The Greatest Guide To What Is The Average Car Insurance Cost Per Month? - The ...

from web site

Travelers supplies secure chauffeur discounts of between 10% and also 23%, depending upon your driving record. For those not aware, points are generally examined to a chauffeur for moving violations, and also much more factors can bring about higher insurance costs (all else being equivalent). 3. Take a Defensive Driving Program Sometimes insurer will give a discount for those that complete an accepted defensive driving program.

insurance companies insurance insurance affordable affordable

Make certain to ask your agent/insurance business concerning this price cut before you enroll in a course. It's vital that the effort being expended and the price of the training course convert into a big enough insurance cost savings. It's additionally crucial that the driver sign up for a certified course.

4. Look around for Better Cars And Truck Insurance Policy Rates If your policy will restore and also the yearly premium has actually increased markedly, take into consideration searching and getting quotes from completing business. Also, yearly or 2 it probably makes good sense to acquire quotes from various other firms, just in situation there is a reduced rate available.

That's because the insurer's credit reliability must additionally be considered (credit). What good is a plan if the company doesn't have the wherewithal to pay an insurance claim? To run an examine a particular insurance firm, think about taking a look at a website that ranks the economic strength of insurance provider. The financial strength of your insurance firm is necessary, however what your contract covers is likewise crucial, so make certain you understand it.

In basic, the less miles you drive your car per year, the lower your insurance coverage rate is likely to be, so always ask about a business's mileage limits. Use Mass Transportation When you sign up for insurance, the firm will usually begin with a questionnaire.

Facts About How Much Is Car Insurance In 2022? - Motor1.com Revealed

perks auto cheap car insurance auto insurance

perks auto cheap car insurance auto insurance

Find out the specific prices to guarantee the various vehicles you're thinking about before purchasing (insurers). 7. Boost Your Deductibles When choosing car insurance coverage, you can usually choose a insurance deductible, which is the amount of cash you would need to pay before insurance coverage foots the bill in the event of a mishap, theft, or other sorts of damages to the vehicle.

8. Enhance Your Debt Ranking A chauffeur's document is certainly a huge consider figuring out auto insurance prices. Nevertheless, it makes good sense that a vehicle driver who has been in a great deal of accidents can cost the insurance provider a great deal of money. Individuals are occasionally shocked to locate that insurance policy business might likewise think about credit report scores when establishing insurance premiums.

Regardless of whether that's true, be mindful that your credit score ranking can be a factor in figuring insurance costs, and do your utmost to keep it high.

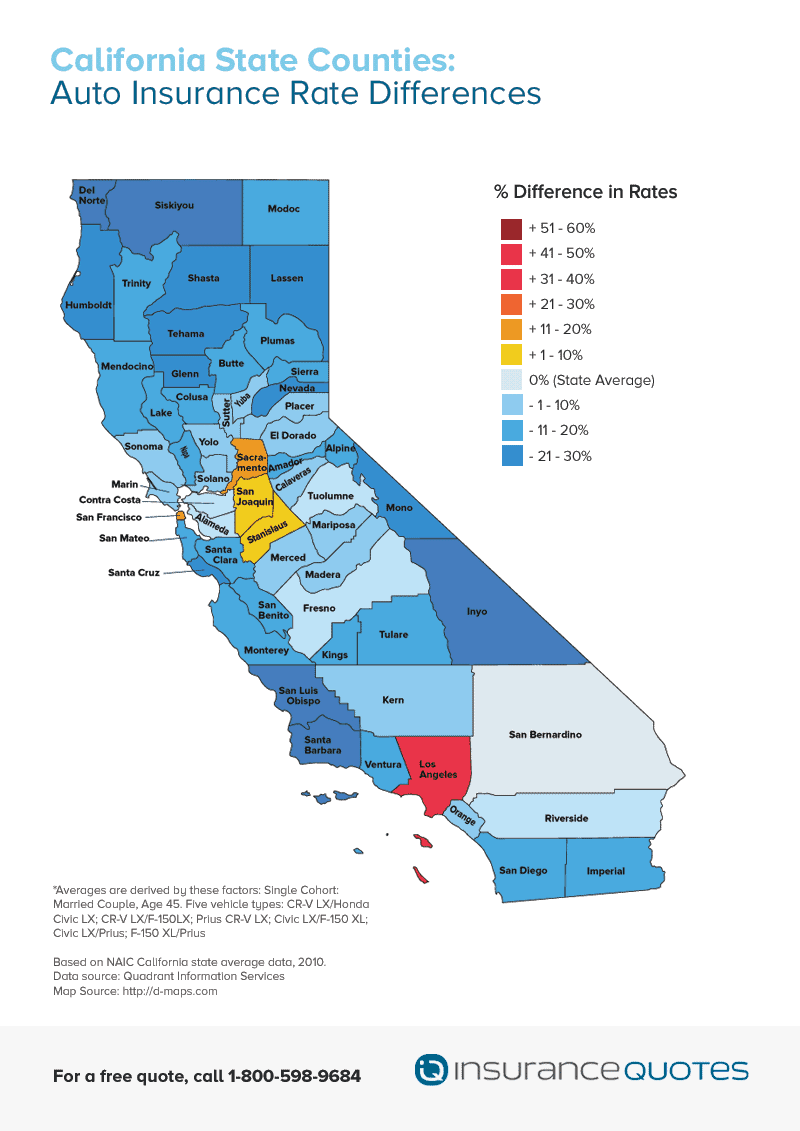

You can check debt records absolutely free at Annual, Credit Report, Record. com 9. Take Into Consideration Place When Estimating Car Insurance Coverage Rates It's unlikely that you will transfer to a various state just due to the fact that it has lower car insurance prices. Nevertheless, when intending a move, the possible change in your cars and truck insurance rate is something you will certainly intend to factor into your budget - credit score.

If the worth of the car is only $1,000 and also the collision coverage costs $500 each year, it may not make feeling to buy it. 11. Obtain Discount Rates for Setting Up Anti-Theft Gadgets Individuals have the possible to reduce their annual costs if they install anti-theft devices. GEICO, as an example, uses a "potential savings" of 25% if you have an anti-theft system in your car.

The smart Trick of Where You Live Has A Huge Effect On Car Insurance Rates That Nobody is Talking About

Vehicle alarms as well as Lo, Jacks are 2 kinds of gadgets you could intend to ask about. If your key inspiration for mounting an anti-theft gadget is to decrease your insurance premium, consider whether the price of including the tool will cause a considerable enough savings to be worth the trouble and also expenditure.

Speak to Your Agent It's important to note that there may be various other price savings to be had in addition to the ones described in this post. Actually, that's why it often makes sense to ask if there are any kind of unique discounts the business offers, such as for armed forces personnel or workers of a specific business.

Nevertheless, there are numerous points you can do to minimize the sting. These 15 suggestions should obtain you driving in the best direction. Bear in mind also to compare the ideal cars and truck insurer to locate the one that fits your protection requirements as well as budget.

cheapest car insurance low cost affordable car insurance affordable

cheapest car insurance low cost affordable car insurance affordable

The money we make assists us offer you accessibility to complimentary credit history and records and also assists us create our various other wonderful tools and also instructional products. Payment might factor right into how and where items appear on our platform (as well as in what order). Considering that we usually make cash when you discover an offer you like as well as get, we attempt to show you provides we think are an excellent suit for you.

Naturally, the offers on our system don't stand for all financial items available, yet our objective is to show you as several fantastic alternatives as we can (auto). If you're in the marketplace for a vehicle, there's a likelihood you'll need to fund your purchase with an automobile lending.

The Ultimate Guide To Humana: Find The Right Health Insurance Plan - Sign Up For ...

Generally, Americans are paying even more to drive their autos these days, whether the car is leased or bought. The ordinary lease settlement was $531 a month in the same period.

Your car loan's passion rate also figures highly in your regular monthly car payment., including Typical interest prices for auto loans are commonly reduced for people with solid credit than for people whose debt needs more job - low cost auto.

If you get a pre-owned vehicle, you might pay less total due to the fact that of the reduced cost tag, regardless of a greater passion rate. Cooperative credit union car fundings commonly have lower rate of interest than financings from banks. And also if you have exceptional credit history, you might be able to receive a 0% APR promotion used by a car manufacturer's finance company.

This is due to the fact that dealers may increase your rate of interest price as settlement for organizing your funding. Your auto lending or lease will likely include costs that can be rolled into your monthly payments, like car enrollment costs and tax obligations. Again, the typical size of car car loans and leases has grown.

Normally, a longer loan term will certainly suggest a reduced month-to-month cars and truck repayment yet a longer term can likewise mean more passion paid over the life of the car loan. Look for car car loan supplies If you're wanting to lower your vehicle payment, you have a couple of options. As an example, you can increase your down payment so you do not need to borrow as much.

What Does Average Monthly Car Insurance Rates Do?

Consider the most crucial features of your following vehicle. If you make some concessions, you could find an auto that fits your requirements without damaging the financial institution. Bear in mind that smaller automobiles have a tendency to have lower operating expense as well as a used car will likely cost less than a new one (cheap auto insurance).

Websites like Kelley Blue Publication or Auto, Investor can aid. Attempt to work out each component of the deal separately, including the car's cost, funding and any type of trade-in vehicle rate. The monthly expense of renting a brand-new vehicle can be a lot lower than it is for buying the same new auto (cheapest car insurance).

If you've already bought your automobile with a vehicle funding, you still might be able to obtain a lower regular monthly repayment by refinancing your finance. If you're able to refinance at a rates of interest that's lower than your existing one, that can aid you conserve cash (car). Re-financing with a much longer funding term likewise may reduce your regular monthly settlement, but you'll most likely pay more interest in the long run.

As you develop your cars and truck budget plan, bear in mind to element in the various other expenses that feature vehicle ownership like fuel, automobile insurance coverage and ongoing upkeep as you consider just how much you can pay for to finance. Inspect for auto loan offers Paris Ward is a content Browse around this site planner at Credit report Fate, giving visitors with the most recent information that will assist their monetary development.

dui credit score cars vans

dui credit score cars vans

When it comes to elements that impact the typical automobile insurance cost, there are some elements that you can control, at least partially. And also the most apparent factor is your age. cheaper car insurance.

Rumored Buzz on Average Cost Of Car Insurance In 2021 - The Motley Fool

When you develop a cars and truck insurance coverage plan, you'll have to determine just how much of a deductible you want, most often either $500 or $1,000. What specifically is a vehicle insurance policy deductible?

Deductible So what's the distinction in between your insurance policy premium and also your insurance deductible? The premium is what you pay per month, every six months or each year depending on your policy's payment strategy to keep your insurance plan.

This is due to the fact that you're essentially paying to have less out-of-pocket expenditures must you submit a claim, so your future claims payouts may cost the insurer even more than someone with a greater insurance deductible (cheap car insurance). On the other hand, the greater your deductible, the lower your costs will be. Typical Cars And Truck Insurance Coverage Deductible The ordinary automobile insurance policy deductible is $500, which, if an insurance claim is submitted, will generally be less than whatever the expense of repairs are for a major mishap.

With a $500 deductible, you would just pay $500 towards the repairs, while your insurance company would pay the rest. Is it much better to have a $500 deductible or a $1,000 insurance deductible?

Having the right details in hand can make it much easier to obtain an exact car insurance coverage quote - risks. You'll wish to have: Your vehicle driver's certificate number Your automobile identification number (VIN) The physical address where your car will certainly be saved You might also want to do a little research on the sorts of coverages offered to you.

How Much Is Car Insurance Per Month In 2022? Get Tips For ... Can Be Fun For Anyone

Commonly vehicle insurance coverage business will bill a lot more for younger chauffeurs and also give reduced prices for older chauffeurs. Insurance carriers see young chauffeurs as unskilled and have a greater risk of obtaining in mishap.

28 Rent $98. 59 Generally, motorists that presently have vehicle insurance policy protection will obtain a more affordable regular monthly price than motorists who do not (insurance). Because cars and truck insurance coverage is a need in all 50 states, companies may doubt why you don't currently have protection. As a result of this, they might see you as a greater risk driver.