5 Simple Techniques For The Padres Owe Fernando Tatís Jr$340 MillionHe Owes an

from web site

Best Online Stock Trading Brokerages - Intuit Mint for Beginners

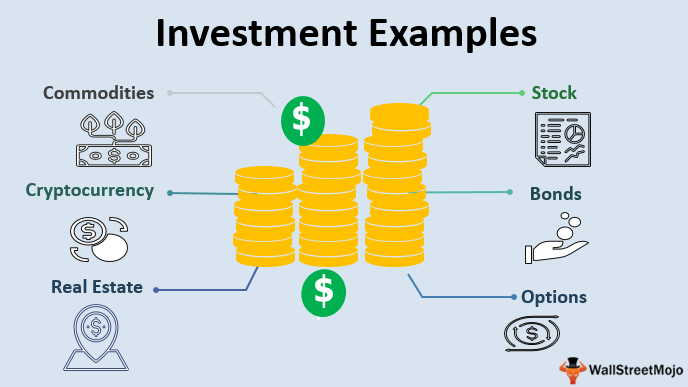

Set of actions with the intent of earning profit To invest is to designate cash in the expectation of some advantage in the future. In finance, the gain from a financial investment is called a return. The return may consist of a gain or a loss recognized from the sale of a residential or commercial property or an investment, latent capital appreciation (or devaluation), or financial investment income such as dividends, interest, rental earnings and so on, or a combination of capital gain and income.

Financiers normally expect greater returns from riskier investments. When a low-risk investment is made, the return is also generally low. Similarly, high danger comes with high returns. Investors, especially beginners, are frequently encouraged to adopt a specific financial investment technique and diversify their portfolio. Diversity has the statistical effect of decreasing total risk.

Financial investment varies from arbitrage, in which profit is produced without investing capital or bearing danger. Cost savings bear the (typically remote) risk that the monetary supplier may default. Foreign currency savings likewise bear forex threat: if the currency of a cost savings account varies from the account holder's house currency, then there is the danger that the currency exchange rate in between the two currencies will move unfavourably so that the value of the savings account reductions, determined in the account holder's home currency.

Investment Calculator - Dave Ramsey - Questions

This section needs growth. You can help by contributing to it. The Code of Hammurabi (around 1700 BC) provided a legal structure for financial investment, developing a method for the pledge of collateral by codifying debtor and creditor rights in regard to pledged land. Keep Checking Back Here for breaking monetary commitments were not as extreme as those for criminal offenses involving injury or death.

This was a plan between one or more investors and an agent where the investors entrusted capital to a representative who then traded with it in hopes of earning a profit. Both celebrations then received a formerly settled portion of the earnings, though the agent was not liable for any losses.

Amsterdam Stock market is considered to be the world's oldest stock market. Established in 1602 by Dutch East India Company, the business issued the first shares on the Amsterdam Stock Exchange. In the early 1900s, purchasers of stocks, bonds, and other securities were described in media, academia, and commerce as speculators.