Some Ideas on COMMON MISTAKES IN FILLING THE PF APPLICATIONS You Should Know

from web site

Indicators on List of EPF Forms - Check Form List for Employers - Wishfin You Should Know

Comments and Aid with epf form 10d pdf download used: 9. 10. 11. 12. 13. 14. 15. 16. Member's profession (figured out according to the date when the pension was earned): 17. 18. 19. 20. 21. 22. 23. 24. 25. S.P.P.A. Earnings Tax: 26. 27. 28. 29. (e) Name of the employer: (d) Name of the taxpayer: S.P.P.A.

(e) Name of the company:: (d) Name of the taxpayer: (c) S.P.P.A. Utilized Date of Receipt of Pension:: 29. 30. (f) Total Pounds, Pounds Sterling, or Canadian Dollars (c) (d) (e) Amount due from the Company: (f) (g) (h) (i) (k) Overall amount payable to you: 0.

Facts About 589.pdf - Government of Rajasthan ENERGY PORTAL Uncovered

Employed Date of Receipt of Pensions:: 31. 32. (i) Taxpayer Number:: 33. 34. 35. (j) Taxpayer:: 36. S.P.P.A. Employed Month of Birth: 37. 38. 39. 40. 41. 42. S.P.P.A. Pension Date: S.P.P.A. Annual Income(s): 43. 44. 45. S.P.P.A. Annual Gross Earnings 0.

0. S.P.P.A. Pension Quantity: S.P.P.A. Annual Earnings (leaving out pension amounts got as gifts or otherwise) 0. 0. 0. S.P.P.A. Annual Gross Earnings 0. 0. 0. S.P.P.A. Annual Internet Earnings (omitting pension quantities got as presents or otherwise) 0. 0. 0. S.P.P.A. Income Tax: Nil Overall Quantity of Pensions to be paid for the year of Pension Earned: (a) S.P.P.A.

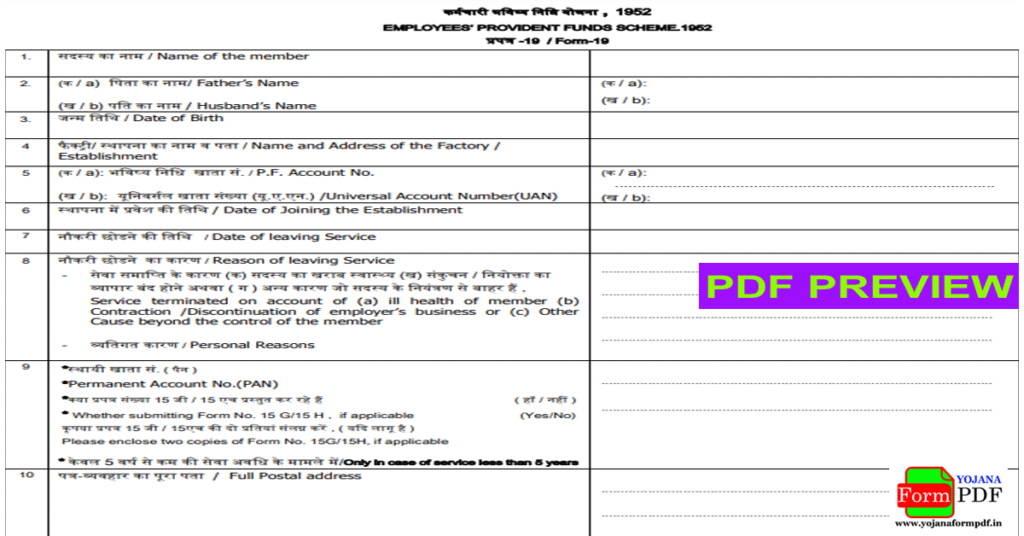

Details about PF withdrawal forms - Which to use when for Dummies

0. 0. S.P.P.A. Pension Amount 0. 0. 0. Total Tax 0 What is epf kind 10d? You can discover the Type 10D for claiming monthly pension. This kind is supplied by the Workers' Provident Fund Organisation (EPFO) and it has actually to be sent by the first claimant i. e. member or widow/widower, orphan, or candidate as the case might be.

Worker Provident Fund Organization (EPFO) supplies a regular monthly pension to the pf account holders under Staff member Pension Plan (EPS-95). Whenever a worker is utilized under EPF registered business. The staff member can get the advantages provided by the EPFO. Additionally, an employee's 12% of wage (Standard Pay+DA) will be deducted and goes to the EPF account.