Get This Report about Missouri Commercial Auto Insurance

from web site

-min[1].jpg)

4 Simple Techniques For Car Accident Claim Lawyer in StLouis - Sansone & Lauber

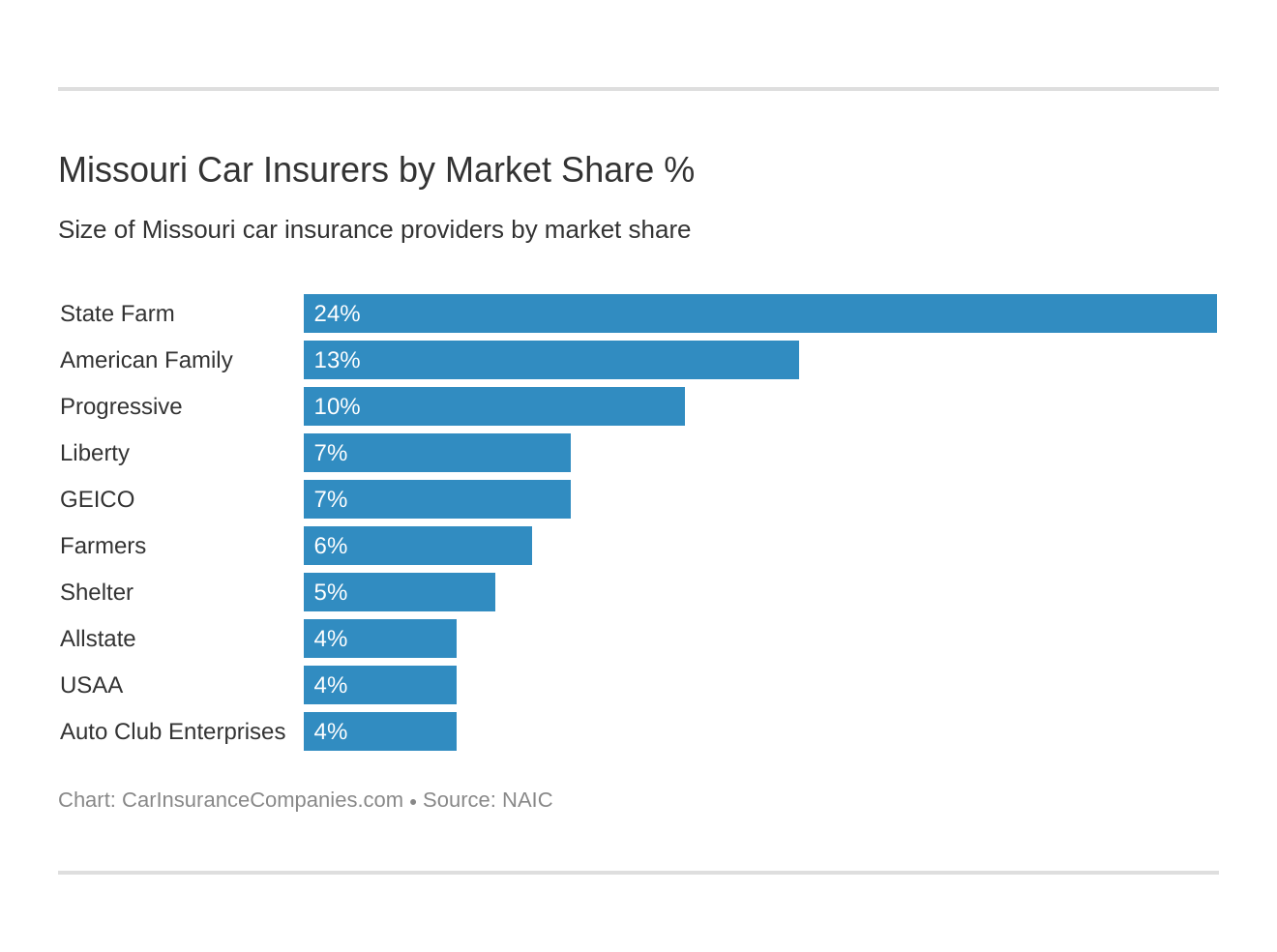

4 best cars and truck insurer in Missouri While you might be looking for the most inexpensive car insurance coverage in Missouri, think about which service providers offer the highest-quality protection. The insurance choices listed below flawlessly combine affordable policies with extensive protection. # 1 USAA: Low Rates for Military J.D. Power regional rating: 897/1,000AM Finest financial strength ranking: A++Better Company Bureau (BBB) rating: A+ Those who serve in the military, along with veterans and immediate member of the family, can find quality automobile insurance protection through USAA.

Power. Keep reading: USAA insurance review # 2 State Farm: Most Popular Service provider J.D. Power local ranking: 847/1,000 AM Finest monetary strength ranking: A++BBB rating: A+ More Americans cover their cars utilizing State Farm than any other service provider. That's most likely due to the company's competitive rates, vast network of regional agents and outstanding monetary health.

Keep reading: State Farm review # 3 Progressive: Low Rates for High-Risk Drivers J.D. Power regional rating: 837/1,000 AM Finest financial strength ranking: A+BBB score: Not ranked While its rates tend to be a little higher than some of its rivals, Progressive typically accepts motorists declined by other companies. If More In-Depth have a poor credit score or your driving record contains a DUI or at-fault mishap, it deserves getting a quote from the insurer.

The Only Guide for Missouri Car Insurance [Rates + Cheap Coverage Guide]

Keep reading: Progressive insurance coverage evaluation # 4 Shelter Insurance Coverage: Strong Local Coverage J.D. Power local ranking: 856/1,000 AM Best monetary strength score: ABBB score: A+ Shelter isn't always the most inexpensive cars and truck insurance coverage service provider in Missouri, however it's understood for its excellent customer care and robust local existence. The Columbia, Mo.-based service provider has offices all across the Show-Me State, making it quickly available.

Power rankings. Missouri automobile insurance requirements Missouri follows an at-fault system, meaning that whoever causes an accident is responsible for paying for all damages. States with at-fault systems frequently have below-average car insurance costs, however that's not the case with cars and truck insurance coverage in Missouri. Missouri minimum coverage requirements According to state law, Missouri drivers need to fulfill the following state minimum coverage requirements: Bodily injury liability insurance: $25,000 per person and $50,000 per accident Home damage liability protection: $20,000 per mishap Uninsured vehicle driver physical injury coverage: $25,000 per person and $50,000 per mishap If you want greater security beyond Missouri's minimum coverage limits, consider including comprehensive coverage and accident insurance coverage to your vehicle insurance coverage.