Some Ideas on What You Need To Know About Your Car Insurance Deductible You Need To Know

from web site

If you pick a reduced auto insurance policy deductible quantity, it's likely your costs will be higher (automobile). While you're paying a lot more currently, if something happens down the line and you enter into a mishap, you'll pay much less out-of-pocket after that. Your insurance deductible quantity must be something you feel comfy paying or have easy access to in a reserve, or as a last resort, a line of credit scores.

On the various other hand, comprehensive and accident insurance policy can cover mishaps, theft, as well as weather events that can come out of no place. You can pick the insurance deductible amount for each type of protection, so if you think you are a secure vehicle driver, it might make sense to have a higher accident insurance deductible (where you can often protect against a crash) versus detailed (where the events are commonly out of our control).

That means considering your risk levels, needs, funds, and extra. You additionally want to make sure you have the best insurance coverage to shield yourself in numerous scenarios. If you're still paying for miles you aren't driving, it's time to rethink your vehicle insurance coverage.

If you make use of the conventional mileage rate, you can not subtract automobile insurance coverage premiums as a separate expenditure. This includes car insurance coverage as well as the various other products provided above.

Several people use a personal cars and truck for both personal as well as organization functions. To figure out what puts on your tax obligations, you'll divide the expenditures between individual and business use based on the miles that you drive. For instance, if 70% of the miles you drive are for service, and the various other 30% are for individual, you'll typically be able to apply 70% of your costs to your deduction.

What Should My Insurance Deductible Be? Fundamentals Explained

An automobile insurance policy deductible is the amount you concur to pay out of pocket for a claim prior to your plan pays the rest. Keep reading for more information concerning automobile insurance policy deductibles, consisting of: Just how a car insurance deductible jobs Some types of auto insurance policy need you to pay a set quantity expense before the policy covers the remainder of the case.

The damages is covered under your crash insurance, and the repair services appear to $7,000. If you have a $500 deductible, you pay $500, then your cars and truck insurance coverage company pays the remaining $6,500 (cheaper car). When do you pay a deductible for vehicle insurance coverage? Not all sorts of car insurance require you to pay an insurance deductible.

: covers damages as a result of reasons apart from collision, including theft, criminal damage and fire. An uninsured/underinsured motorist insurance policy case might have an insurance deductible, depending on where you live. Without insurance motorist coverage deductibles have a tendency to be managed by your state rather than you choosing the amount. Automobile liability insurance policy covers problems as well as injuries you trigger to various other people or their residential or commercial property.

Do I pay a deductible if I'm not at mistake? If you are in a crash that is not your fault, you usually will not pay an insurance deductible.

You will certainly require to pay your deductible in this circumstances, yet if it's later on found that you're not at mistake for the crash, you can get a refund. There are a pair of various other possibilities that might occur: Your insurance provider might determine to seek activity versus the other chauffeur's company to redeem their expenses - insurance affordable.

What Is Car Insurance Deductible 2022? How Does It Works? Fundamentals Explained

If you are not able to redeem your insurance deductible from your carrier, you can take the various other driver to small claims court for the deductible quantity. Remember, however, that the deductible amount may not worth the time. Automobile insurance coverage deductible vs (car insurance). exceptional Deductibles and also premiums are 2 sorts of settlements you make to your auto insurance provider for coverage.

Auto insurance coverage can help spend for costly repair services as well as injuries after a mishap. It may not cover 100% of the cost. An auto insurance coverage deductible is the amount you are in charge of paying of pocket. Some sorts of protection have a deductible, as well as others don't. Whether you need to pay a deductible depends on the kind of insurance coverage case you submit as well as that (if anybody) is at mistake.

The insurance policy company will only pay for costs that surpass $1,000. Deductibles usually vary from $100 to $2,500. If you have even more than one type of protection with an insurance deductible, you can select different insurance deductible amounts for each coverage kind.

If you can not pay for to pay your insurance deductible, you will not be able to cover all the fixings. The insurance coverage firm will just pay for costs that surpass your insurance deductible.

automobile insure insurance affordable car insurance

automobile insure insurance affordable car insurance

If you assume it's unlikely you'll need to sue, you could think about a greater deductible. Whatever amount you select, it is necessary to make sure you can afford to pay it if you require to sue adhering to a crash. Deductibles put on some kinds of car insurance protection yet not to others.

What Is A Car Insurance Deductible? - Bankrate for Beginners

cheap auto insurance car insured insurance liability

cheap auto insurance car insured insurance liability

This type of protection assists pay for repair service and replacement costs if you're in a collision. Covers incidents that are out of your control and also don't include an accident, such as extreme weather condition, rodent damages, falling objects, theft, as well as criminal damage. Helps spend for car fixings if the at-fault motorist doesn't have insurance policy or does not have enough insurance coverage to cover the expense of the repairs.

This kind of insurance coverage is not readily available in all states. If an insured driver strikes you, you do not need to pay a deductible since the other motorist's insurance will certainly cover the damages. However if you ever before require to file a claim with your insurance business, you will be liable for paying the deductible - cars.

Let's discuss how deductibles function and how to choose the finest one for your spending plan and insurance coverage needs. Simply put, a deductible is the quantity of cash you'll have to add in the direction of working out an insurance coverage case.

Rare, there are some exceptions where a deductible is non-applicable. If one more insured motorist is accountable for your problems as well Homepage as injuries, a deductible does not use (cheap car).

But for new vehicle owners, the expectation may not be as rosy. The average cost of a brand-new automobile is approximated to be $37,000, which leads to higher costs. If you drive a brand-new vehicle and also are associated with a major crash, it can trigger thousands in damage (let alone the possibility for personal injury) or complete the vehicle.

All About Is High-deductible Car Insurance The Right Choice For You ...

For vehicle drivers with a high insurance deductible, the bulk of the repair service costs would certainly drop on them. Stacking Insurance deductible, Before signing on the dotted line for your plan, you ought to verify exactly how each circumstance is dealt with.

Your deductible is established at $1000, and also the agreement states it is applied independently. This implies you would certainly need to add toward car repair work as well as the clinical expenses of each and also every guest. For this factor, always ensure your deductible is packed in as several clauses as possible to avoid scenarios of this nature (cheap insurance).

Not surprisingly, the chance of being included in an incident increases the even more time you spend behind the wheel. So the more you drive, the reduced the deductible should be to help make certain marginal losses in the event of a mishap. If you're just placing in a couple of thousand miles per year, selecting a higher insurance deductible can conserve you money on your premium prices, and this difference might be able to assist contribute if a crash does ever happen - cheaper car insurance.

While an insurance deductible may not apply if you were not the motorist liable, it does not necessarily shield you in situations where the accountable vehicle driver is underinsured or without insurance. The decision you make on your deductible price ought to be a matter of individual preference. The expense of an insurance coverage premium ranges with the deductible, so discovering the balance comes down to evaluating your spending plan as well as risks of having a mishap. affordable auto insurance.

Your car insurance coverage deductible is generally a set amount, say $500. If the insurance policy adjuster identifies your case amount is $6,000, and also you have a $500 deductible, you will certainly obtain a claim repayment of $5,500.

The smart Trick of What Is A Car Insurance Deductible? - Kelley Blue Book That Nobody is Talking About

cars insurance insurance companies cheaper

cars insurance insurance companies cheaper

Deductibles vary by policy and also vehicle driver, and also you can choose your cars and truck insurance policy deductible when you acquire your plan - insured car.

Contrast quotes from the leading insurance firms. Which Car Insurance Policy Insurance Coverage Kind Have Deductibles?, there are differing deductibles based on those different kinds of coverage.

car affordable affordable cheaper cars

car affordable affordable cheaper cars

This protection pays for fixings to your lorry when you are at mistake. This might be when your vehicle is harmed in an accident with an additional lorry or a things such as a tree or wall (low-cost auto insurance). This deductible is normally the highest possible insurance deductible you will certainly have with your cars and truck insurance plan.

In that situation, you would not pay a collision insurance deductible. Accident defense insurance coverage pays the clinical expenses for the motorist as well as all travelers in your auto. Without insurance driver protection pays your expenditures when you remain in a car crash with a vehicle driver who is at mistake but does not have insurance policy or is insufficiently insured to cover your expenses - cheap car.

Our What Is A Car Insurance Deductible? - Credit Karma Diaries

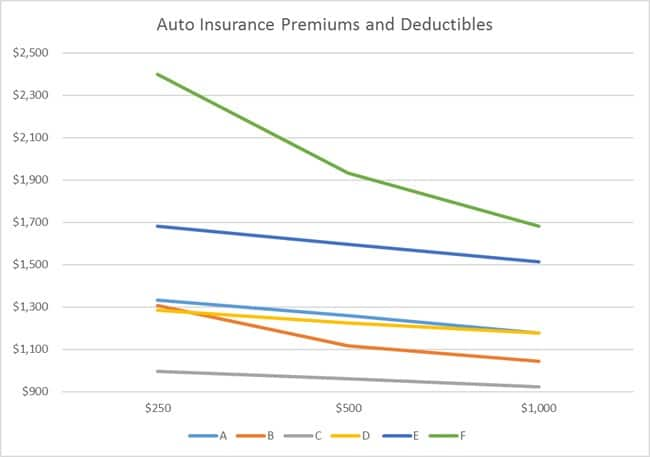

What Is the Typical Insurance Deductible Cost? Due to the fact that consumers choose varying kinds of cars and truck insurance policy protection with different financial restrictions, deductibles can differ considerably from one vehicle driver to the following. For most vehicle drivers, regular deductible quantities are $250, $500 and $1,000. According to Cash, Nerd's information, the average automobile insurance deductible quantity is around $500.

Likewise, your cars and truck insurance deductible will certainly vary based on that protection and the cost of your premium. Generally speaking, if you choose a policy with a greater insurance deductible, your costs will certainly be lower. This can be a great choice as long as you can pay that greater deductible in case of a crash.

In fact, you can conserve a standard of $108 annually by increasing your deductible from $500 to $1,000. For those with limited spending plans, selecting a reduced costs as well as a greater insurance deductible can be a method to guarantee you can spend for your cars and truck insurance policy. If you can afford it, paying a greater premium might imply you don't have to come up with a whole lot of cash money to pay a lower deductible in the event of a crash.

It is necessary to have your inquiries pertaining to car insurance deductibles addressed before that takes place, so you know what to expect. Increase ALLWho pays an insurance deductible in an accident? Do you pay if you're not responsible? When there's a car accident, the at-fault motorist is required to pay the auto insurance coverage deductible.

If the at-fault chauffeur does not have insurance or enough insurance policy to cover the various other motorist's expenditures, the no-fault motorist can use his vehicle insurance as second insurance coverage to pay the expenses. When do you pay a deductible if you are required? Usually, if you are needed to pay a car insurance deductible, the amount of the deductible will certainly be deducted from your case repayment when it is issued - cheapest car.