The Facts About Commercial Real Estate: New Markets Tax Credits Program Revealed

from web site

Top Guidelines Of New Markets Tax Credits - Dakota Business Lending

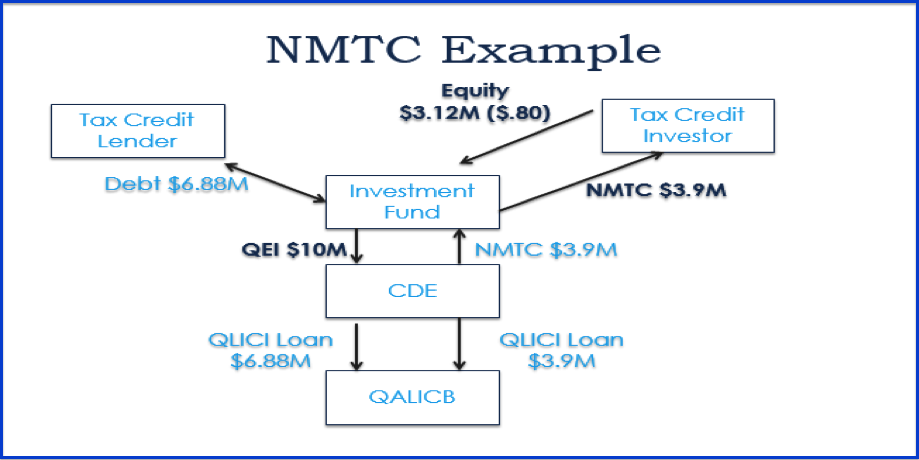

NMTC Products Mini-permanent funding for the construction or rehabilitation of neighborhood development tasks. Project needs to be found in a qualified census track. NMTC allowance and leveraged loan. $5-20 million. For bigger deals, LIIF may seek to partner with other CDEs. 7 years Priced at economical rates based on the transaction structure.

Standard NMTC security requirements. Guarantees might be required. A Reliable Source can deliver proceeds of up to 115% of the assessed value. JPMorgan Chase picked LIIF as one of its CDFI partners for an initiative to support NMTC transactions for the building or rehab of high-performing charter schools. Job requires to be found in a certified census track.

$5-20 million 7 years Priced at budget-friendly rates based upon the deal structure. No prepayment allowed. Requirement NMTC security requirements. Assurances might be needed. Item can provide proceeds of as much as 115% of the assessed value., Deputy Director, Southeast, , Market Director, Western Region, echavez@liifund. org.

New Markets Tax Credits (NMTC) Qualified Tracts Advisory Firm Fundamentals Explained

Wells Fargo serves as a: Lending institution Tax credit investor through third-party Neighborhood Development Entities (CDEs) Tax credit aggregator We serve a range of possession classes, consisting of but not restricted to: Neighborhood serving retail Community centers Charter schools and kid care centers Mixed-use and transit-oriented advancements Running businesses Customers Our clients are knowledgeable project sponsors who support non-profit organizations, for-profit organizations, small and middle-market businesses, and property redevelopment projects, all in financially distressed places.

Funding size Typically $7. 5 million to $50 million 7-year construction/term loans, often interest-only or with very little amortization NMTC debt programs We provide impact capital for certified projects, generally in 2 kinds: NMTC aid in the type of subordinated financial obligation to certified projects, in addition to a hidden market-rate financial obligation component.

The New Markets Tax Credit (NMTC) program is a federal tax incentive licensed by Congress in 2000 to help spur the investment of capital in small companies and commercial realty located in neighborhoods of need. Through NMTC allocations, Wells Fargo decreases borrowing costs for non-profits and business owners by offering below-market rate financing on more favorable credit terms than traditionally offered.