The Single Strategy To Use For Department Of Human Services - Families And Children

from web site

Having an at-fault crash on your record suggests higher insurance. There are also individual considerations you can not regulate, such as your age and sex. To find out more please go to our web page as well as see what elements impact Ontario car insurance prices quote. Will the rate of insurance policy decrease for vehicle drivers? Although the Ontario provincial federal government has made pledges Take a look at the site here to obtain insurance policy controlled, the annual standard expenses are still on the rise.

Nonetheless, individuals are starting to obtain a break to some degree (car). You need to take crucial actions to minimize settlements such as comparing quotes each year to get the cheapest vehicle insurance coverage as well as collaborating with an insurance expert. In terms of age, you can expect to begin seeing reduced prices as soon as you transform 25.

With less experience when traveling, mishaps are most likely, and so are other problems (insurers). Car insurance not just provides security from economic and legal liability, but it can also provide added functions like roadside assistance. It comes at an added preliminary cost, yet it will be worth it in the long run if you have an occurrence when driving.

This will certainly help you locate not just the best price yet also the appropriate coverage on your own or your teen motorist. Once you have the right quote, identify what buying choices are available. While some business just allow you to acquire insurance with an agent, others might enable you to receive a quote and also acquire a policy online.

Often Asked Concerns Just How Much Does Cars And Truck Insurance for Young Drivers Price?

To make up for this absence of experience, teens are generally billed more (cheaper car insurance). Our research into an option of the top auto insurance policy firms found the ordinary yearly price for 17-year-olds to be $5,095, contrasted to $1,810 for 42-year-olds and also $1,497 for 67-year-olds (suvs). That suggests 17-year-olds are paying approximately 181% greater than 42-year-olds.

What Is The Cost Of Car Insurance For 16-year-old Driver? - Way Can Be Fun For Everyone

car cheaper cars auto affordable

car cheaper cars auto affordable

Various other aspects that can influence the expense of automobile insurance policy for teens are the amount of protection you purchase, the kind of cars and truck you drive, and just how much you drive annually. Relocating violations or accidents on your driving document can also boost prices. Just how We Picked the Best Vehicle Insurance for Teenagers Our team assessed 25 insurer and accumulated hundreds of information points prior to choosing our leading options.

After USAA, the most affordable for trainees is State Ranch. For insurance coverage with this insurance firm, a high-school trainee will pay an approximated $429 each month generally. The next 3 most affordable firms for high-school pupils are GEICO, Nationwide, as well as Allstate. College students, on the various other hand, can expect to pay a bit less for cars and truck insurance coverage.

An additional fantastic choice for teenagers, trainees, as well as brand-new chauffeurs is telematics. Maintain in mind that not all insurance policy companies supply this choice.

Do not fail to remember to ask about discount rates for automobile safety functions. That will certainly help you obtain the most affordable price - cheap car insurance. You can start with this device from GEICO.

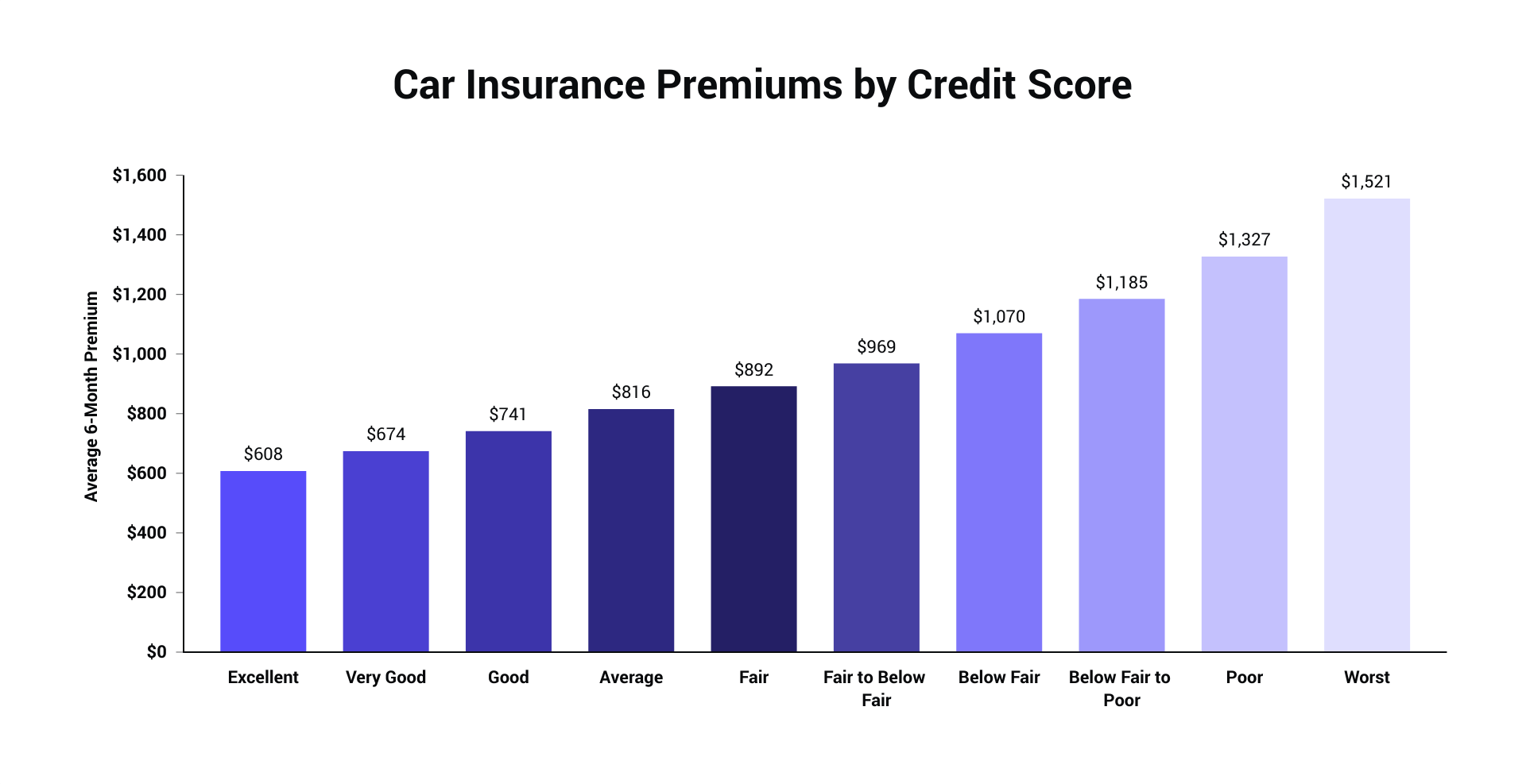

affordable car insurance vehicle auto insurance credit

affordable car insurance vehicle auto insurance credit

accident auto low cost credit

accident auto low cost credit

Auto insurance policy for 16-year-olds can be terrifying to consider (cheapest car insurance). Moms and dads and also guardians promptly think of the cost, and also just how frustrating choosing the appropriate insurance coverage plan can be. According to the Centers for Disease Control and also Prevention, the threat of a vehicle accident is higher amongst 16- to 19-year olds than among any kind of other age team.

As a result of the boosted threat, the price of your vehicle insurance coverage can increase with a teenager involved. The cost often tends to rise by a standard of $800 annually, recent information suggests. In this overview, you'll discover exactly how to obtain a recently accredited chauffeur insured, what aspects influence insurance expenses, as well as exactly how to reduce insurance policy costs.

Indicators on What Is The Cost Of Car Insurance For 16-year-old Driver? - Way You Need To Know

car insurance company affordable cheapest

car insurance company affordable cheapest

The expense to add a teen onto an insurance plan can be high due to lack of driving history and experience, however it likewise varies based upon numerous elements (cheap insurance). Adding teenagers to a parent's plan, sharing an automobile, and keeping good qualities can all assist reduced automobile insurance expenses for young people.

cheap auto insurance perks risks perks

cheap auto insurance perks risks perks

Usually talking, cars and truck insurance coverage instantly extends to young chauffeurs. Some insurance coverage carriers are more stringent. To recognize what your insurance policy service provider calls for, call and talk with your vehicle insurance policy representative. trucks.

Having a teenager on an insurance coverage plan is expensive, the majority of states need all vehicle drivers within a house to have automobile liability insurance before they can lawfully drive (vans). By having vehicle liability insurance policy, every person running the lorry will be secured for clinical, lorry repair service, and various other expenses when the policyholder is at fault in an accident. trucks.

When accredited, you will then more than likely be called by mail, telling you it's time to include the driver to the plan. If you overlook the notifications, the insurance policy carrier might not restore your policy or it might need you to leave out the driver from the policy. Just How Much It Expenses to Insure a 16-Year-Old Identifying the expense of car insurance coverage for any type of someone is incredibly tough to do.

Companies take into consideration the number of years you have actually gotten on the road, your accident and also violation history, and the location of where your automobile is usually parked. With a young person on your policy, the cost often ends up being far more costly. Normally, a driver's experience has a huge effect on one's plan.

Research shows that, in basic, men are a lot more likely to drive under the influence, obtain into car mishaps and, especially, get into major car mishaps.

The What's The Best Car Insurance For Teens? - Metromile PDFs

Still, many people believe really feel that specific habits is a better indicator of a person's threat than their sex identity. Great driver status can only be made with time. Rates can boil down incrementally gradually, depending upon your insurance coverage provider, but age 25 is when insurance policy prices have a tendency to decrease significantly - insured car.

Below, you'll find the errors they most generally make.: A nervous driver might focus too much on the lorry in front of them. Teenagers have a tendency to have passage vision as well as gaze right ahead, missing out on potential risks like pedestrians and animals (cheaper auto insurance).: Sidetracked driving can be as harmful as impaired driving.