About Cheapest Sr22 Insurance Missouri Mo Non Owner Near Me

from web site

Due to the fact that insurance firms make use of various variables to rate rates, the least expensive insurer before an offense possibly won't be the least expensive after - sr-22. Actually, our analysis located that while Geico had the most affordable ordinary annual price for a good driver with minimal protection, after a DUI the rate increased by even more than 150%, pushing the company out of the top 5 least expensive companies for an SR-22 in The golden state.

Exactly How Long Does SR-22 Last? Just how long do you have to have an SR-22?

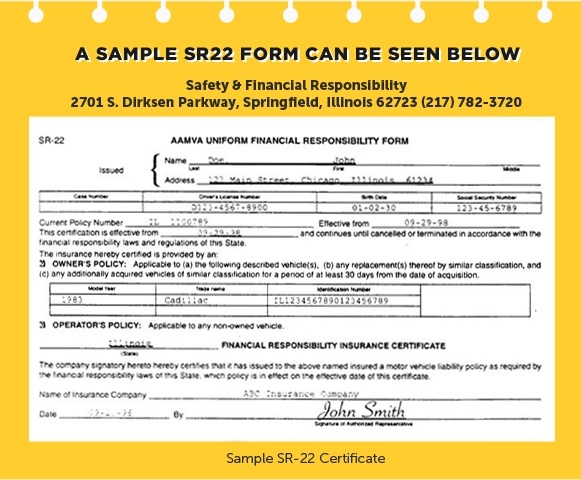

An SR-22 is a certificate of financial responsibility needed for some drivers by their state or court order. An SR-22 is not a real "type" of insurance coverage, yet a type submitted with your state - insurance group.

Not every person requires an SR-22/ FR-44.: DUI convictions Reckless driving Mishaps caused by uninsured chauffeurs If you require an SR-22/ FR-44, the courts or your state Electric motor Automobile Division will inform you.

Is there a fee linked with an SR-22/ FR-44? This is a single charge you have to pay when we file the SR-22/ FR-44.

The 7-Second Trick For Sr-22 Insurance: What It Is And How To Get It – Forbes Advisor

A filing fee is billed for each specific SR-22/ FR-44 we submit. For instance, if your partner gets on your policy and both of you require an SR-22/ FR-44, after that the filing charge will certainly be charged two times. driver's license. Please note: The fee is not consisted of in the rate quote because the filing cost can differ.

Your SR-22/ FR-44 should be valid as long as your insurance coverage plan is active. If your insurance policy is terminated while you're still required to carry an SR-22/ FR-44, we are needed to inform the appropriate state authorities. coverage.

Say hello to Jerry, your new insurance agent. We'll contact your insurer, examine your present plan, then locate the coverage that fits your demands and also saves you money (coverage).

ignition interlock insurance group division of motor vehicles ignition interlock insurance companies

ignition interlock insurance group division of motor vehicles ignition interlock insurance companies

sr22 coverage sr-22 insurance vehicle insurance coverage vehicle insurance

sr22 coverage sr-22 insurance vehicle insurance coverage vehicle insurance

The expense of SR-22 insurance policy is commonly significantly greater than the price of conventional vehicle insurance policy plans, as insurance policy holders with previous driving infractions are considered risky to insure. Just how do I get SR-22 insurance policy protection in Wisconsin? To obtain SR-22 insurance protection in Wisconsin, you will certainly need to function with an auto insurer licensed to do service in the state.

If you're filing an SR-22 kind as an under-18 vehicle driver, allow the insurance policy firm understand the declaring is in lieu of sponsorship, indicating that you're making an application for protection to drive under the age of 18 without a moms and dad or guardian as an enroller. When your insurance firm submits the SR-22 kind on your part, it will normally charge a level charge between $15 and $50.

How Long Do I Have To Have Sr22 Insurance In Tennessee? - An Overview

insurance department of motor vehicles driver's license driver's license coverage

insurance department of motor vehicles driver's license driver's license coverage

insurance coverage insurance liability insurance insurance companies sr22 coverage

insurance coverage insurance liability insurance insurance companies sr22 coverage

Upon refining the SR-22 form, the DMV ought to send you a letter verifying proof of insurance policy coverage and also that you are lawfully qualified to drive once more (driver's license). How long is SR-22 insurance protection called for in Wisconsin?

To discover the cheapest price for SR-22 insurance policy in Wisconsin, we suggest for SR-22 quotes from multiple insurance firms (vehicle insurance). Insurance provider assess danger in a different way and bill different rates appropriately, so looking for multiple quotes is often the most effective method Click here for more to find affordable SR-22 insurance coverage. department of motor vehicles. We additionally recommend asking about prospective discount rates, as drivers are typically eligible for expense decreases based on their lorry type, driving record, engagement in a defensive driving program, being a great student as well as much more.

In Wisconsin, all drivers under age 18 are called for to have an enroller to acquire a driver's license or instructor's authorization. Major driving violations such as Drunk drivings or DWIs (driving while drunk or damaged), hit-and-runs or careless driving can cause cancellation or suspension of a driver's permit, along with the need for a work license.