The Advantages Of Working With Los Angeles Tax Attorney - An Overview

from web site

All About Orange County's Trusted IRS Tax Attorney - Semper Tax Relief

.jpg)

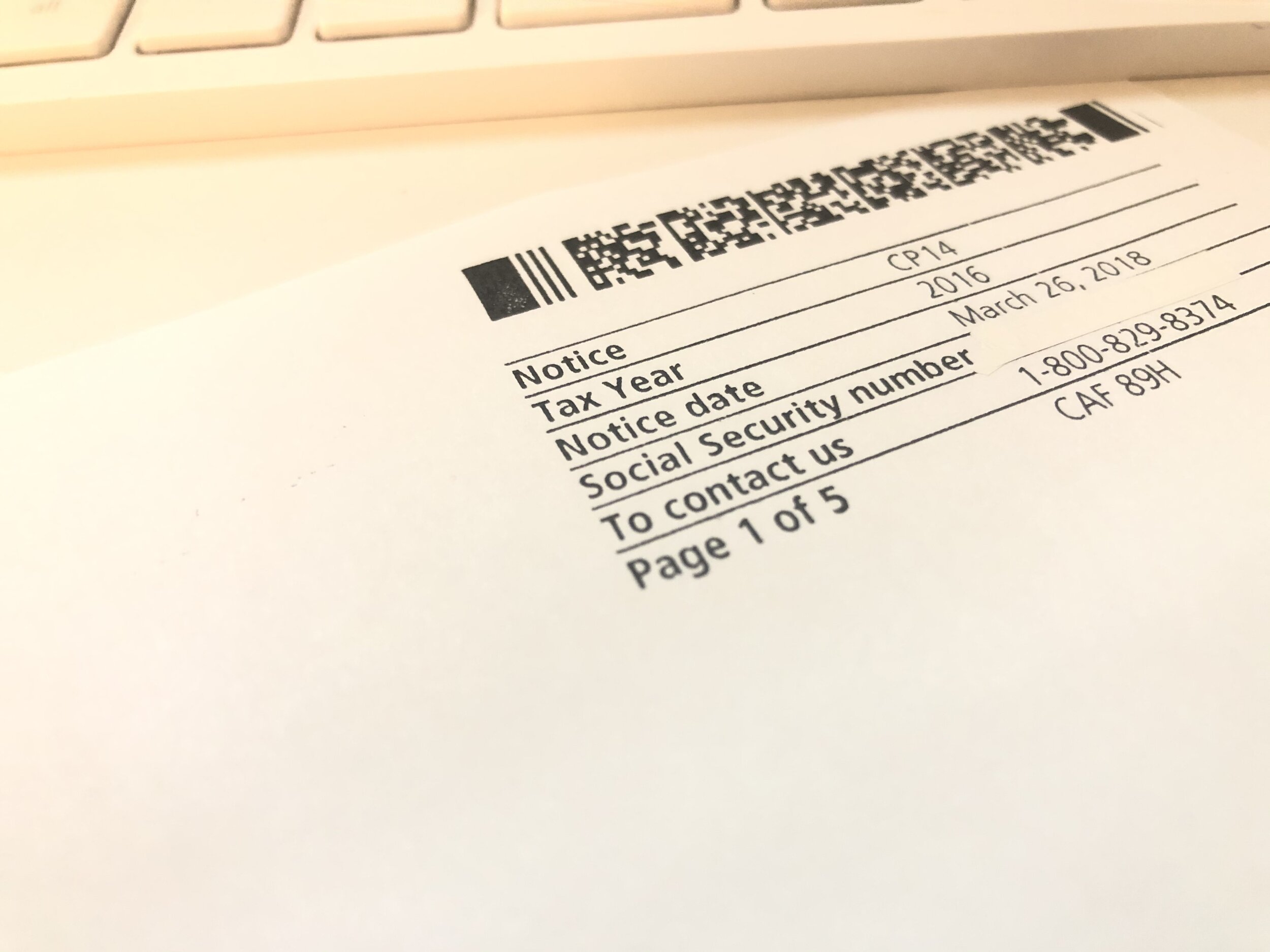

If you've recently gotten an internal revenue service audit letter, do not worry! An IRS audit can be daunting, however with the assistance of a knowledgeable Orange County internal revenue service Audit Attorney, you can make it through it efficiently and efficiently. In this post, we'll offer a fundamental overview of what to anticipate during an IRS audit, and we'll also discuss a few of the finest ways to prepare for and represent yourself during an audit.

If you have actually received an internal revenue service Audit Letter, don't panic! A skilled Orange County internal revenue service Audit Attorney can help guide you through the procedure. What is an IRS Audit Letter? An Internal Revenue Service Audit Letter is a notification from the Internal Earnings Service (IRS) that you are being audited. The letter will state the reasons for the audit and offer details on how to set up a consultation with an IRS auditor.

Arrange a consultation with your Orange County IRS Audit Lawyer as quickly as possible to go over the details of the audit and what steps you need to take next. But what should you do if you get an audit letter? How can you make certain that you're prepared if the IRS comes knocking on your door? We'll walk you through the process of handling an IRS audit, and we'll introduce you to our team of skilled Orange County IRS audit attorneys.

The IRS audit is understood as an Evaluation of your taxes. IRS Tax Lawyer Los Angeles Semper Tax Relief Check Out This Site may come from an internal revenue service regional auditor or the internal revenue service correspondence system. A local auditor's title is an Earnings Agent, and they will be the sole contact for the audit treatment. If you got a correspondence audit, there is no contact person, just the Correspondence Audit department's contact info, which implies you may talk to different representatives when calling in.

The Basic Principles Of Top 10 Best Irs Tax Attorney in Los Angeles, CA - Yelp

The internal revenue service claims they select audits randomly for taxpayers. However, common internal revenue service Audit targets Services, consisting of Corporations, LLCs & Self Employed. Individual Taxpayers that Make A List Of Deductions on Set Up A, have rental realty Sch E, or are self-employed Sch C, are likewise targeted. If you are targeted, reach out to our Orange County internal revenue service Audit Lawyer today.