The 5-Minute Rule for Understanding Total Loss Insurance Claims

from web site

Were the damages to your lorry quite extensive? The reasons an insurance coverage company would certainly make a decision to call your car a complete loss include: It can't securely be fixed.

The value of your automobile before it was harmed in a mishap will help identify whether or not an insurance coverage company will decide to total your automobile - prices. describes that some business will decide to complete a lorry if damages surpass 51 percent of its worth prior to the mishap.

cheaper trucks cheap car insurance cheapest car insurance

cheaper trucks cheap car insurance cheapest car insurance

This quantity is typicallynset by the state you live in, as well as they will make use of a formula for establishing the percentage of damages that insurer can total a car. What's Your Vehicle's Actual Cash Value? An auto's actual money value is just how much it is worth when taking its devaluation into consideration. car insurance.

There are a variety of variables they will take into consideration when making a decision if it deserves fixing. Insurance policy. com shares what a few of these are: Gas mileage, Body problem, Inside problem, Tires, Any kind of components or upgrades that have actually been included, On top of that, they will certainly check out the marketing rate of comparable cars in your area.

You can then look for your own comparisons that you believe to be a closer match to what your lorry is worth and also existing them to the insurer. It is very important to keep in mind, however, that an insurance provider will certainly never pay you greater than your vehicle's actual cash worth (ACV).

Your insurance company is not going to get you a brand-new car. They just have to pay you the ACV of the one you shed. The bright side is, according to Insurance. com, numerous states will make insurance firms pay the sales tax obligation on your new automobile. Obviously, they do not really pay it on the new lorry you acquire, yet rather include it in the settlement for the car you shed.

What Does What Happens If The At-fault Party Doesn't Have Car Insurance? Mean?

If the insured acquires an automobile for less than the amount of the amounted to one, the insurance firm only has to pay the sales tax, transfer, and title fees based on the reduced amount. Paying sales tax as well as charges is a responsibility of the insurance firm in the instance of failure insurance claims.

The insured celebration will certainly be reimbursed with the completed lorry's ACV by the insurance company whether changing the harmed car or fixing it. This includes paying sales tax. The state sales tax obligation for the expense of a replacement vehicle will be paid on a complete loss when the insurance provider has actually worked out for the ACV of the damaged car.

They will pay the taxes when the insured event acquires a new automobile that changes the shed one for a complete loss insurance claim. Sales tax obligation, title charges, as well as transfer costs only need to be paid by the insurance firm in third-party cases if the plan so requires. This list demonstrates just how differed the demand for paying sales tax obligation can be from state to state. suvs.

Keeping Your Totaled Auto, It's possible that you may want to keep your auto, even after your insurance provider regards it a failure. Insurance. com describes that this is a possibility, however the title will become what is called a 'salvage title.' This implies that you will have to complete any type of required repairs in order to have the ability to drive the vehicle.

If you want to keep your car, they will deduct this amount from your ACV settlement. When thinking about whether or not to keep your completed vehicle, remember that there's a factor the insurance provider really did not want to repair it. Often, there are damages carried out in an automobile accident that aren't quickly noticeable, as well as as soon as a technician starts to take the cars and truck apart, they might find much more repair services than you anticipated.

It is tough for them to approximate the complete extent of the damages. Comprehending why an insurer would certainly consider your vehicle a failure after a crash and also recognizing what takes place next off will certainly aid you survive this challenging time. While losing your lorry isn't completion of the globe, it's excellent to recognize what your choices are if it takes place.

Some Known Incorrect Statements About Total Loss Car Vs. Repairable Vehicles - American Family ...

This content is developed and also maintained by a third celebration, and also imported onto this page to aid users supply their email addresses. You may be able to locate even more details about this and also similar content at piano. cheaper car.

Regulations on this concern can differ from state to state. You need to constantly get in touch with straight with a lawyer to establish the regulation that applies to your details scenario. Generally talking, nevertheless, the term, "failure" normally describes the value of a vehicle being entirely diminished because of a mishap.

low-cost auto insurance cheap car prices car insurance

low-cost auto insurance cheap car prices car insurance

Total losses typically take place when the damages to the lorry goes beyond 75% of the vehicle's fair market worth. Both Maryland and also Virginia laws utilize a 75% limit to determine total loss as well as the laws are cited listed below. Different insurance provider will make use of different portions in determining whether a car would be taken into consideration repairable.

The insurance companies are just required to give you money for the repair service expenses or the marketplace value of the car, whichever is less - laws. Maryland defines a salvage automobile as one whose repair work expense goes beyond 75% of the fair market price of the lorry prior to enduring the damage 11-152.

insured car cheapest auto insurance insurance affordable cheaper car insurance

insured car cheapest auto insurance insurance affordable cheaper car insurance

148; 1993, c. 376; 2000, cc (prices). 235, 257. The chapters of the acts of assembly referenced in the historical citation at the end of this area may not constitute a detailed list of such phases and might omit phases whose provisions have actually ended.

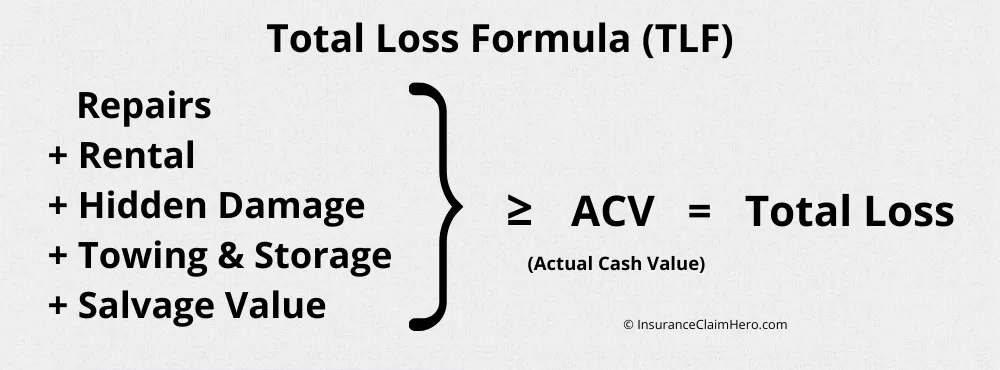

Table of Component: When Is an Automobile Thought About Totaled? A vehicle is thought about to be an overall loss when the overall price of damages strategies or surpasses the value of the auto. insurance. Most insurer establish an auto to be totaled when the car's expense for repair services plus its salvage worth corresponds to greater than the actual cash value of the automobile.

The Ultimate Guide To Automobile Physical Damage Total Loss Claims - Department ...

Exactly how does your insurance identify if your vehicle is a failure? Evaluators will estimate the expense of repair work, then determine if the expense to repair the lorry consisting of points like price of substitute components, salvage worth and also labor costs will certainly relate to even more than what the cars and truck is really worth on the open market (insurance company).

To better comprehend what constitutes a total loss, allow's take a more detailed check out just how a failure's value is computed and after that we'll get to the bottom of just how much insurance policy spends for an amounted to vehicle - vehicle insurance. If the Airbags Deployed, Is the Cars And Truck Thought About a Failure? Not always.

If, nevertheless, the expense of changing the airbags is more than the value of your vehicle, your vehicle will likely be an overall loss. Numerous marvel if air bags deploy, is an automobile completed even if the damages is small? A great deal more enters into equating a total loss than simply air bag deployment.

vehicle automobile auto insurance trucks

vehicle automobile auto insurance trucks

If, after including the salvage worth expense to the complete repair work quote, that figure is higher that the vehicle's actual cash money worth, the car is considered totaled. What Happens When Your Auto Is Amounted to and also You Are Not At-fault? In scenarios where a mishap causes a complete loss at the mistake of one more vehicle driver, the at-fault driver's insurance will generally pay you the value of your totaled vehicle (cheap auto insurance).

You'll generally have to pay all of your insurance deductible regardless of how much insurance policy pays for a completed car. Do you pay a deductible if your car is amounted to and you still owe thousands on the automobile?

laws affordable car insurance cheap cheapest

laws affordable car insurance cheap cheapest

If you were in a mishap that sustained $5,000 in damages, your insurance firm would keep the deductible of $1,000 as well as pay the remaining $4,000. At American Family Insurance coverage, we recognize mistakes occur, and want to aid you out when we can.

A Biased View of Total-loss Thresholds By State - Carinsurance.com

Be sure to get to out to your representative and ask about adding this key coverage. What Happens When Your Vehicle Gets Totaled? Usually, the insurance provider will certainly take possession of your car with a completed cars and truck title transfer to their name. Afterwards, they'll likely market it to a salvage customer.

This is called being bottom-side-up, and it's why you ought to have auto lease or car loan void protection. Void protection is an added auto coverage you can include in your vehicle plan so, in the event you're bottom-side-up when your automobile is totaled, it'll aid pay for the void between what your cars and truck deserves and what you still owe to your lender, based on any type of suitable protection limits.

So, if your car's ACV is $4,000, you'll have an additional $1,000 Home page in gap insurance coverage with this added defense in location. Another crucial information regarding this coverage is that the financing has to be a car financing and also be obtained only to acquire the car. If you made use of a home equity financing to purchase an automobile, this coverage would not be readily available (cheap insurance).

Keep Protected with Auto Insurance coverage Having actually a totaled vehicle isn't an enjoyable scenario to deal with, yet knowing what comes next can help decrease some of the tension.

This write-up is for educational purposes just and includes info widely readily available via various resources. automobile.

If they will cost more to repair than what it's worth, the insurer will certainly proclaim the car a complete loss. The company will then repay you for the real cash worth of the car not the overall price of the repairs - vehicle. Here's exactly how it functions. Insurance policy firms "overall" an auto when the price to fix the damage surpasses the lorry's market worth.

Some Known Details About Accident - La Dept Of Insurance

If the insurer completes your vehicle, they will pay you the car's actual money worth (ACV). The real money worth is just how much it deserved right before the loss. auto insurance. It includes a decrease in worth for devaluation, so the ACV will be less than what you spent for the lorry, also if it's fairly brand-new.

Each state establishes the limit for stating lorries a failure yet providers might pick to use a lower limit. In most cases, the insurance company will certainly amount to a cars and truck even if the repair service costs are much less than the car's actual cash money worth often a whole lot less. That's due to the fact that it can be tough to figure out the full level of the damage prior to fixings begin.

Let's claim you have a car that deserves $10,000. Under state law, the insurance firm has to state it a failure if the expense of the damages is $7,000 or even more. But if the insurance company's limit is 60% of the ACV, it will certainly be completed when repair service costs are $6,000 or even more.

And all you can see, generally, is the outside of the automobile and also the undercarriage. When the body shop takes the vehicle apart and also pulls the panels back, they generally find much more damages," stated Josh Damico, vice president of insurance coverage operations at Jerry, an automobile insurance policy contrast service.