Little Known Facts About How Does Renters Insurance Work.

from web site

While 137 companies offered policies in 2001, an actuarial Timeshare Calculator firm reported that only 17 providers sold standard long-term care policies in 2016.

Long-lasting care insurance (LTC or LTCI) is an insurance coverage product, offered in the United States, UK and Canada that helps pay for the expenses related to long-term care. Long-term care insurance covers care typically not covered by health insurance coverage, Medicare, or Medicaid. Individuals who require long-lasting care are generally not sick in the standard sense however are not able to carry out two of the 6 activities of everyday living (ADLs) such as dressing, bathing, eating, Wesley Timeshare Exit toileting, continence, moving (getting in and out of a bed or chair), and walking. Age is not a figuring out factor in requiring long-term care. About 70 percent of individuals over 65 will require a minimum of some kind of long-lasting care services throughout their lifetime.

As soon as a modification of health happens, long-term care insurance coverage might not be readily available. Early onset (prior to 65) Alzheimer's and Parkinson's illness happen rarely. Long-lasting care is an issue due to the fact that people are living longer. As people age, lot of times they require assist with daily activities of day-to-day living or require guidance due to severe cognitive impairment. That effects ladies even more considering that they frequently live longer than guys and, by default, become caregivers to others (What is an insurance deductible). Long-term care insurance can cover home care, assisted living, adult day care, reprieve care, hospice care, nursing home, Alzheimer's centers, and house adjustment to accommodate disabilities. If home care coverage is bought, long-term care insurance coverage can pay for house care, frequently from the first day it is needed.

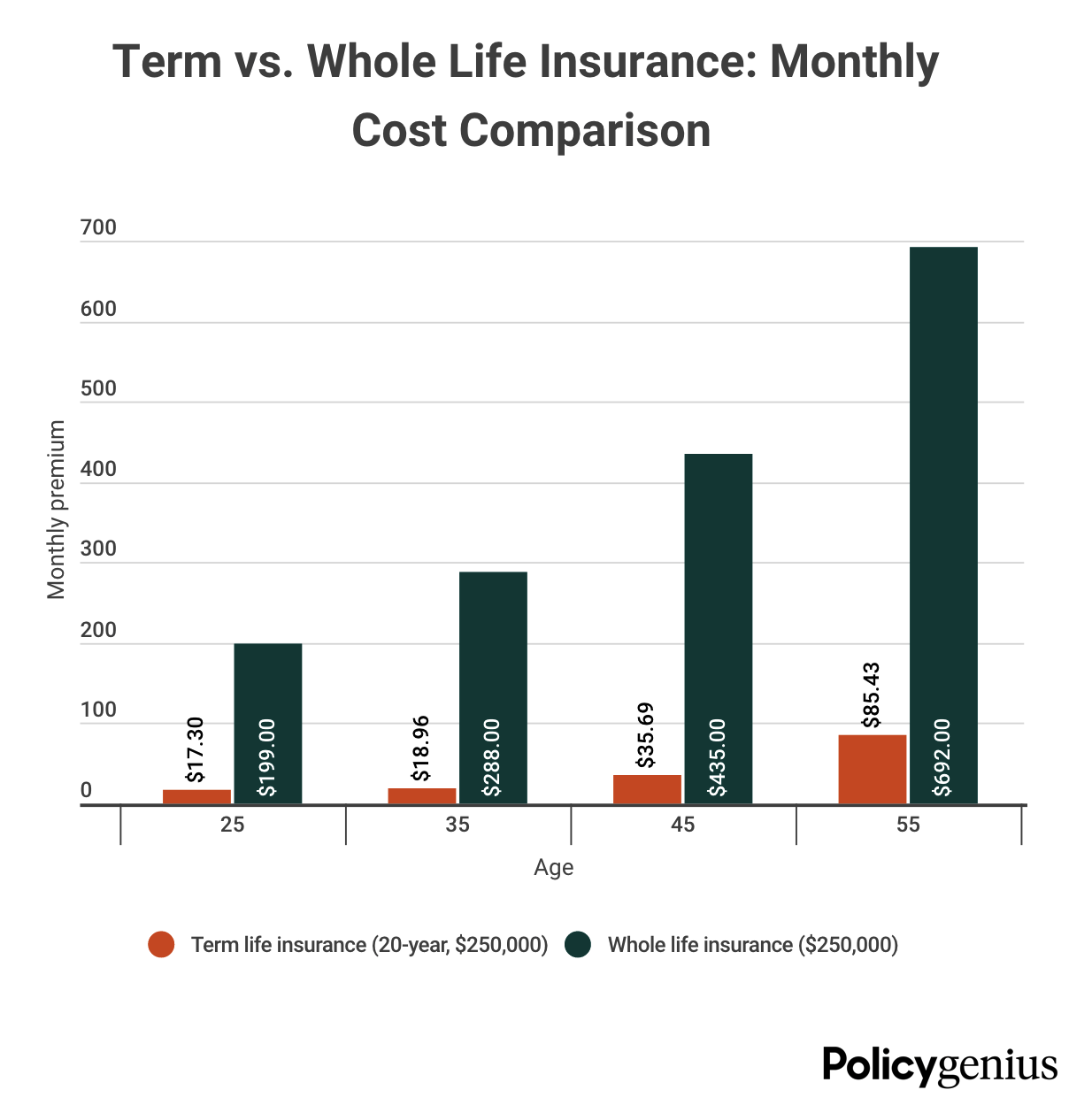

Lots of specialists suggest shopping in between the ages of 45 and 55 as part of a general retirement plan to protect assets from the high expenses and burdens of extended healthcare. Other advantages of long-term care insurance: Numerous https://www.mindstick.com/articles/126392/how-to-properly-exit-your-timeshare individuals may feel uneasy depending on their children or family members for support, and discover that long-lasting care insurance might assist cover out-of-pocket expenditures. Without long-lasting care insurance, the cost of providing these services may rapidly diminish the savings of the private and/or their household. The expenses of long-term care vary by area. The U.S. federal government has an interactive map to estimate the costs by state.

The amount of the deduction depends upon the age of the covered person. Advantages paid from a long-lasting care agreement are normally omitted from income. Some states likewise have reductions or credits and proceeds are always tax-free. Company deductions of premiums are identified by the kind of business. Normally corporations paying premiums for an employee are 100% deductible if not consisted of in staff member's gross income. In the United States, Medicaid will provide long-term care services for the bad or those who spend-down assets since of care and exhaust their assets. In most states, you must spend down to $2000. If there is a living spouse/partner they may keep an extra quantity.