Excitement About Car Insurance For Uber And Lyft Drivers

from web site

insurance low-cost auto insurance money affordable

insurance low-cost auto insurance money affordable

car insurance car insurance cheapest car

car insurance car insurance cheapest car

credit score car insured vans vehicle insurance

credit score car insured vans vehicle insurance

Nerdwallet also notes that due to the fact that rideshare insurance is just offered as an extension or as a hybrid bundle, you can only buy it from your current provider. For instance, if you have an individual automobile insurance plan with Allstate, you can't acquire rideshare protection from Mercury (vehicle insurance). When choosing in between a personal plan extension or a hybrid package, you must do the following: Let your provider know that you're driving for a rideshare policy.

Investopedia took a look at some leading suppliers and also considered the advantages and disadvantages of each one. They report that a rideshare plan from GEICO: Covers you whether you're off or at work, Does not limit your gas mileage, Covers distribution solution changes, Is somewhat more costly than various other plans, Is not offered in every state.

A State Farm rideshare policy: Is offered in most states, Covers distribution solution drivers, Does not restrict gas mileage, Just covers spaces in service-provided policies, Costs even more than similar strategies from other carriers, Because State Ranch's rideshare strategy is created to cover the gap in between your individual plan and also the policy supplied by the business you drive for, it's recommended for part-time drivers.

With this info, you're certain to discover outstanding insurance coverage at a sensible price. Inspect this out if you need additional information, sources, or assistance on cars and truck insurance coverage. This web content is produced and preserved by a 3rd celebration, as well as imported onto this page to assist customers give their email addresses. You may be able to find more info regarding this as well as similar web content at.

3 Easy Facts About Auto Insurance For Rideshare Drivers - Nolo Shown

For consumers with a personal car plan, the added costs priced estimate by firms like Farmers as well as Erie for rideshare insurance policy are typically from $6 to $25 each month. Allstate offers its rideshare protection for just $15 to $20 per year. car. Rideshare insurance policy sets you back much less than numerous chauffeurs would think, making it well worth the rate.

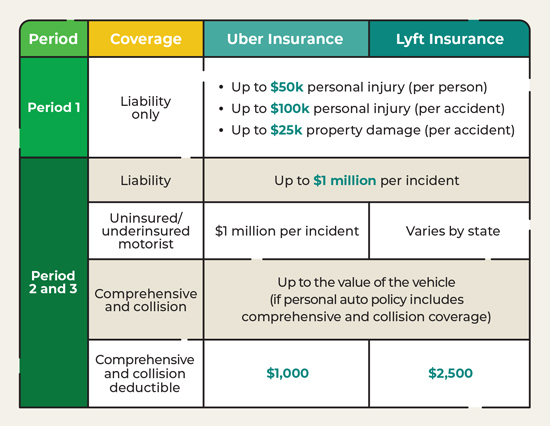

Lyft's is also greater$2,500. If you get involved in a mishap throughout periods 2 or 3, Allstate pays you the distinction between these deductibles and those on your individual auto plan. So, if your individual insurance deductible is $500, Allstate will certainly give you $500 if you drive for Uber or $2,000 if you drive for Lyft to assist pay your bills.

Rideshare is add-on insurance coverage, not a stand-alone policy. If you like your present car insurance policy company and also their rideshare insurance coverage appears practical as well as provides you a comfy degree of coverage, purchase from them. If you're not pleased with what you're supplied, consider switching over firms. Contrast purchase the very best general dealpersonal and also ridesharingthat you can obtain - vehicle.

When subscribing to be Visit this website a rideshare vehicle driver for Uber, Lyft or any firm that has you delivering clients or items for money, you might need to acquire rideshare insurance coverage - accident. If you enter into a car mishap while driving for one of these companies as well as don't have rideshare insurance policy, your individual liability cars and truck insurance policy policy may not cover the expense of damages, as well as you could even have your coverage went down.

Unknown Facts About What Is Rideshare Insurance? Do I Need It? - Getjerry.com

There can be other consequences to driving without rideshare insurance policy., the deductibles for these policies can be high.

When your insurance provider locates out, you may be gone down from insurance coverage. If you are at mistake for a mishap, the rideshare company might have an accident policy that pays to repair your automobile, yet it is likely to find with a high insurance deductible - cheaper car. In addition, your very own insurance coverage service provider may not cover the expense of damage to your lorry, even if you have detailed insurance policy as well as accident insurance plan (cheapest).

Rideshare insurance is typically offered as an add-on or recommendation to an existing policy (cars). Our referrals for rideshare protection If you are pleased with your existing automobile insurance firm, contact an agent to inquire about rideshare insurance. The simplest method to obtain protection is to include it to your existing plan (vehicle insurance).

credit insurers laws low-cost auto insurance

credit insurers laws low-cost auto insurance

Use the device listed below to contrast cars and truck insurance price alternatives from numerous top insurance firms in your area. Geico: Editor's Option Geico provides rideshare insurance policy protection that replaces your existing Geico plan. By converting your personal plan to a rideshare policy, you will be covered by the exact same insurance whether the rideshare application is on or off (cheapest car insurance).

Rumored Buzz on Commercial Auto Insurance - Get A Free Quote - Geico

Right here are the aspects our rankings take right into account: Track record: Our research study group considered market share, ratings from market professionals and years in business when providing this rating. Accessibility: Vehicle insurance provider with higher state availability and few eligibility demands racked up greatest in this group (vehicle insurance). Insurance coverage: Business that use a variety of selections for insurance policy protection are most likely to satisfy customer needs - automobile.

Lyft as well as Uber Insurance coverage, Uber insurance policy or Lyft insurance coverage gives minimal protection while you have the app on as well as are waiting for a request known as Duration 1. Not all insurance policy firms offer rideshare insurance coverage plans, neither is protection readily available in all states. auto. How To Acquisition Rideshare Insurance As mentioned, rideshare insurance is thought about supplementary coverage that can be included to your existing individual automobile insurance coverage plan.

We recommend inspecting if your present protection provider offers rideshare insurance policy or industrial insurance coverage. Our research team has actually assessed the top insurance coverage service providers in the United States as well as found these to be standout alternatives for rideshare insurance. If you don't have rideshare insurance coverage, you run the danger of: Shedding your personal vehicle coverage Dropping right into protection spaces for crashes that occur while you're ridesharing or driving for on-demand shipments Paying out of pocket for repairs, injuries, as well as more Partnership West Rideshare Insurance coverage covers you all the time, so you can focus on making cash, not fret concerning shedding it.