Some Ideas on Do You Have Medicare Supplement Insurance? - Avera You Need To Know

from web site

Medicare Supplement Insurance - Montana State Auditor Fundamentals Explained

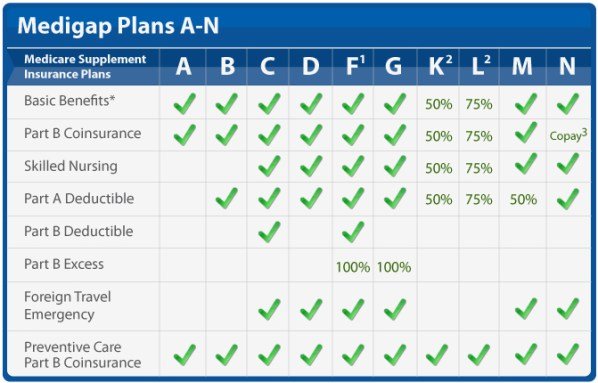

Plan K has an out-of-pocket yearly limit of $6,620 in 2022. Strategy L has an out-of-pocket annual limit of $3,310 in 2022. 4. Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office sees and as much as $50 for emergency clinic check outs that don't lead to an inpatient admission.

Plan F: Finest Medicare Supplement Strategy for Coverage As you can see by the chart above, there is one Medicare Supplement strategy that stands above the rest when it concerns the benefits used. A Good Read is the only Medigap strategy to use coverage in each of the nine benefit locations offered by this kind of insurance.

Roughly half of all Medigap recipients are enrolled in Plan F. Nevertheless, Strategy F does feature one disadvantage. Federal legislation has actually made Plan F off-limits to anybody who first became qualified for Medicare on or after January 1, 2020. Only those who became eligible for Medicare before that date may enroll in Plan F.

The smart Trick of Is a Medicare Supplement Plan Right for Me? - Excellus That Nobody is Discussing

Medigap Plan C is the only other kind of Medigap strategy that undergoes the very same registration guideline as Plan F. If you were eligible for Medicare before 2020, you might still have the ability to enroll in Plan F or Strategy C if either plan is available where you live.

So what's the finest Medigap plan for somebody who ended up being qualified for Medicare after Jan. 1, 2020? Strategy G offers all of the same advantages as Plan F other than that it doesn't pay for the Medicare Part B deductible. The Part B deductible is $233 per year in 2022, so it's a relatively small cost requirement when compared to some other types of Medicare out-of-pocket copays and deductibles.

Strategy D is another prospect for the best Medigap plan for brand-new enrollees. Plan D offers the exact same protection as Strategy G with the exception of Medicare Part B excess charges. However, excess charges can normally be avoided just by making sure to just visit health care providers who accept Medicare assignment.