How What is a surety bond, and how do I secure one? can Save You Time, Stress, and Money.

from web site

Little Known Facts About Berkeley, California Bonds - Fidelity Insurance Service.

When you buy multiple industrial policies from The Hanover through your regional independent representative, you will take pleasure in the convenience of one contact for all your insurance needs consisting of customer service, insurance coverage billing, renewals and claims.

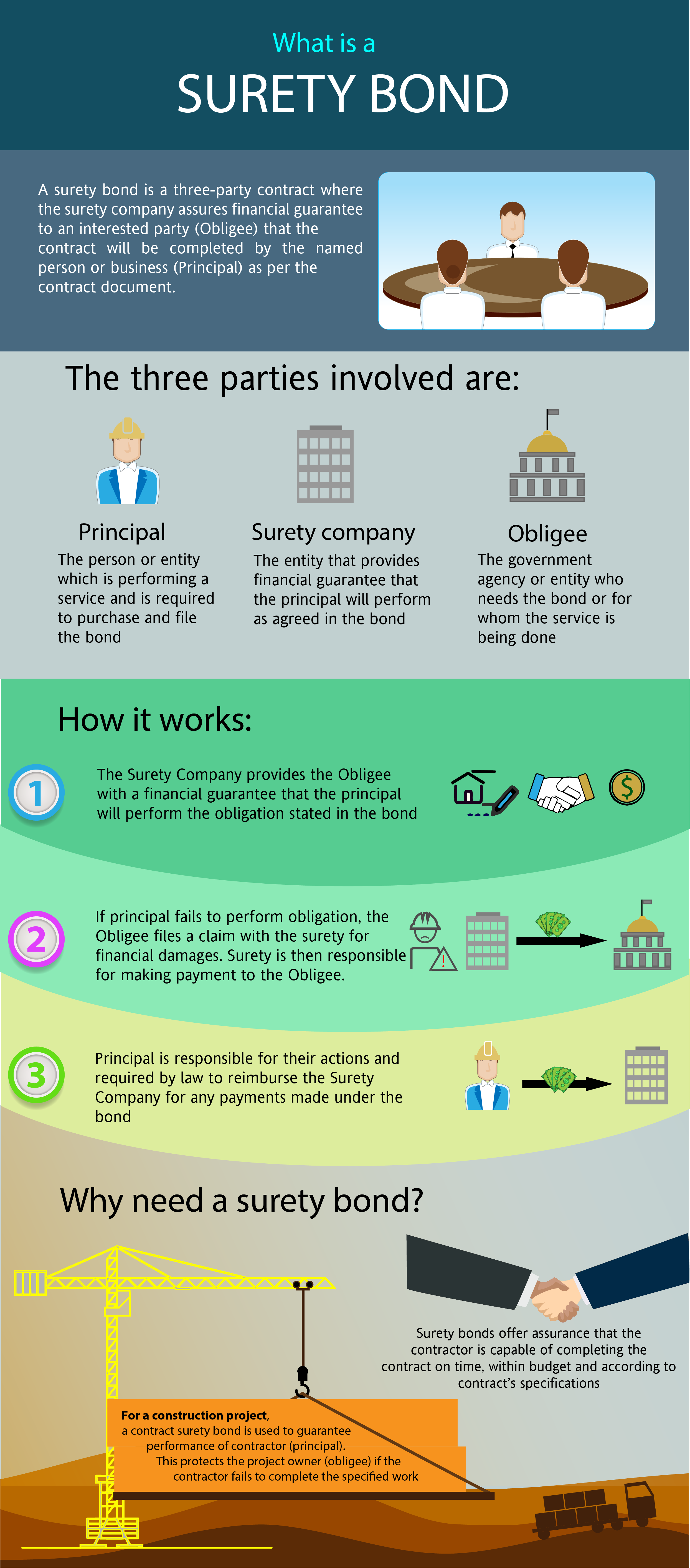

/ A surety bond is a type of threat management tool; it's a contract where the surety (often a big insurance provider) offers their financial support of the principal (the party responsible for satisfying a commitment) for the advantage of the obligee (the celebration to whom the primary owes the obligation).

How GOVERNMENT CODE CHAPTER 653BONDS COVERING can Save You Time, Stress, and Money.

Unlike a standard loan or insurance arrangement, which normally involved 2 distinct parties, a surety bond is an arrangement in between 3 parties: This is the celebration accountable for satisfying a responsibility, that responsibility being to finish a defined task or simply to carry out company in a way acceptable to appropriate laws and guidelines.

In most cases, the principal does not seek a surety bond up until that bond is needed of them by another celebration. This is the celebration owed the commitment from the principal. This celebration could be the general public who benefits from the primary performing company in accordance with suitable laws and policies.

The 3-Minute Rule for Court & Fiduciary Bonds - Colonial Surety

If an obligee feels the principal hasn't fulfilled the terms of the bond, the obligee might file a claim against stated bond seeking financial settlement for damages. As long as that claim stands, the surety business backing the bond warranties payment. Read This is the celebration that offers the financially backed assurance to the obligee that the principal is capable of satisfying the commitment.

When the surety figures out the principal is both capable of satisfying the commitment and efficient in remedying scenarios where a breach in the responsibility has occurred, the surety will use itself as the intermediately responsible party, financially, in the type of a surety bond. Upon payment of the surety bond premium and issuance of the bond, the surety becomes the preliminary course of option for the obligee in circumstances where the principal has failed to meet the corresponding commitment.

Surety bond - Wex - US Law - LII / Legal Information Institute - Questions

Afterward, the principal should pay the surety back the complete quantity of the claims settlement, potentially with extra interest and costs added. Surety Bond Definition To understand what a surety bond is, it can be helpful to compare it to insurance. A surety bond resembles an insurance policy in some ways but has key differences.