The Ultimate Guide To Detroit And Michigan Lead The Nation With The Highest Auto ...

from web site

Part of the reason Michigan's insurance policy is still so high is that some people, those without ample insurance policy, are still not qualified to opt out of paying for PIP - insurance. Others that are eligible might not realize they can make the modification or know exactly how to do so. To pull out, chauffeurs have to confirm that they have qualified wellness insurance coverage as well as authorize a special kind for their insurer.

Still, some chauffeurs are mindful that they can decide out of paying for medical coverage on their car insurance coverage yet they are selecting to maintain it. As a registered nurse, Lahaie says she's seen up-close the advantages of PIP, that it picks up where health and wellness insurance can leave off and also can cover lengthy medical facility stays, pay for excellent rehabilitation services as well as wheelchair ramp installation when needed.

Trusted, accurate, current WDET is here to maintain you educated on vital info, information and also resources associated with COVID-19. This is a stressful, unconfident time for several. It's much more crucial than ever before for you, our audiences and also viewers, who are able to contribute to keep sustaining WDET's goal. Please make a present today.

vehicle insurance cheaper car cheaper cars insured carcredit score cars insurance insurers

vehicle insurance cheaper car cheaper cars insured carcredit score cars insurance insurers

9 WDET, informing the tales concerning individuals living in the Detroit area and also the concerns that influence us below.

Advocates of Michigan's reform of its no mistake car insurance coverage regulation in 2019 promised it would certainly minimize vehicle insurance coverage premium prices for drivers throughout the state as well as make insurance coverage for Detroiters, that paid the highest possible premiums of any city in the nation extra inexpensive (cheap). The proof up until now recommends the regulation has stopped working oftentimes to deliver on both promises.

Some Ideas on How To Get The Most Affordable Michigan Car Insurance You Need To Know

Virtually 36% claimed their automobile insurance costs were greater. Clients of one company - Citizens Insurance coverage - paid generally $90 more in 2021 than they did in 2019 for auto insurance, according to the business's latest price declaring with the Michigan Division of Insurance and also Financial Providers. People Insurance policy revenues rose 24% in the 2020-21 fiscal year, contrasted to the financial years 2017 via 2019 (vehicle insurance).

He states the Guv and also state legislature require to acknowledge that the no fault reform has stopped working to reduced insurance policy prices for many Michiganders, "so it does not simply turn out to be a faucet of cash money to the insurance provider (laws)."Heller said the Citizens Insurance rate declaring reveals a much more uncomfortable issue.

There are greater than 18,000 such Michiganders that had actually been receiving lifetime attendant and also various other treatment from the fund. The new no fault legislation cuts insurance settlements to these survivors' long-term treatment suppliers by virtually half, and lots of are failing. Some survivors have passed away as a result of losing treatment, and also others have actually landed in medical facilities due to the fact that there was nothing else location for them to go.

Personal Financing Expert composes regarding products, strategies, and tips to assist you make clever choices with your cash. We might get a small payment from our companions, like American Express, but our coverage and also recommendations are constantly independent and also unbiased., Michigan Go here is the second-most pricey state for in the United States, with an average costs of $1,358.

auto insurance insurance vehicle insurance insured carcar trucks cheap insurance insurance companies

auto insurance insurance vehicle insurance insured carcar trucks cheap insurance insurance companies

That doesn't mean you can not locate a bargain. It's worth looking around and obtaining quotes from a number of business. Then, compare those quotes to obtain the most insurance for your money. Your driving background, zip code, and also individual elements like marital relationship status or sex might affect your rates. In the US, motorists have to have liability coverage.

9 Simple Techniques For American Family Insurance: Auto, Home, Life, & More

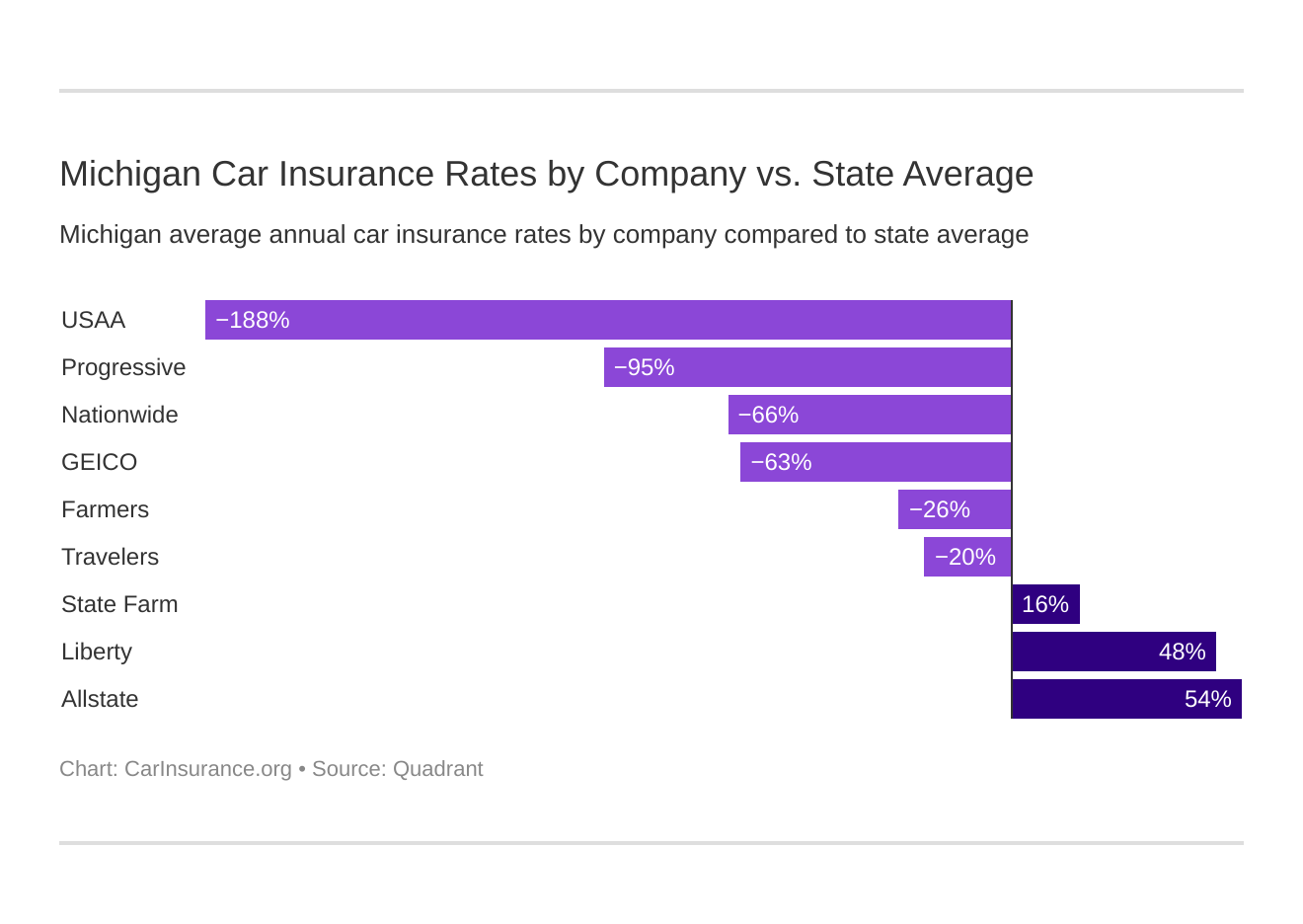

Consumer fulfillment is defined by five aspects: billing procedure and also plan info; claims; interaction; plan offerings; and also cost. According to a 2021 study by J.D. Power, a consumer research company that checks customers, these are the leading vehicle insurance policy business in the North Central region (which includes Michigan): J.D - vehicle insurance. Power consumer satisfaction positions: Erie Insurance coverage, State Ranch, COUNTRY Financial, Met, Life, American Household, Auto-Owners Insurance Policy, Progressive, GEICOThe Hanover, Liberty Mutual, Nationwide, Farmers, Allstate, Grange Insurance, Safeco, Travelers, Vehicle Club Team, USAA * - Since USAA is just offered to army and also veterans it is not consisted of, but it had the highest score of all the companies noted, The following are the most prominent automobile insurer in Michigan, based on the portion of insured Michigan vehicle drivers that utilize them: * USAA is just for active military, veterans, as well as their households.

One more method to save is to look around every insurance provider rates plans in different ways, as well as no two plans are the same. Rates vary substantially depending upon whether you obtain liability, comprehensive, or collision protection. Think about the quantity of protection and the sorts of protection detailed on your quote. Remember, you're seeking the most insurance coverage for your cash.

Why is Michigan cars and truck insurance policy so pricey? No-fault legislations are one of the major factors Michigan citizens see such high cars and truck insurance rates., each chauffeur is repaid for damages by their very own insurance coverage company.

TOP AUTO INSURANCE PROVIDER FOR DRIVERS WITH DUI: Progressive TOP AUTOMOBILE INSURER FOR YOUNG DRIVERS: Auto-Owners TOP CAR INSURANCE PROVIDER FOR MARRIED DRIVERS: Modern No matter who is at fault in an accident, motorists in Michigan are required to bring accident protection (PIP) insurance. One of the major reasons insurance policy costs in the state are so high is due to the fact that of this additional compulsory coverage.

cars credit score low-cost auto insurance vanscheap insurance auto insurance companies cheaper

cars credit score low-cost auto insurance vanscheap insurance auto insurance companies cheaper

It's normal to understand that automobile proprietors in Michigan misunderstand as to exactly how they can obtain affordable automobile insurance policy in the state without giving up appropriate coverage. If you simply obtained your driver's certificate or recently moved to Michigan, you could be curious concerning the state's vehicle insurance coverage laws as well as how to get the finest automobile insurance in Michigan - perks.

Some Known Factual Statements About The Best Cheap Car Insurance In Michigan - Business Insider

Michigan Car Insurance coverage Rules The state of Michigan has a variety of cars and truck insurance policy policies that need to be obeyed. As a result of Michigan's status as a no-fault state, a few of these laws are unique to the state. Car insurance in Michigan is managed as follows: In Michigan, all chauffeurs are needed by regulation to bring a minimum amount of car insurance protection.

Michigan cars and truck insurance coverage PIP demands After a vehicle accident, PIP benefits in Michigan will certainly cover your clinical expenditures and also shed salaries - cheaper car. PIP advantages are paid despite mistake since of the no-fault law. You do not need to file a claim versus the at-fault chauffeur since they are paid by your very own insurer.

Acceptable evidence of insurance is in the kind of a digital record. Typical Price of Auto Insurance Business in Michigan Auto insurance coverage in Michigan is one of the most costly in the country, with an average costs of $7,175 each year. Refer the complying with table to get the varieties of the different insurance quotes.

Cheapest Cars And Truck Insurance Policy Prices Estimate for Michigan Drivers It's feasible to save money on cars and truck insurance policy without needing to compromise on insurance coverage. Affordable cars and truck insurance is readily available in Michigan from a range of providers. insurance. Using information on average yearly rates, we found a few of the most cost-effective vehicle insurance service providers in the state of Michigan.

As a final choice, people can search to locate the best deal for their circumstance - insurance affordable. Minimize the quantity you spend for automobile insurance policy by increasing the deductibles. This generally has a direct impact on your total premiums. Reduced costs imply greater deductibles for vehicle insurance policy, and the opposite is additionally real.

Not known Details About Out Of State Student Guide To Car Insurance In Michigan

For customers who have 2 or even more insurance coverage with the same company, a multi-policy discount rate is often offered. Integrating your car insurance with your home or occupant's insurance will certainly lower your costs. Insurance companies typically charge clients a monthly costs for a six-month strategy, however this is typically a single settlement.

Most of the moment, if you switch insurers throughout your contract, the insurer will refund the extra section of your premium. Car insurance discount rates are available from all of the major insurers. Discount rates for secure vehicle drivers, good trainees, as well as automobiles with security features are among one of the most typical. In some cases, the discount rate will certainly be instantly related to your policy, while in other instances it will certainly require to be asked for by you.

Insurance fraudulence, lawsuits expenses, as well as high health care prices are all a result of the vast array of insurance coverage alternatives offered in Michigan. Points to Find Out About Vehicle Insurance Policy When Transferring To Michigan Michigan is among the extra costly states in the country for vehicle insurance policy and also it's a no-fault state.

If you're changing insurance companies, check transition discount rates. These can help you to save cash. Below are some info on vehicle insurance policy discount rates readily available in Michigan for your research study. Often Asked Concerns Who has the most affordable car insurance in Michigan? In Michigan, USAA provides the most affordable insurance policy rates for both the state minimum and the greater 50/100/50 liability-only insurance. low cost auto.

cheap auto insurance laws cheaper auto insurance cheapest auto insurancecheap auto insurance affordable auto insurance liability affordable car insurance

cheap auto insurance laws cheaper auto insurance cheapest auto insurancecheap auto insurance affordable auto insurance liability affordable car insurance

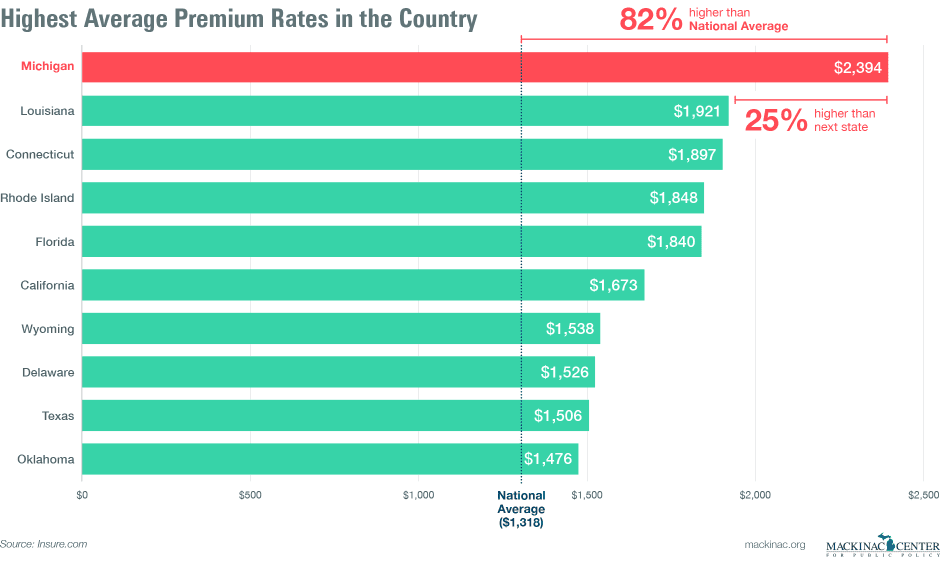

The 2nd most economical carrier with all forms of coverage is Nationwide. How much is auto insurance monthly in Michigan? Car insurance coverage in Michigan sets you back a standard of $162 a month, or $1941 a year. How much is vehicle insurance in MI? Vehicle insurance is expensive in Michigan. Michigan's ordinary vehicle insurance policy premium is $2610 a yearmore than the nationwide average of 82. dui.

The Definitive Guide for Michigan To Refund Drivers $400 For Each Vehicle They Own - Npr

Your car insurance premiums are greater than simply the state in which you live. Why is Michigan car insurance policy so high? Michigan auto insurance coverage is costly due to 2 factors: the state has no-fault policies, and also it likewise needs endless accident cover. It can be expensive for those with a poor credit report background or driving records to get vehicle insurance in Michigan. car.

Cars And Truck Insurance Policy for Michigan Drivers Michigan chauffeurs require cars and truck insurance policy coverage that has their back. We're below to help you find the security you require to feel great behind the wheel. If you're trying to find the ideal auto insurance coverage in Michigan, you'll require to locate an insurance provider that goes over as well as beyond for their consumers.

At the minimum, ensure to have a copy on your phone. Michigan approves digital proof of insurance and also with The Hartford mobile app, we make it easy to constantly have it with you. Download the app today by going to the Google Play or App Shop. Know that in Michigan, the charges for driving without cars and truck insurance protection consist of: Fines of $200 - $500 Up to one year behind bars 30-day certificate suspension or till you have vehicle insurance Michigan Uninsured Driver Facts The state of Michigan does not require motorists to lug uninsured/underinsured driver coverage.

Michigan Cars And Truck Insurance Coverage Laws for Remaining Safe As you take a trip through Michigan, there are numerous safe driving regulations meant to secure you, like:4 Michigan Seat Belt Laws It is an obligatory legislation to wear a safety belt while driving or being in the pole position of a cars and truck in Michigan - suvs.

Michigan Distracted Driving Legislations Texting while driving is banned for all drivers in Michigan. Fines start at $100 as well as added offenses will certainly cost you $200. To stay concentrated while driving, evaluate directions before you leave and take a trip sometimes when you are typically conscious and also alert. Michigan Teenager Motorist Laws Michigan has actually executed graduated licensing regulations to make certain that teens get the experience as well as maturity required to be risk-free behind the wheel.

4 Easy Facts About Insurance Alliance Touts No-fault Savings For Michigan Drivers ... Explained

Call The Hartford Regarding Car Insurance in Michigan Common Questions Concerning Car Insurance Policy in Michigan Just How Much is Auto Insurance Coverage in Michigan? Michigan auto insurance rates will certainly be various for every person, depending upon things like your credit rating, driving document and also insurance coverage rating - suvs. As an example, having an at-fault auto crash can influence your vehicle insurance rates.