The Difficulty Of Getting A Little Home Mortgage

from web site

In most of the U.S., the optimum conforming home mortgage for one-unit residential properties is $510,400 in 2020. The amount your rate of interest will raise when you get loan provider credit scores isn't a fixed portion. " You need to actually look at how much greater your interest rate is mosting likely to be, which is mosting likely to differ every now and then. If your goal is to repay your home mortgage as quickly as possible, you could utilize the money that would certainly have gone toward shutting expenses and instead utilize it to pay for your loan equilibrium. A partnership in between Pinnacle Financial institution and not-for-profit organization, The Functions Inc., runs a program in the Memphis location that has a pool of $2 million for mortgage loans up to $50,000. The Works offers newbie buyers with credit rating therapy and car loan origination.

- Home mortgage insurance saves you for a while if you begin to miss payments on your loan.

- Not only exist plenty of car loan choices, however at On Q Financial we make it easier with our mobile finance app that enables you to publish your records securely from your phone.

- Committed home mortgage lending institutions, on the other hand, often make it faster and also simpler to get approved for a financing.

- If you choose a finance program that requires a down payment, browse for additional programs.

Ask a house mortgage consultant to help you contrast the monthly and also lasting prices of all finances. Mortgage insurance coverage requirements may create you to pay even more over the life of the financing. To aid people end up being home owners, the federal government insures loan providers if the customer defaults on the funding. This enables financial institutions and also home mortgage firms to issue beneficial fundings, also for newbie customers with little credit scores as well as no money down.

The home loan rates of interest alone doesn't inform the entire tale, says Gordon Ron Jon Timeshares Miller, head of state of North Carolina-based mortgage broker, Miller Financing Team. Specifically because customers can pay to obtain whatever rate they desire, he said. When you choose to pay closing costs upfront in order to maintain your rate as low as feasible, "you're paying today for Timeshare Cmo a benefit you're never mosting likely to get," Miller states. All customers should pay closing prices commonly ranging from 3% to 6% of the car loan. These costs can make or break the bargain you assume you're hopping on the rate of interest. Freddie Mac's study shows that soliciting even one added deal can conserve customers $1500 usually-- you'll want to get the most effective price feasible for your mortgage.

How Home Loans Work

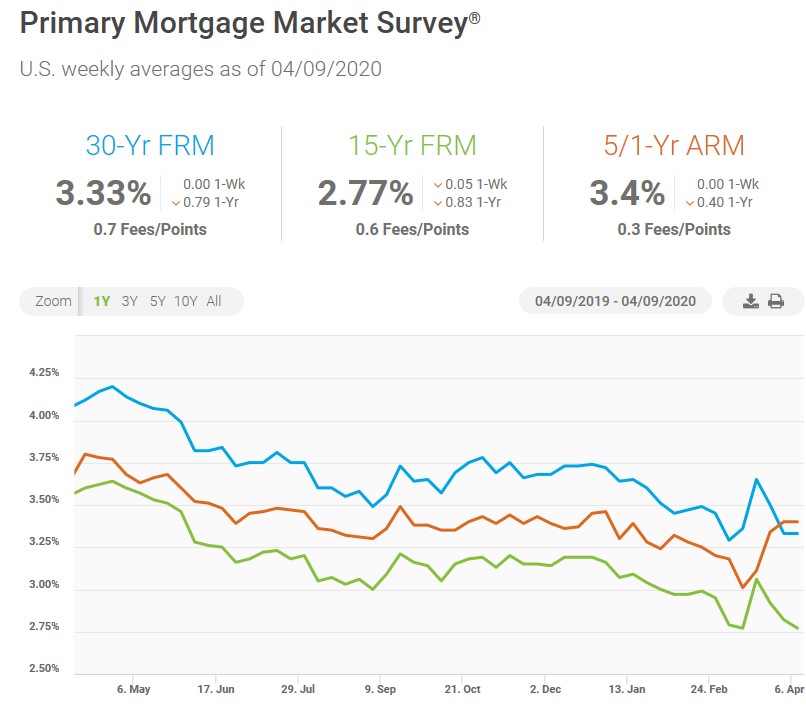

The Federal Book quickly went down interest rates to dissuade a financial recession. The Fed recently introduced that interest rates will certainly be rising in 2022 as they relocate to reduce inflation. Once your offer has actually been accepted, there's a bit a lot more work to be done to finalize the sale and your financing. On Q Financial are a group of professional home mortgage individuals that exceed the first application. Each action of the procedure numerous individuals concentrate on assisting make the mortgage involved fruition.

Mortgage Rates & Lendings

They're progressively popular with novice home buyers, also, according to the National Organization of Realtors. Adjustable-rate loans commonly come with a lot lower rate of interest than fixed-rate options initially, however they carry the included danger of future rate increases. ARMs can be a good option if you know you will not remain in the home long, or if you're willing to refinance right into a fixed-rate loan before your low-rate duration expires. A home loan is a particular sort of financing that's used to buy a residence or a piece of real property.

These posts are for Wesley Financial Reviews academic purposes only as well as provide general mortgage details. Products, services, procedures and offering criteria described in these short articles may vary from those available through JPMorgan Chase Bank N.A. For more details on readily available products and services, and to discuss your options, please call a Chase Residence Financing Consultant. This type of financing is only available for united state military experts and active-duty servicemembers. A down payment is the initial, in advance payment you make when acquiring a home. This money appears of pocket from your personal financial savings or eligible gifts.