All About Rideshare Insurance For Uber & Lyft - Mercury Insurance

from web site

cheapest insurance affordable vehicle insurance cheap car insurance

cheapest insurance affordable vehicle insurance cheap car insurance

When subscribing to be a rideshare vehicle driver for Uber, Lyft or any firm that has you carrying customers or goods for cash, you could require to purchase rideshare insurance policy. If you enter an auto crash while driving for among these companies and also don't have rideshare insurance coverage, your personal obligation cars and truck insurance policy policy may not cover the cost of problems, and also you can even have your protection went down - business insurance.

There can be various other repercussions to driving without rideshare insurance policy. credit score. As stated, if you use your car for commercial purposes without informing your insurance provider, you might have your coverage dropped or see a premium walking. While the majority of ridesharing companies offer crash and extensive insurance, the deductibles for these policies can be steep.

When your insurance firm finds out, you might be gone down from coverage (low cost). If you are at mistake for a mishap, the rideshare firm may have a collision plan that pays to repair your car, yet it is most likely to come with a high deductible. Additionally, your own insurance coverage provider may not cover the cost of damages to your automobile, even if you https://why-uber-lyft-driver-needs-rideshare-insurance.nyc3.digitaloceanspaces.com/index.html have extensive insurance and collision insurance coverage plans - trucks.

Rideshare insurance policy is commonly offered as an add-on or endorsement to an existing policy. Our referrals for rideshare coverage If you are delighted with your existing automobile insurer, call a representative to ask regarding rideshare insurance. The most convenient means to get protection is to add it to your existing plan.

Make use of the device listed below to contrast cars and truck insurance coverage price options from numerous leading insurance providers in your location. Geico: Editor's Selection Geico offers rideshare insurance policy coverage that replaces your existing Geico policy. By converting your personal plan to a rideshare plan, you will certainly be covered by the very same insurance coverage whether the rideshare application gets on or off.

Rideshare Coverage - Elephant Insurance - The Facts

car insurance affordable car insurance cheap dui

car insurance affordable car insurance cheap dui

Right here are the aspects our ratings consider: Reputation: Our study group thought about market share, rankings from industry professionals and years in business when giving this rating. Accessibility: Vehicle insurer with better state accessibility and also couple of qualification requirements scored highest possible in this classification. Coverage: Companies that use a range of choices for insurance policy protection are much more most likely to meet consumer needs.

A note regarding the pandemic: Amidst the COVID-19 pandemic, several insurance provider are expanding protection to immediately consist of a motorist's individual lorry when they are delivering food, medication and other basics for a shipment firm. For more details, see Geek, Pocketbook's coronavirus and also vehicle insurance guide.Insurance for Uber and Lyft drivers on top of those business'protection is the most effective way to be totally covered at work. According to insurance representative team Relied on Option, the average industrial policy for a traveler vehicle expenses from$ 1,200 to$2,400 a year or more. Lyft and also Uber Insurance, Uber insurance policy or Lyft insurance policy offers minimal coverage while you have the app on and are awaiting a request understood as Period 1. Period 3: You have passengers in the vehicle. Your Uber or Lyft insurance coverage remains in full force. Lyft insurance as well as Uber insurance coverage are practically similar. The insurance deductible amounts for thorough and also crash insurance coverage are different. low cost auto. A deductible is your share of repair work costs before your insurer pays the rest of a case. Period 1: Application gets on; you're waiting on a request . An individual plan without ridesharing coverage does not cover you. Some distribution app business offer protection. Duration 2: Request accepted, and also you're en path to get a shipment. Some distribution app business supply insurance coverage. Period 3: You have the food or goods in the cars and truck. State Farm, on the other hand, states its rideshare insurance policy commonly sets you back 15%-20 %even more than a personal auto policy without rideshare insurance coverage. cheaper car insurance. Not all insurers share approximated rates, but below's a snapshot of some that do. Rideshare insurance expenses by company, Expense over conventional plan * Starting at about$27 each month. Whether or not you remain in rideshare setting when a car crash takes place, your initial

laws business insurance laws insurance company

laws business insurance laws insurance company

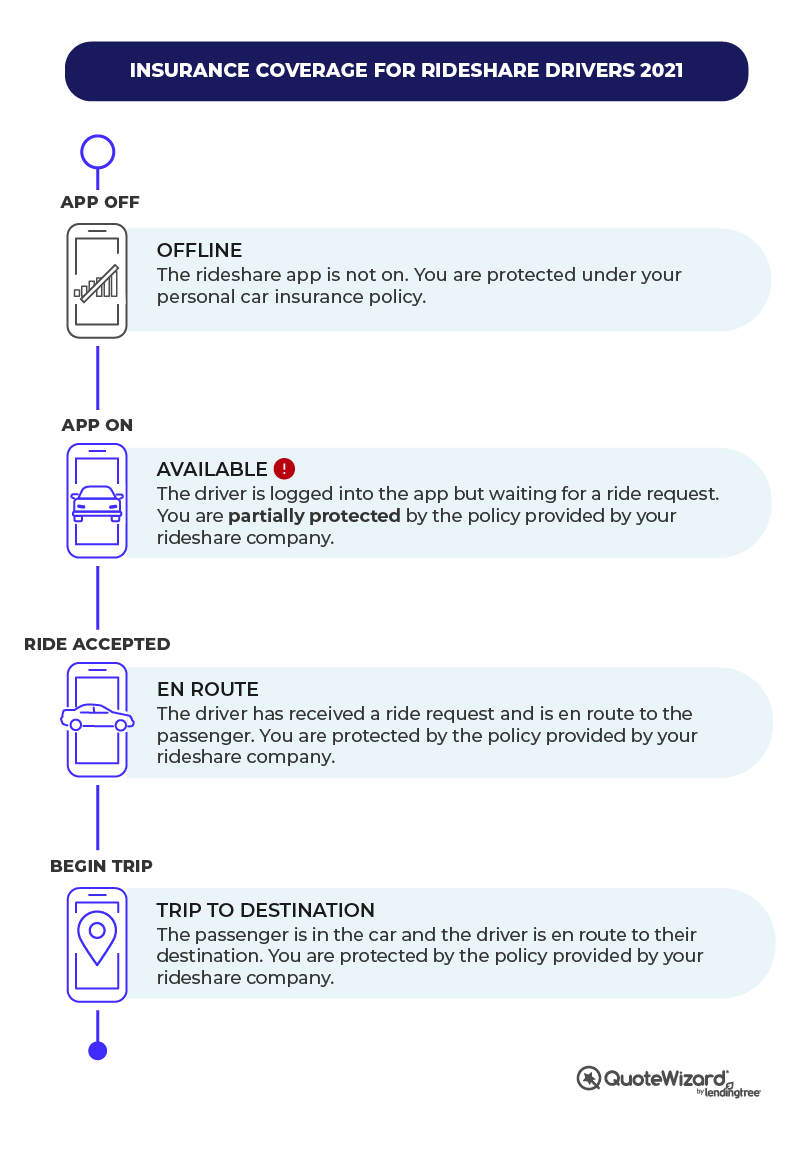

step must be to call the authorities. Depending on the kind of crash and also your rideshare firm's regulations, you could have to supply your personal proof of insurance coverage or the rideshare company's certificate. Exchange details with the other motorist as you generally would. Next, inform your individual car insurance firm. Even if you can count on your company to cover the damage, your individual insurer will certainly learn about any kind of mishaps, and also it's ideal they hear it from you. Chauffeurs that have not been straightforward regarding their driving standing can discover themselves in a challenging circumstance: If you pick not to tell your insurer, you risk being went down. Motorists ought to take a look at what's covered in both their individual policies as well as the rideshare firm's insurance. To be completely covered, you'll most likely need either rideshare insurance coverage or an industrial automobile plan. Not all insurance business use rideshare insurance coverage, nor is coverage readily available in all states. Business policies are extra commonly readily available. Even if your business uses complete insurance coverage during all stages of the work previously, during and also after requests your individual car insurance company could drop you if you don't divulge that you use your car to generate income. If you disregard to reveal this to your insurer; they will be likely to cancel your plan should you ever before enter a crash throughout a time when you do not have protection from the rideshare program. If you are a rideshare motorist, you need to recognize that although you are covered under these business's plans; there are certain voids in the coverage, especially when you remain in Duration 1, during your driving change. It is vital to know how you are covered during each. Duration 0: You are off obligation as well as have the App transformed off. Your individual plan is in impact and also covering you.

Duration 1: You are on duty with the Application activated, yet you're awaiting a trip demand - vehicle insurance. All agencies we collaborate with below at Keystone Insurance coverage. With the rideshare program's ever-growing popularity, it is just an issue of time before even more companies will craft as well as supply these.

policies. When trying to find local car insurance coverage, make certain to inspect with your fully-licensed Utah insurance coverage representative if you are not pleased with your current plan. Both Uber and Lyft supply" contingent "chauffeur protection during this period : You're called for to buy coverage on your own, however if your insurance provider rejects your case, your TNC's insurance will certainly safeguard you. Some insurance provider do not enable you to buy variable degrees of protection that go right into result at different times, so you'll have to purchase a policy to meet those higher restrictions. 6 celebrities: 4. 75 stars: 4. 85 stars As levels of solution rise, Lyft likewise has much more strict star ratings for its drivers, although the demands are not as rigorous as Uber's. To drive for a particular solution tier, you need at the very least the adhering to scores:: 4. uber, CONSUMES )or service of the automobile (i. e. Turo). Information for vehicle drivers If you are driving for a ridesharing firm, there are some important actions for you to take. 1. Inform Infinity Insurance. Your individual insurance needs to be updated so that you are using your automobile for ridesharing. Yet rideshare insurance it's not without its limits and the auto insurance policy protection supplied can vary in different states.A TNC company's rideshare insurance covers their motorists just when they're moving a traveler customer with their app. Were to take place while you serviced a consumer on the clock, you would certainly be covered under their rideshare insurance. Throughout times when you're driving around logged right into the app waiting for customers-there may be voids in your rideshare coverage. A Ridesharing insurance coverage recommendation is there to stop voids in the rideshare insurance supplied from Uber and Lyft and to make certain you're covered from the minute you switch your rideshare application on when you switch it off.

The Ultimate Guide To Best Rideshare Insurance Companies & Tips For 2022

The rideshare insurance deductiblesare cheaper than more affordable of Uber and Lyft, so it's not only the just choice for rideshare insurance but also however additionally economical much more. When it comes to ridesharing with an application, the type of hybrid plan that is readily available combines a personal policy and also rideshare insurance coverage into one insurance policy with one set of premiums. You normally require to have a preexisting vehicle insurance plan to include on rideshare insurance.

insurers prices insurance company auto

insurers prices insurance company auto

Get a Free Rideshare Insurance Policy Quote At we desire to aid you discover the ideal insurance policy to cover your rideshare or distribution service. To cover that gap in insurance coverage, Rideshare Insurance coverage is created to enhance the insurance coverage that rideshare firms supply motorists. Rideshare insurance coverage functions to cover the void in between your personal automobile insurance as well as the partial coverage given by Uber as well as Lyft.

Duration 1: The chauffeur is logged into the application yet is waiting on a trip demand. Duration 2: The driver has actually received a trip request as well as is en course to the passenger. Educating your company will provide you the chance to speak about alternatives for insurance coverage to avoid spaces. insurers. Your insurance company might additionally have an affordable rideshare insurance coverage offered for you to contribute to your normal plan. Companies providing rideshare insurance coverage Numerous firms offer rideshare insurance policy, and also you can frequently acquire it with your personal automobile insurer. What happens if rideshare vehicle insurance coverage isn't offered in my area? Additionally, the business that currently offer rideshare insurance policy may expand protection to other areas, so watch for any type of adjustments . If your firm does not supply rideshare insurance coverage, you can switch to another supplier that provides rideshare insurance coverage or think about a business insurance coverage if you wish to fill up the protection void.