What's The Average Cost Of Car Insurance In 2020? - Business ... Things To Know Before You Get This

from web site

Info regarding your revenue and current expenses, Having all this details easily available will certainly make the procedure of learning how much auto insurance coverage is going to set you back much quicker. Do You Required to Have Auto Insurance policy? Practically every state in the U.S. needs any individual who owns and operates an automobile to have some kind of automobile insurance coverage (vehicle).

Even in those states, it's still an excellent idea to have some kind of cars and truck insurance coverage. What Are the Components of Vehicle Insurance Coverage? There are numerous elements that will certainly comprise your insurance coverage, relying on the kind of protection you decide for. Responsibility, Accident, Comprehensive, Personal Injury Defense, Uninsured Driver, Each of these elements have their advantages as well as disadvantages for motorists.

The negative aspect of this insurance coverage is that your car and residential property may not be covered. This is where having accident coverage is available in convenient. It will cover problems to your lorry. If your lorry is older, it could not deserve the extra price. Comprehensive insurance coverage will aid to pay for problems that aren't associated with a mishap with another driver; hitting a deer, hailstorm tornado damage, burglary, or various other unanticipated incidents.

cars vans insurance company insurance

cars vans insurance company insurance

If you're in an accident in which you or your travelers are wounded, accident defense will cover it, despite who is at mistake. Insurance coverage is usually called for, not every chauffeur carries it as they should. This is when having uninsured vehicle driver coverage is necessary. It will aid cover the expenses sustained by a crash if the various other party does not have the insurance policy protection required to pay for damages - business insurance.

business insurance cheap car cheaper auto insurance affordable auto insurance

business insurance cheap car cheaper auto insurance affordable auto insurance

For those that pay every six months, the typical cost for insurance will certainly be about $751. The state you live in will certainly additionally play a duty in figuring out the quantity you will certainly pay for your car insurance coverage.

Full Coverage Car Insurance Cost Of 2022 - Truths

46, Maine at $703. 82, Wisconsin at $737. 18, as well as Indiana at $755. 03 on the checklist. Why are some states cheaper than others? Commonly, the major reason is population thickness. Website traffic and crime/theft price likewise contribute to just how much you will pay on standard for auto insurance policy in your state.

For instance, if you are a single 30-year-old woman that lives in Minnesota, a state that remains in the middle when it comes to the typical cost of insurance coverage, you will likely discover your quote someplace in the $1136 per year array. If you are an 18-year-old man university pupil trying to get insurance policy for the first time, you will certainly find yourself paying a higher rate, even in the very same state.

The make as well as version of your car are very important factors to just how much average car insurance policy will be for you. AAA's Your Driving Costs study in 2018 found that the least costly insurance coverage might be discovered for a small SUV, while one of the most expensive insurance policy would certainly be for a small sedan.

The insurer you pick to provide you with insurance coverage is additionally mosting likely to impact the price. The preferred provider State Farm has several of the least costly rates, while Freedom Mutual, one more prominent alternative, has some of the highest possible premiums. Cars And Truck Insurance Policy Discounts, The Good News Is, there are a variety of price cuts readily available to help you conserve money on your auto insurance coverage.

low cost auto cheaper car insurance cars cheaper car

low cost auto cheaper car insurance cars cheaper car

Safe chauffeur discount rate: This is available to vehicle drivers that have a background of secure driving, implying they have not been associated with a crash or have taken a motorist's education training course. Safety and protection tools discount: If you have actually set up any anti-theft gadgets, such as an alarm system, you could get this discount rate. low cost auto.

Unknown Facts About Car Insurance Rates By Make And Model 2022 - Finder.com

Blog site Ordinary Cars And Truck Insurance Policy In Ontario By Month, Age And Sex Wondering just how much your cars and truck insurance will cost in Ontario? The price of auto insurance in Ontario is among the highest possible in the nation. There are several elements insurance firms make use of to determine just how much the rates will certainly be for your vehicle plan.

In this blog site, we'll provide you an in-depth failure of the typical vehicle insurance policy costs in Ontario by age and gender. What is the ordinary expense of auto insurance policy in Ontario?

They are higher or lower relying on your location, the kind of lorry you drive, driving history, and many various other considerations. Exactly how much is car insurance policy each month? Just how much you pay monthly in Ontario will vary based on your annual costs. You can approximate your car insurance coverage per month by separating your overall amount by twelve month.

Mature chauffeurs experience more savings. Male as well as females in the 18-25 age variety pay even more. Insurance policy for young drivers is more pricey because they are more probable to enter into a crash. This suggests there are greater insurance claims prices connected with more youthful drivers. The exact same holds true for elders. credit. As soon as you get to a specific age, you can see prices start increasing once more.

affordable car insurance cheaper car affordable accident

affordable car insurance cheaper car affordable accident

They tend to drive more, are extra likely to be included in accidents, and take part in riskier driving behaviours. Males pay even more than ladies. To illustrate this point we sourced data from our quoter and contrasted men as well as ladies in a series of age categories. We then compared them to the general standard for all vehicle drivers.

Facts About Tesla Bets It Can Bring Down Insurance Costs, Make Driving ... Revealed

Individuals with a G2 licence will certainly pay even more than a person with a G licence. As you progress with the licensing system, the quantity will certainly lower. G1 vehicle drivers can not be provided as the key driver on a policy. However a plan with a G1 driver provided will lead to a price increase.

To conserve cash, you can get provided on a parents or guardians intend as a periodic vehicle driver. It will certainly boost the premium, but not as much as if you took out a different policy.

Prices can vary considerably by age, driving document and also insurance background. Look into our auto insurance policy calculator to read more about determining prices. Exactly how much is does it set you back to insure a teen driver? Teenage motorists are recognized for paying a lot for insurance. Based on information from our quoter, the standard for a teenager (age 16-19) is.

For an 18-year-old securing a policy, they can anticipate it to be around $688 per month or $8,250 each year. Contrast this to the regular amount of a 40-year-old, and also you'll see a significant difference (cars). They pay approximately $1,977 per year. Why a lot of a difference? Teens are a higher danger to roadway safety and security.

In Brampton it is about $2,400 each year, which is the highest possible in the province. Cities such as Kingston and also Belleville average regarding $1,000 per year.

The smart Trick of How Much Is Car Insurance Per Month In 2022? Get Car ... That Nobody is Discussing

London has to do with $1,400 each year. Mississauga is over $2,000 every year. Hamilton is about $1,600 each year. A few other aspects that influence prices for auto insurance Several things have a straight effect on the cost of car insurance policy. Some you have control over (what you drive, driving history) and also others you do not (insurance sector aspects).

There are also specific considerations you can not control, such as your age and also sex. Will the cost of insurance coverage go down for vehicle drivers? Even though the Ontario rural federal government has actually made assurances to obtain insurance policy under control, the annual standard expenses are still on the rise.

Individuals are beginning to obtain a break to some level. In terms of age, you can expect to start seeing reduced expenses when you transform 25.

The ordinary cost of car insurance is a combination of the vehicle you drive and your character (auto). Your age, location, credit report as well as driving history all aspect in. The sort of car also matters, as does its features. High-end automobiles will certainly set you back even more than preferred brand names to insure. A newer model might actually set you back less than a cars and truck that is a couple of years of ages because of the quick advancement of safety and security functions.

Typical name plates will be much more budget-friendly because their components are simple to find. The very same opts for designs constructed from a common platform of elements by the maker. Some cars are much more likely to have a hostile motorist behind the wheel. The combinations are unlimited (cheap auto insurance). Before you purchase your next car, see what it will certainly set you back to insure it.

Understanding Car Insurance Rates - Reviews.com Things To Know Before You Buy

Auto insurance coverage is essential to safeguard you monetarily when behind the wheel.!? Below are 15 techniques for conserving on cars and truck insurance costs.

Which Age Team Pays the Many for Auto Insurance? Insurance provider normally charge a lot more for motorists that are under the age of 25. 7 Great site If you are 50 years or older, you fulfill the AARP member age requirement and also can request coverage with The Hartford. Because 1984, The Hartford has helped almost 40 million AARP members obtain the automobile coverage they need with unique benefits as well as discount rates What State Has the most affordable average cars and truck insurance policy rates? According to III, in 2017, these states had some of the lowest car insurance rates:8 To read more, obtain a quote from us today.

They'll aid you obtain the car policies you need, whether it's to aid spend for problems after a crash or to secure you from accidents with uninsured vehicle drivers.

55 in 2018 (one of the most recent year covered in the record) - insurance affordable. Nevertheless, your very own costs may differ. The quickest way to discover out just how much an auto insurance coverage policy would cost you is to make use of a quote calculator tool. Enter your postal code below to receive cost-free, instantaneous insurance coverage quotes from a few of the best vehicle insurance coverage business in your location.

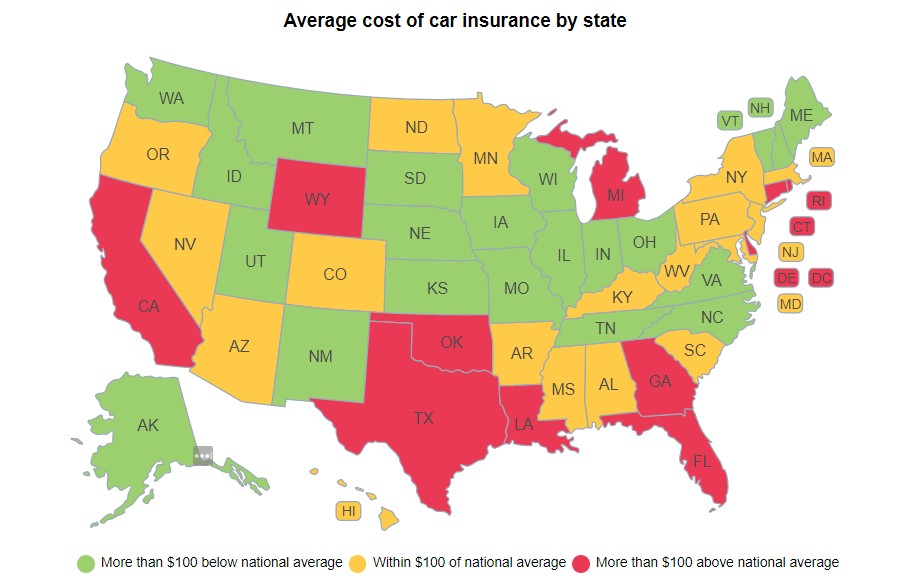

Various states additionally have various driving conditions, which can impact the expense of automobile insurance coverage. To offer you some suggestion of what chauffeurs in each state invest yearly on automobile insurance, the table listed below shows the typical cost of car insurance by state, according to the 2021 NAIC Vehicle Insurance Policy Data Source Report.

Car Insurance: The 25 Least Expensive Vehicle Premiums Fundamentals Explained

Bundling: Bundling your house and also car insurance plan commonly leads to premium price cuts. You can additionally conserve money for insuring multiple lorries under the exact same plan. Paying ahead of time: Most insurance firms provide a pay-in-full discount - perks. If you have the ability to pay your entire premium at once, it's typically a much more economical choice.

Our approach Since customers depend on us to supply objective and also precise details, we produced an extensive ranking system to develop our rankings of the most effective vehicle insurance provider. We accumulated information on lots of automobile insurance companies to grade the business on a variety of ranking factors. The end result was an overall score for each supplier, with the insurance providers that scored the most points topping the checklist.

Schedule: Car insurer with higher state schedule as well as couple of qualification demands racked up greatest in this group. Coverage: Companies that offer a range of options for insurance policy protection are most likely to meet customer demands (insurance). Expense: Average car insurance coverage rates as well as discount rate possibilities were both considered. Client Experience: This rating is based on volume of problems reported by the NAIC as well as customer satisfaction scores reported by J.D.

Among the biggest variables for consumers seeking to get car insurance policy is the rate. Not only do prices differ from company to firm, but insurance expenses from state to state differ. According to , the ordinary yearly expense of vehicle insurance policy in the United States was $1,633 in 2021 and is forecasted to be $1,706 in 2022.

Average rates vary commonly from state to state. Relying on typical vehicle insurance coverage costs to estimate your car insurance premium might not be the most exact way to figure out what you'll pay.

The 2-Minute Rule for Average Cost Of Car Insurance - Nextadvisor With Time

cheapest car insurance cheap car insurance auto

cheapest car insurance cheap car insurance auto

Insurance providers use several factors to determine rates, as well as you may pay more or much less than the typical driver for protection based upon your risk profile. More youthful motorists are generally a lot more most likely to get into a crash, so their premiums are usually greater than standard. You'll likewise pay more if you have an at-fault accident, several speeding tickets, or a DUI on your driving document.

Maintaining the minimum amount of insurance policy your state needs will certainly enable you to drive legitimately, and also it'll set you back much less than full protection - cheaper car. But it may not offer sufficient protection if you remain in an accident or your automobile is harmed by another covered case. Interested concerning how the ordinary price for minimal insurance coverage compares to the price of complete insurance coverage? According to Insurify.

However the only way to understand specifically just how much you'll pay is to shop around and also get quotes from insurers. Among the aspects insurance providers use to identify prices is location. Individuals who stay in areas with greater theft prices, accidents, as well as natural calamities typically pay even more for insurance. And because insurance laws and also minimal insurance coverage needs differ from state to state, states with greater minimum needs generally have higher average insurance policy expenses.

The majority of yet not all states enable insurance provider to make use of credit score scores when establishing rates. As a whole, applicants with lower scores are extra most likely to file a case, so they usually pay extra for insurance policy than motorists with higher credit scores. If your driving document consists of crashes, speeding up tickets, Drunk drivings, or various other offenses, expect to pay a higher premium.