The Only Guide for Employee Retention Credit Over - Amended Payroll Filings

from web site

What Does Tax Incentives Benefits Mean?

Employers have 3 years from the date the original return was submitted, or 2 years from the date the taxes were paid, to file an internal revenue service Type 941-X. We're Here to Help If you have questions about these credits, would like assistance in identifying if your business is eligible, or help calculating or claiming the credit, please contact your Moss Adams professional.

[This short article has been upgraded from an earlier variation.] The Facilities Investment and Jobs Act authorized by the Home on Nov. 5, 2021, sped up the end of the credit retroactive to Oct. 1, 2021, instead of on Jan. 1, 2022 (other than for incomes paid by a healing start-up company, for which the expiration date would stay the same).

Early termination of ERTC implies that "businesses will need to pay back the payroll taxes retained to monetize their expected credit," recommended Marvin A. Kirsner, an investor in the Fort Lauderdale, Fla., office of law office Greenberg Traurig LLP. (See the SHRM Online articles House Passes Facilities Costs with Work Environment Provisions and After Repeal of Staff Member Retention Credits, Next Steps for Employers.) Although https://employeeretentionrebate.com/employee-retention-tax-credit-nfib-ertc-202020212022/ (ERTC) is ending at the end of 2021, there's still time for qualified companies to claim the credit, if they haven't already."Qualified companies are still able to make the most of the staff member retention credit versus relevant employment taxes and certified earnings paid to their employees through Dec.

How Employee Retention Credit Over - Amended Payroll Filings can Save You Time, Stress, and Money.

"Although the program is set to sunset at the end of 2021, the credit can be declared on amended payroll tax returns as long as the statute of constraints remains open, which is 3 years from the date of filing," said Brent Johnson, co-founder and CEO of Clarus R+D, a maker of software application for declaring tax credits.

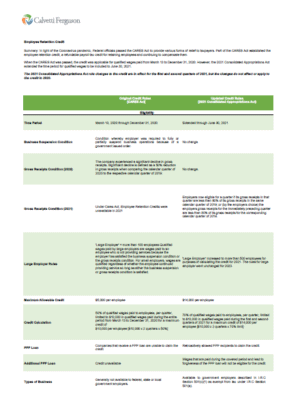

9-12 in Las Vegas and practically.] ERTC Essentials, The ERTC, also referred to as the Worker Retention Credit (ERC), was created by the Coronavirus Help, Relief and Economic Security (CARES) Act, signed into law in March 2020, to motivate services to keep workers on their payroll. The Consolidated Appropriations Act, 2021 (CAA), enacted in December 2020, and the American Rescue Plan Act (ARPA), enacted in March 2021, modified and extended the credit and the availability of particular advance payments of the credits through the end of 2021.