8 Easy Facts About What Does Homeowners Insurance Cover? Described

from web site

Insurance policy that pays the insurance policy holder the expense of changing the harmed property without deduction for depreciation, yet limited to a maximum dollar quantity. Extended Replacement Expense. A prolonged replacement expense plan, one that covers costs as much as a particular portion over the limit (generally 20%). This provides you protection versus such things as an abrupt rise in building costs.

This covers the expense to change your residence minus devaluation prices for age and also use. For instance, if the life span of your roof covering is 20 years and also your roof is 15 years of ages, the price to change it in today's market is mosting likely to be much more than its real cash money value (affordable insurance).

That's not the marketplace worth, however the cost to rebuild. If you do not have enough insurance, your company may just pay a section of the price of replacing or fixing damaged products. Below are some tips to assist make certain you have adequate insurance: For a fast estimate on the total up to reconstruct your home: multiply the regional building costs per square foot by the complete square video footage of your residence.

You ought to additionally consult your insurance agent or firm agent. (Note: This is only a quote and should not replace yearly coverage reviews). affordable. Aspects that will certainly establish the expense to rebuild your residence: a) building costs b) square video footage of the framework c) sort of outside wall surface constructionframe, stonework or veneer d) the style of your house (ranch, colonial) e) the variety of rooms & shower rooms f) the kind of roofing g) connected garages, fire places, outside trim and other unique features like curved windows or one-of-a-kind indoor trim.

Building regulations require frameworks to be built to minimum requirements. If your home is badly harmed, you may have to restore it to comply with the brand-new criteria requiring an adjustment in layout or structure products. These usually set you back more. Do not guarantee your residence for the market value. The price of reconstructing your residence might be greater or less than the cost you spent for it or the price you can sell it for today.

Not known Facts About Homeowners Insurance Information

Write down significant items you own along with all offered info, such as (a) serial numbers (b) make and/or design numbers (c) purchase prices (d) present value (e) date of purchase (insurer). Take either still or video pictures and also attach receipts to the inventory when readily available.

homeowners insurance claims homeowner insurance insurance companies finances

homeowners insurance claims homeowner insurance insurance companies finances

Update the inventory when you make significant acquisitions. The most vital point you can do to guard your residence and residential or commercial property is to understand that your insurance policy is an agreement as well as you require to recognize what's in it. Your insurance coverage agent or company agent will certainly be able to stroll you though it and address any type of inquiries - homeowners policy.

The majority of loan providers won't offer a home loan without house owners insurance policy coverage, so deal with your insurer or agent, along with your Realtor, to help you move right into and also shield your dream residence. Know what your home owners insurance covers. Know the variables that influence your homeowners insurance coverage cost and policy revival.

Distance to a fire hydrant and a station house, whether your neighborhood is shielded by specialist or volunteer firemens, and also any elements that impact the moment it would certainly take to snuff out a fire in your location - insurer. The condition of the pipes, home heating and also electrical systems in your residence. Numerous firms make use of good credit report to use you a discount or as one of the variables in determining to offer a policy to brand-new customers.

Insurance coverage is designed for large, "unexpected as well as unforeseen" losses, not for small "damage." Numerous factors determine what you'll spend for property owners insurance policy, so whether you're buying or building a brand-new home or simply evaluating the price as well as protection under your current house owners insurance plan, understand what impacts your lower line - property insurance.

Getting My What Does Homeowners Insurance Cover? - U.s. News To Work

If you wish to know of prior losses that might influence the availability or rate of your brand-new residence's insurance coverage, ask the vendor to give a copy of the house's loss background record (called an idea or A-PLUST Record) with the disclosure declarations. This is a document of house insurance policy declares that have actually been reported or filed in the past five years.

When you're offering your residence, likewise make sure you know what the loss background is on your very own residence. The even more info you have going into the residence acquiring process, the https://storage.googleapis.com/unbiased-view-homeowners-insurance-statistics/index.html less likely you are to experience challenges along the method.

Numerous companies provide discounts or take into consideration good credit history as one of the variables when selling brand-new policies, so it can actually repay to handle your personal financial resources. Buy hail and fire repellent roof covering products - homeowner's insurance. Your roof covering is the most prone component of your house as well as several firms think about the roof covering materials into the costs you are charged.

Obtain a duplicate of your own loss background record, such as a CLUE record from Choice, Point or an A-PLUS report from Insurance Provider Office (ISO). Ask the vendor to supply a copy of the residence's loss background report (called an idea or A-Plus Report) with the disclosure declarations. This can inform you to any kind of damage that may have taken place to that residential property. property insurance.

See to it you get the quantity of insurance you need. Put in the time to properly guarantee your home. See to it that you have enough coverage to: Reconstruct the residence if it is destroyed by fire or another insured disaster. Replace whatever in it. Protect your assets if someone is wounded on your property (insurance companies).

10 Easy Facts About What Is Homeowner's Insurance? Why Is Homeowner's ... Shown

If you can pay for a higher out-of-pocket deductible, it will save you in the short-term on your insurance costs and additionally dissuade you in the long-lasting from making tiny claims that might put your insurance in jeopardy for non-renewal. Replacement cost coverage for properties. Expanded or assured replacement price protection for the structure.

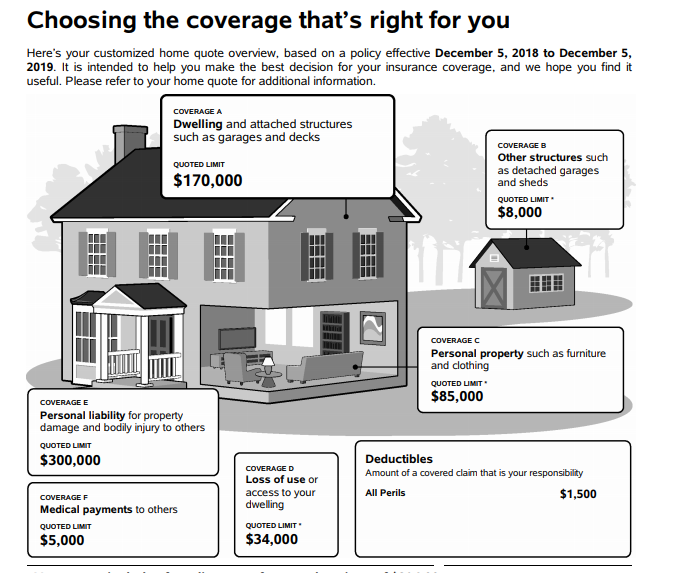

Your house's structure is referred to as your residence (insurance premiums). The total dwelling coverage limitation will cover the expenses of repairing or replacing the structure of your residence. Protection for various other frameworks on your residential property - consisting of sheds, barns, detached garages, - are typically covered at a level equal to 10% of the house coverage limitation.

for home insurance homeowners insurance property insurance a home insurance insurance discount

for home insurance homeowners insurance property insurance a home insurance insurance discount

The personal home limitation is generally a percentage (e. g., 50%) of the home insurance coverage limitation. You need to examine to make sure the amount of coverage for your personal property is sufficient to cover the loss and also if not, call your insurance coverage producer to see regarding increasing the limitation.

For instance, if your fridge has a 20-year life span and is 17 years of ages, if it were harmed, the company would certainly not pay to change the refrigerator but to pay for what a refrigerator with only 3 years of efficiency would certainly cost. Many residence insurance coverage cover the components of your residence on an actual cash money value basis.

The premium will certainly be a little greater for this insurance coverage; nevertheless, you might desire to consider this choice. Replacement cost is the quantity of money it would require to change or rebuild your house or repair damages with materials of comparable kind and top quality, without deducting for devaluation. Many insurers call for home owners to insure their homes for a minimum of 80% of the substitute expense as well as some may call for 100%.

How Homeowners Insurance can Save You Time, Stress, and Money.

Presuming (1) it would cost $200,000 to change your residence, (2) it is insured for $160,000 (80% of its replacement value), (3) you do not have a deductible on your policy and also (4) a fire causes $40,000 worth of damages, then your insurance policy company will pay $40,000 to repair the expense of the case at the replacement price under the plan.

If you're not exactly sure where to begin, or you intend to contrast home insurance coverage prices estimate from several companies, get going today with Reliable (powered by Youthful Alfred). Clients who have utilized Young Alfred for insurance have saved hundreds of bucks each year. Break out quotes currently Compare quotes from top-rated insurance coverage carriers in your area, Save time, money, and initiative, Completely digital experience, Easy application procedure, No spam, phone calls, upselling, or fake quotes, Your details is maintained personal and never ever sold In this short article, we'll discuss what property owners insurance coverage is, just how it functions, and also how to obtain a quote for a brand-new policy (homeowners policy).

/cdn.vox-cdn.com/uploads/chorus_image/image/69033428/rsz_adobestock_209462615.0.jpg) homeowner insurance cheaper cheapest insurance inexpensive security systems a home insurance

homeowner insurance cheaper cheapest insurance inexpensive security systems a home insurance

Kinds of property owners insurance policy plans Depending upon what sort of house you have as well as exactly how much insurance coverage you need, there are a variety of different kinds of house owners insurance you can choose from. Your plan will likely cost more as the sorts of coverage boost. HO-1: Standard Kind This is a simplistic homeowners insurance coverage plan that covers your residence and items in a restricted number of scenarios.

HO-4: Tenants Broad Kind Given that these plans are intended for tenants, an HO-4 policy just covers your belongings not the framework of the residence. These policies resemble HO-2 in terms of the hazards they cover - insurance premiums. HO-5: Comprehensive Kind This is just one of one of the most pricey kinds of house owners insurance policy, since it covers the widest series of dangers.

Take a look at the table below for the main types of insurance coverage you'll typically obtain. House, Damage and damage to the residence, You get to select (subject to minimums called for by your home loan lender) Other structures, Frameworks on the property that aren't connected to the home, including sheds, fences, and also free-standing garages, Concerning 10% of dwelling insurance coverage Individual residential or commercial property, The expense to repair or change damaged or taken individual things, like furniture, home appliances, apparel, and also electronic devices.

The 7-Minute Rule for What Does Homeowners Insurance Cover?

for home insurance condo insurance landlord security systems credit

for home insurance condo insurance landlord security systems credit

Say you have a roof that's 15 years old, built with materials made to last 20 years. If a lightning strike damages this roof, your insurance provider wouldn't pay out the cost to replace it. Rather, you 'd be covered for about 25% of that cost because your roof covering has concerning one-quarter of its valuable life left.

With this insurance coverage, you'll still be covered if the price to fix the damage to your house surpasses the protection restrictions of your plan. Many insurers won't offer this coverage on older residences. What insurance doesn't cover Before you purchase a house owners insurance coverage, be sure you comprehend what is and also isn't covered.

Your real premium will certainly depend on numerous aspects including: Place: If you live in an area susceptible to natural calamities, for example, you'll commonly pay a higher costs (insurer). Your regional federal government additionally plays a role.

Deductible: The deductible on an insurance coverage describes the amount you pay toward repair service expenses prior to insurance covers the remainder. Greater deductibles commonly indicate reduced monthly costs. Amount of insurance protection: House owners insurance plan normally have optimal amounts of protection, based upon the expense of changing your home (affordable). Higher-value residences or houses in locations where it costs more to build may call for greater amounts of insurance coverage, meaning a higher price.

So, although you might not have submitted any insurance claims, if the previous proprietor filed two, your insurance coverage premium would be underwritten as though you filed both insurance claims (homeowners). How to get a property owners insurance policy quote To obtain the ideal home owners insurance coverage plan for you, you'll need to figure out how much insurance you require, after that contrast deals from a number of various firms to discover the ideal bargain.