The Best Strategy To Use For What is decentralized finance (DeFi)? - Hedera

from web site

The Single Strategy To Use For Decentralized Finance (DeFi) Definition - Investopedia

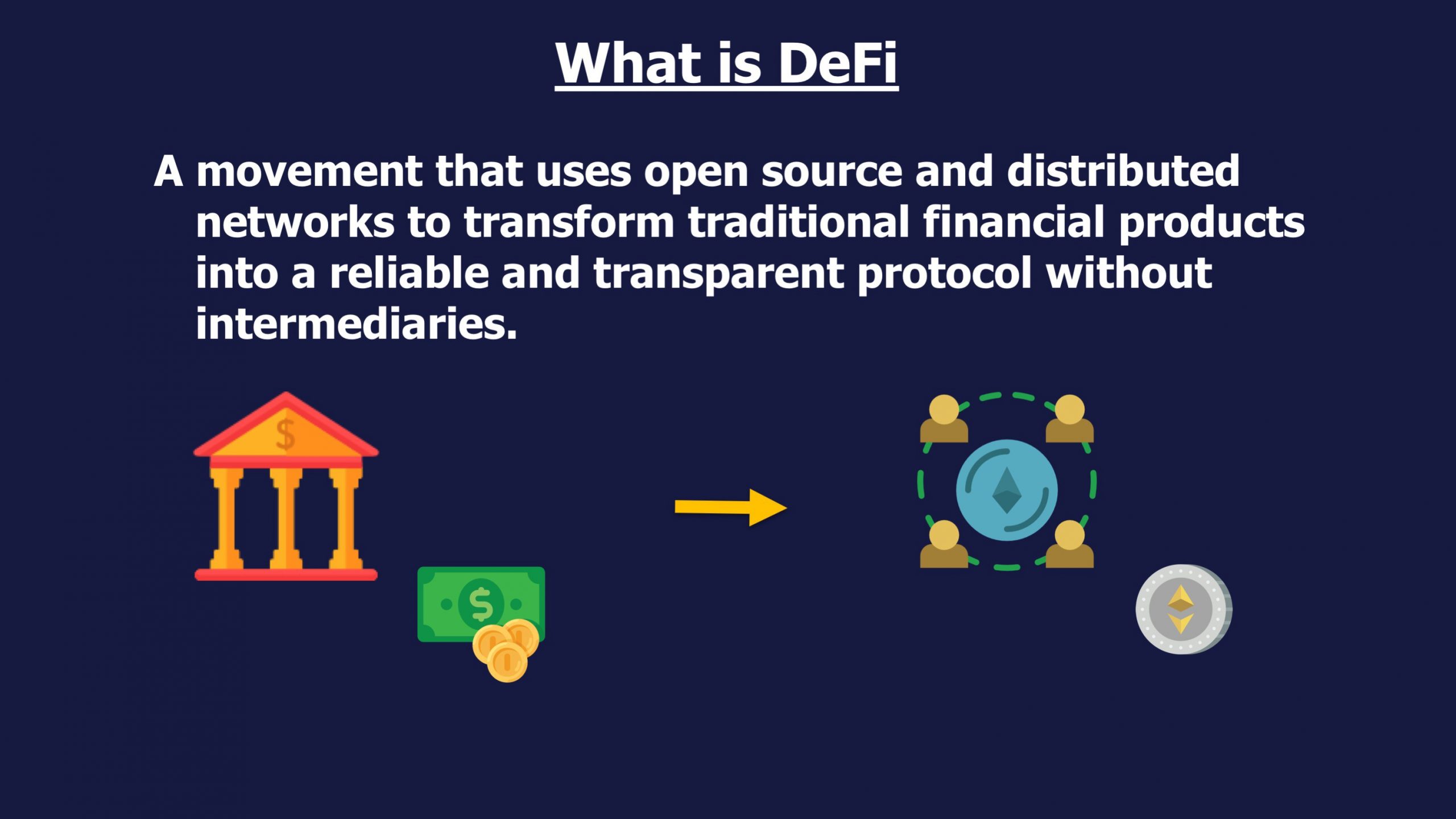

Applications called d, Apps are utilized to deal with deals and run the blockchain. In the blockchain, transactions are tape-recorded in blocks and then validated by other users. If these verifiers agree on a transaction, the block is closed and secured; another block is created that knows about the previous block within it.

Info in previous blocks can not be changed without affecting the following blocks, so there is no other way to change a blockchain. This idea, in addition to other security protocols, supplies the secure nature of a blockchain. De, Fi Financial Products Peer-to-peer (P2P) financial transactions are one of the core facility behind De, Fi.

To totally comprehend this, consider how you get a loan in centralized financing. Read More Here 'd require to go to your bank or another lender and use for one. If you were approved, you 'd pay interest and service charge for the privilege of using that loan provider's services. Peer-to-peer loaning under De, Fi doesn't mean there won't be any interest and costs.

What Does Crypto.com DeFi Wallet - Securely Store and Earn from Your Do?

In De, Fi, you 'd use your decentralized finance application (d, App) to enter your loan needs, and an algorithm would match you up with peers that meet your needs. You 'd then require to concur to one of the lending institution's terms and get your loan. The transaction is recorded in the blockchain; you receive your loan after the agreement system verifies it.

When you make a payment via your d, App, it follows the same process in the blockchain; then, the funds are moved to the loan provider. De, Fi Currency De, Fi is designed to utilize cryptocurrency for deals. The innovation is still developing, so it is challenging to figure out precisely how existing cryptocurrencies will be implemented, if at all.

The Future of De, Fi Decentralized finance is still in the beginning phases of its development. For beginners, it is unregulated, which implies the environment is still filled with infrastructural accidents, hacks, and rip-offs. Present laws were crafted based upon the idea of separate monetary jurisdictions, each with its own set of laws and guidelines.