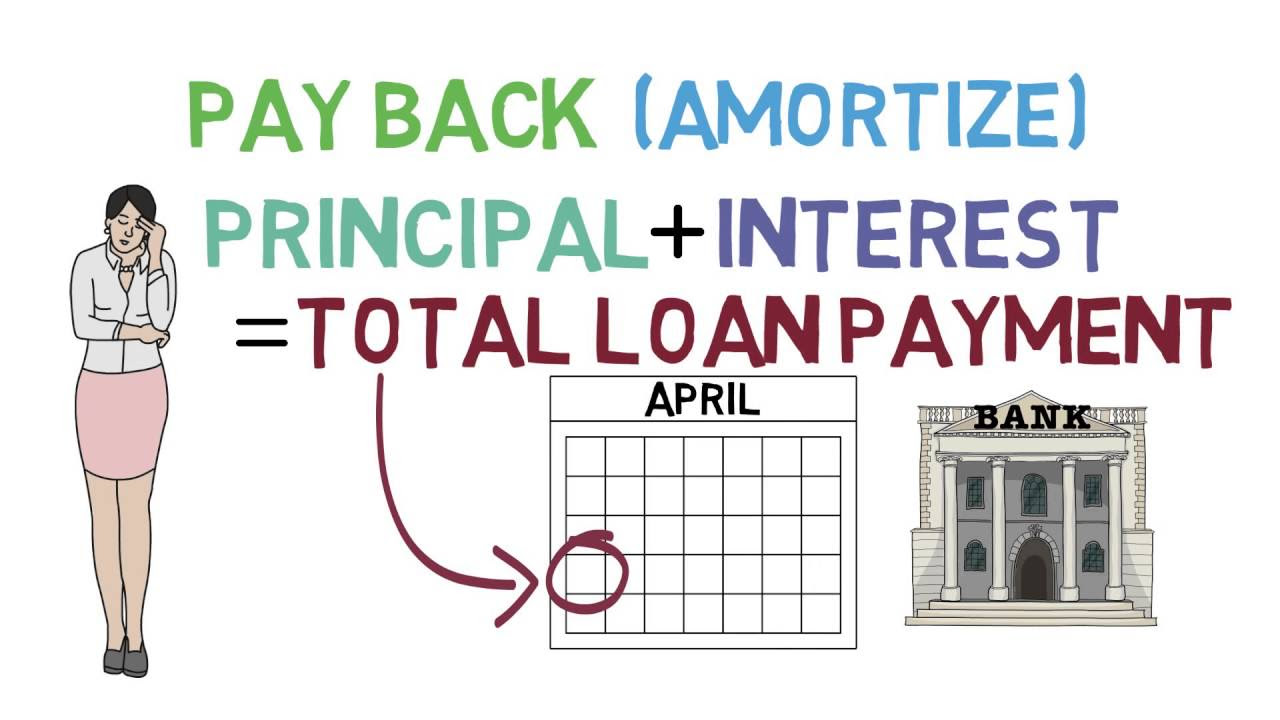

Pay day loans are a great solution for folks who happen to be in distressed need of dollars. Men and women only need to know around they are able to regarding their personal loan before they agree to the financing and acquire the funds. Payday cash loans charge incredibly high rates of interest and charges, which make it very difficult to pay out every one of the cash back.

If you are taking out a pay day loan, ensure that you are able to afford to spend it rear within one to two weeks. Online payday loans needs to be utilized only in emergency situations, when you absolutely do not have other options. Whenever you sign up for a payday advance, and are unable to shell out it again right away, 2 things happen. Initial, you have to shell out a cost to hold re-stretching your loan until you can pay it off. Second, you retain getting billed more and more fascination.

When evaluating a pay day loan, will not choose the first firm you locate. As an alternative, assess as numerous charges as possible. While some companies is only going to ask you for about 10 or 15 percent, other individuals could charge a fee 20 or even 25 percent. Research your options and find the least expensive firm.

You should prevent any cash advance establishments that are not obvious with regards to their interest levels and the relation to the loan. Be extremely, extremely wary of companies that neglect to make known this sort of details.

It is very important only use payday loan professional services when it is necessary. It's crucial that you are mindful to not get kept in a cycle of employing them. You won't have the maximum amount of money each month as a result of service fees and pursuits and you could ultimately discover youself to be not capable to get rid of the loan.

Your credit history is very important when it comes to payday cash loans. You might nonetheless be capable of getting that loan, nevertheless it will most likely amount to dearly with a atmosphere-substantial interest rate. When you have great credit, paycheck creditors will prize you with much better interest levels and unique payment applications.

Should you be set up on acquiring a payday advance, make sure that you get every little thing outside in composing prior to signing any kind of deal. Scams are often used with cash advance web sites and you can inadvertently subscribe to a legal contract.

Look at the following 3 weeks as the windowpane for payment for the payday loan. If you will not have adequate funds to protect your expections when the loan comes do, think about other alternatives. You may have to spend time looking, although you could find some loan companies that will work with what you can do and provide you more time to pay back everything you are obligated to pay.

Make sure you have researched the lending company prior to signing nearly anything. Although a pay day loan might appear to be your last option, you must by no means sign for just one not knowing all of the phrases that include it. Fully grasp all you can in regards to the background of the company to enable you to stop needing to shell out more than anticipated.

When confronted with a payday lender, bear in mind how tightly regulated they may be. Rates are often legitimately capped at varying level's state by express. Determine what duties they may have and what personal privileges that you have being a buyer. Possess the information for regulating federal government offices useful.

Prior to taking a payday loan, make certain you investigate on the firm. It is likely you believe there's not enough time to investigation simply because you require your money at this time! Among the highlights of payday cash loans is the velocity. Some loan companies will give you the borrowed funds quickly. There are a number of spots you can examine to make certain that the corporation you happen to be working with has a good reputation.

Pay day loans are normally because of inside of 14 times of taking out the borrowed funds. You might be provided a decision either to check out the place of work to grab the check out you authored and spend the money for personal loan off or let the payday advance office to send the check out you wrote in your financial institution for settlement.

It is usually a smart idea to look into different pay day firms before committing to 1. Better Company Bureau is a good starting place to find out the authenticity of the firm. Any issues which have been lodged there might be found on the organization's internet site.

Alleviate your concerns about lack of security using a cash advance. Most loan providers would like you to promise some tool that you just own when borrowing money, so they have some thing to consider if you fail to pay back the loan. Payday loans, though only accessible in small amounts, supply income without the need of collateral. This means that, although you may have zero resources to pledge, you can still get a payday loan when you need 1.

As this article has demonstrated, there are many concern that should be considered in relation to online payday loans. Keep in mind your options now and later to be able to consider online payday loans. So make the right selections and have a great time in all your potential ventures.