The Main Principles Of Nine Ways To Lower Your Auto Insurance Costs - Iii

from web site

Neither you neither the various other chauffeur is required to pay a deductible when making a claim under your responsibility coverage. You Picked an Absolutely No Deductible Plan Some states as well as some insurer enable you to have a $0 insurance deductible policy on your extensive protection. If you elected to have a $0 insurance deductible policy, after that you will certainly not require to pay your deductible (cheap car).

Your car insurance policy deductible is usually a collection amount, say $500. If the insurance policy insurer establishes your claim quantity is $6,000, as well as you have a $500 deductible, you will certainly receive an insurance claim repayment of $5,500.

Deductibles vary by policy and motorist, and you can pick your cars and truck insurance policy deductible when you purchase your policy.

Contrast quotes from the leading insurance policy firms. Which Vehicle Insurance Policy Insurance Coverage Types Have Deductibles?, there are varying deductibles based on those different types of coverage.

This insurance coverage pays for repair services to your lorry when you are at mistake. This might be when your car is harmed in an accident with one more car or an item such as a tree or wall. This deductible is generally the highest deductible you will certainly have with your car insurance plan.

The Best Strategy To Use For I Can't Pay My Car Insurance Now What? - Debt.org

In that case, you would not pay an accident deductible. Injury security coverage pays the medical costs for the motorist and all passengers in your vehicle. Uninsured vehicle driver protection pays your expenses when you remain in a vehicle accident with a motorist who is at fault however does not have insurance or is insufficiently insured to cover your expenses.

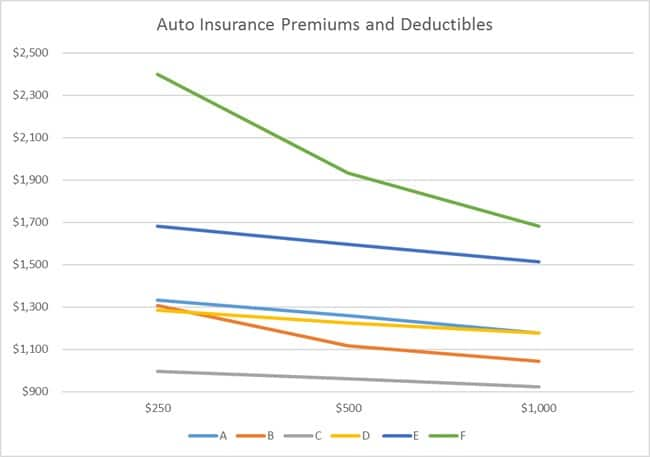

What Is the Average Insurance Deductible Price? Because customers select differing kinds of automobile insurance policy coverage with various financial restrictions, deductibles can differ dramatically from one vehicle driver to the following. For many drivers, regular deductible amounts are $250, $500 as well as $1,000. According to Money, Nerd's information, the typical vehicle insurance policy deductible quantity is roughly $500. perks.

Furthermore, your auto insurance policy deductible will differ based on that protection and also the price of your costs. Usually talking, if you choose a policy with a higher insurance deductible, your costs will certainly be lower. This can be a terrific choice as long as you can pay that greater insurance deductible in the event of a mishap.

car cheaper auto insurance money car

car cheaper auto insurance money car

You can conserve an average of $108 per year by boosting your insurance deductible from $500 to $1,000. For those with tight budgets, choosing a lower premium as well as a higher insurance deductible can be a way to ensure you can spend for your vehicle insurance - laws. However, if you can manage it, paying a higher costs can imply you don't have to develop a lot of cash to pay a lower deductible in the event of a crash.

It is necessary to have your questions concerning car insurance coverage deductibles responded to before that takes place, so you know what to expect. EXPAND ALLWho pays an insurance deductible in a crash? Do you pay if you're not at fault? When there's a car crash, the at-fault chauffeur is called for to pay the automobile insurance policy deductible.

If the at-fault vehicle driver does not have insurance policy or adequate insurance to cover the various other driver's expenditures, the no-fault chauffeur can use his auto insurance coverage as second insurance coverage to pay the prices. car. When do you pay an insurance deductible if you are called for? Usually, if you are needed to pay a cars and truck insurance deductible, the amount of the deductible will be subtracted from your insurance claim repayment when it is released.

What Does When Your Totaled Car Isn't Paid Off - Insurance.com Mean?

Can you prevent paying a deductible? Basically, the only method to avoid paying an automobile insurance policy deductible is not to sue. Or else, if you sue, expect to pay the deductible. While liability coverage does not need a deductible, this insurance coverage pays the other chauffeur's costs for injuries and fixings, not your own.

Compare quotes from the leading insurer. Secret Points Concerning Vehicle Insurance Coverage Deductibles, If you have vehicle insurance, you will need to pay a cars and truck insurance coverage deductible when you sue for repair work and injuries. Just how much you pay for your deductible depends on your cars and truck insurance protection and just how much your automobile insurance costs is - car.

The at-fault driver in the mishap is usually called for to pay a car insurance policy deductible. Liability coverage does not require a car insurance coverage deductible, but just covers the expenditures of the other driver, not your very own. Regarding the Author.

Automobile insurance policy can help spend for expensive repairs and also injuries after an accident. It might not cover 100% of the expense (liability). A car insurance policy deductible is the amount you're liable for paying out of pocket. Some kinds of coverage have a deductible, and https://s3.eu-central-1.wasabisys.com also others don't. Whether you need to pay an insurance deductible depends on the type of insurance policy claim you file and who (if anyone) is at mistake.

business insurance cheaper auto insurance car insurance trucks

business insurance cheaper auto insurance car insurance trucks

The insurer will only spend for expenses that go beyond $1,000. You have to pay the whole $650. Deductibles commonly range from $100 to $2,500 (insurance). Quantities differ by insurer and the sort of protection you're acquiring. The average vehicle insurance coverage deductible is $500, according to American Household Insurance Coverage. If you have greater than one type of coverage with a deductible, you can pick different deductible quantities for each and every insurance coverage kind.

If you can not manage to pay your insurance deductible, you will not be able to cover all the fixings. The insurance business will only pay for expenses that exceed your insurance deductible.

9 Easy Facts About Car Insurance Deductible: What Is It And How Does It Work? Described

If you think it's not likely you'll require to file an insurance claim, you could take into consideration a greater insurance deductible. No matter what amount you select, it's important to make certain you can pay for to pay it if you require to sue adhering to an accident. Deductibles relate to some sorts of car insurance coverage however not to others.

This kind of insurance coverage aids pay for fixing and substitute costs if you're in an accident (insurers). Covers incidents that run out your control as well as do not entail a collision, such as severe weather condition, rodent damages, falling things, burglary, and also vandalism. Assists pay for vehicle repair services if the at-fault vehicle driver does not have insurance policy or does not have enough insurance coverage to cover the expense of the repair work.

This kind of coverage is not available in all states. If an insured chauffeur strikes you, you do not need to pay a deductible given that the other driver's insurance coverage will cover the damage - risks. If you ever before need to file a claim with your insurance business, you will be responsible for paying the deductible.

cheapest insurance accident low cost auto

cheapest insurance accident low cost auto

In this write-up: When you're involved in an auto accident, your wellness is your most immediate concernbut your financial resources are a close secondly. Even if you're well-insured, the costs of an auto crash can easily install (cars). The price of your deductible alone may be sufficient to pose a trouble if you're short on cash at the time of your accident.

Chauffeurs seeking to save money on a monthly costs may ask their insurance firm to elevate their deductible, with the danger being that they'll pay even more out of pocket if they're associated with an accident. Need to you ever enter a mishap, the insurance coverage case process will work like this: Let's say your insurance deductible is $500 and a mishap creates damages that will certainly set you back $2,000 to fix.

If fixings cost less than $500, you will be accountable for paying those expenses by yourself. When your insurance policy provider pays out claimsit may send a check to cover the expense of repairs to you or to your mechanicyour insurance deductible will be taken out of the total amount. What to Do if You Can Not Afford Your Insurance Policy Deductible, If you can't manage your insurance deductible, there is an opportunity you will not be able to begin repair services right now. prices.

Getting My Car Insurance Deductibles: How Do They Work? - The Motley ... To Work

If you have till repair work are completed to find up with the money, you have time to figure out where you'll obtain it. Consider the adhering to alternatives: If you are in between incomes, or have money coming in quickly, you can wait to file your insurance case. This means you'll have money in hand once it comes time to cover the deductible - auto insurance.

If your vehicle was pulled or is already at the auto mechanic, ensure you know the length of time your cars and truck can be saved and what it'll cost you. If your insurer prepares to issue you a check for the repair work, you may have the ability to work out with the technician and ask them to waive your insurance deductible.

There are various kinds of mishaps, as well as you may not need to fix your cars and truck currently. low-cost auto insurance. If the damages was just aesthetic, as well as the vehicle is still secure to drive, think about not suing whatsoever. It might be worth the $500 savings (or whatever your insurance deductible amount is) to not submit the claim, if you can't afford the expense.

If this holds true, and you have an emergency situation fund, currently is the moment to use it. Accidents are emergencies, and paying your insurance deductible might be the difference between having transportation and also not. If you aren't currently saving for emergencies, consider starting a nest egg that helps you protect against scenarios like this.

Financing for several of these loans can come as quickly as one or 2 days after approval, which might assist you get the ball rolling on repairs. When looking over your borrowing choices, make certain to consider the passion you'll pay on the finance. A high-interest funding can make obtaining to cover an insurance deductible a a lot more pricey venture (cheaper cars).

Experian Credit Scores, Match can help you do this. Even a low-interest car loan will cost you passion, however, yet it's likely to be worth it if you require your automobile for work or school. Try Decreasing Your Deductible, Planning ahead is essential, and also the appropriate insurance plan can assist you land a deductible you can manage.

The Ultimate Guide To Automobile Insurance - Official Website

These ratings make use of an individual's traditional debt scores and various other variables to help determine exactly how most likely an insurance policy holder is to file an insurance claim. Having great credit rating could assist get you a more affordable plan, so make sure to know where your rating stands before shopping for insurance.

A cars and truck accident is never excellent, yet the circumstance becomes a lot extra intricate and also possibly costly when the other chauffeur or motorists entailed leave the scene prior to exchanging details. If you get included in a hit-and-run in The golden state, you ought to contact the cops today, after that sue with your insurance coverage provider.

In a hit-and-run, involving police provides the ideal possibility to find the other motorist and proof of what occurred. If the vehicle driver that left the scene is found, they'll need to pay for the problems to your car as well as any kind of medical bills. You might likewise need a cops report in order to file an insurance claim.

See if any eyewitnesses can contribute and ask to remain and also talk to the police. If they can not or won't remain at the scene, get their call details. Take photos of any kind of damage and also look around for any kind of pieces of the various other motorist's automobile that may aid recognize them.

insurance companies prices cheap cheap car insurance

insurance companies prices cheap cheap car insurance

Will insurance policy cover a hit-and-run? There is no such thing as California hit-and-run insurance coverage.

It's also essential to keep in mind that both of these protection types are optional as well as are not likely to be included in a typical automobile insurance coverage policy (auto insurance).

Our What Happens If You Can't Pay Your Car Insurance Deductible? PDFs

7% from the previous year, yet they still occur - money. It's a good suggestion to be prepared as well as have a plan if you are associated with an accident, and also the other chauffeur leaves the scene. What is the finest automobile insurer? There is no person finest automobile insurance policy company for everybody.

These are example rates and also must only be made use of for relative functions. Rates were computed by assessing our base profile with the following events used: clean document (base), at-fault mishap and a hit-and-run.