Some Known Questions About Which Of The Following Typically Have The Highest Auto Insurance Premiums?.

from web site

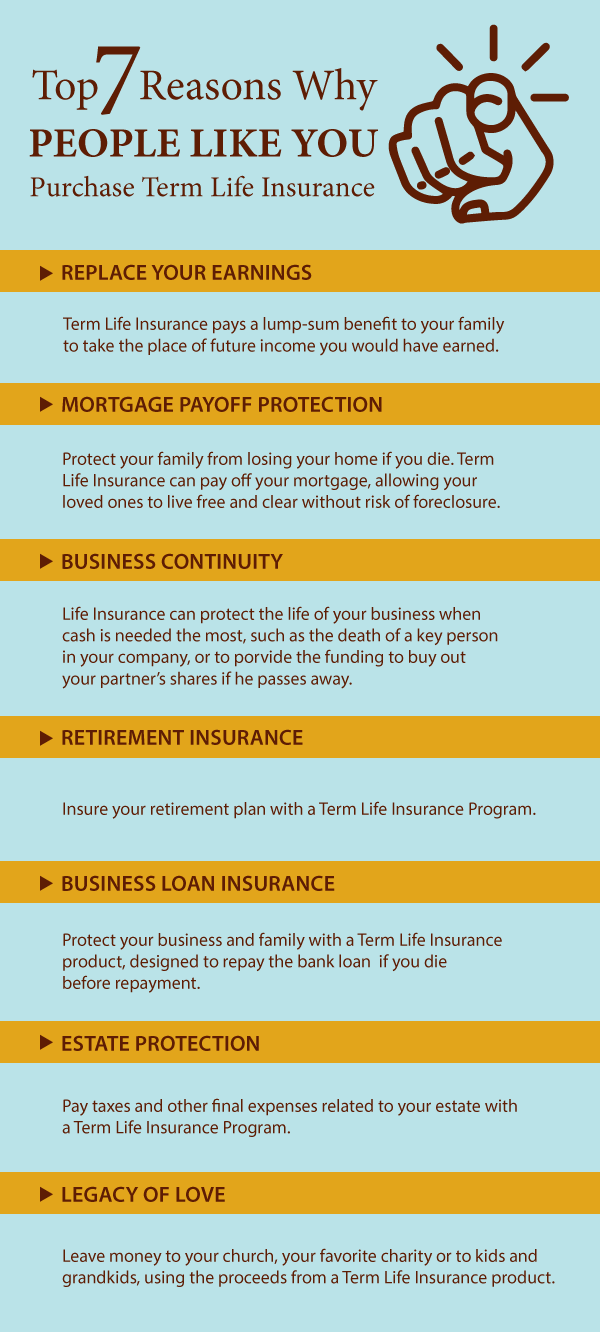

Due to the fact that of the low cost to buy term life insurance coverage, you can buy more defense. That makes it ideal for more youthful households. Term life insurance policies offer you the freedom to choose the length of coverage. You can acquire a policy for as low as one year, however the most typical choices are 10, 15, 20, and thirty years. Death advantages from a life insurance policy usually won't count as taxable income. With term policies, your death advantage is ensured. When you decide how much protection you want, your set premium is likewise guaranteed not to change throughout the regard to the policy (How does cobra insurance work).

The older you get, the greater your premiums will be. If you're just recently married or strategy to https://www.bintelligence.com/blog/2020/2/17/34-companies-named-2020-best-places-to-work start a family, term life is a budget friendly way to ensure your family will be financially safe if you were to pass away suddenly. If you're buying a house, this type of policy can assist settle the mortgage or other financial obligations accumulated. Term life insurance can cover lost earnings and other living expenditures, such as: Home mortgage payments College tuition Funeral service and burial expenses Debt, such as a car or service loan Progressive Responses is your go-to resource for any extra concerns about term life insurance coverage.

Term life insurance is the most affordable life insurance product per dollar of protection, which is why it's typically a preferred option for people who are just entering their prime earning years to secure against loss of earnings. In addition to the survivor benefit quantity, elements that may affect the rate include your age at the date of problem, gender, term duration, general health, and tobacco use.

What Is A Deductible In Health Insurance for Dummies

If your household counts on your earnings, life insurance coverage is a vital part of planning for your household's future. It's grim to think about. Nobody likes to prepare for their death, but a little discomfort now can conserve your family a world of financial tension should the worst happen.Fabric, a Brooklyn, NY-based life insurance Go to the website coverage broker, stated a big misconception is that term life insurance coverage is a waste of cash. You don't get term life dollars back if you outlast your policy, but life insurance coverage ought to be viewed as a financial investment that would alleviate the most vital threat to your family.

Finest Life Insurance Coverage Offers For You Conceal Material stated some term life policies start at simply $11 monthly for $100,000 protection. Term life insurance coverage is acquired to change your earnings if you pass away, so your enjoyed ones can pay debts and living costs. For example, if you and your spouse own a house and you were to die tomorrow, your partner would need to pay the home mortgage on his or her own. If you have a term life insurance coverage policy, your spouse might receive sufficient cash from the policy's death advantage to pay off or at least keep up with the home mortgage.

Cameron Ellis, an assistant professor in the Department of Threat, Insurance Coverage, & Health Care Management at the Fox School of Business at Temple University, notes that buying life insurance is about gaining "peace of mind." Ellis stresses that life insurance coverage covers your household versus lost earnings by a primary wage earner. Fabric said people choose life insurance for their loved ones' monetary security, consisting of protecting their children's monetary future. When choosing life insurance coverage, consider who you're covering and the most important monetary objectives. That will help you choose the right recipient and protection amount. When you buy a term life policy, an insurance coverage company guarantees that it will pay your recipients a set amount if you die during the policy's term.

An Unbiased View of How Much Does Car Insurance Cost

Keep in mind these crucial points about term life insurance coverage: The computations behind life insurance coverage rates are everything about life span and danger. That's why life insurance costs more as you grow older. If you outlive your policy term, the insurance ends and you need to buy another policy if you still wish to carry life insurance. However, the annual premium for another policy could be quite costly because you're older and an insurer will take into account your health conditions. That's why it's crucial to pick a suitable term length early in life. You would require to buy an additional term life policy at an extra charge if you discover a term life policy isn't adequate.

If a policy lapses since of nonpayment, you'll likely pay a greater expense for a new policy. Your survivor benefit does not have actually an assigned usage when you buy a new policy. Normally, these funds are used to cover funeral expenses, debts, home mortgage or change lost earnings of the insured party; however, the death advantage can be used by beneficiaries in any method they choose. Choose your recipients carefully. There is no legal requirement for them to invest it on the products that you prepared. You can also select several beneficiaries, allowing you to break up the cash between relative the way you want.

There are numerous type of term life insurance: - For the policy's period, state 20 years, your premium stays the very same. Many term life policies provide you the alternative to restore your protection at the end of the term without going through another medical examination. However, your premiums might rise annually after the level term duration frequently considerably. - This provides you protection for one year with the option of restoring it each year for a specified period, such as 20 years. With this policy, your rates increase every year that you renew and are determined based on the possibility of your passing away within the next year.

Unknown Facts About What Is Marketplace Insurance

You can expect to pay at least 50% more on premiums for these policies, so make sure you look around. Generally used if you have a health problem or a troubled medical history, these policies require no medical examination. Surefire problem does not ask any health questions, while simplfied asks a couple of concerns. You pay a much greater premium for the coverage than a basic term life policy with a medical examination. That's because the insurer takes on more risk by guaranteeing people without understanding their medical conditions. Surefire problem policies often have "graded" advantages that pay just a partial advantage if you pass away within the very first several years of the policy.

There are a number of types of life insurance coverage depending upon your needs - How much is homeowners insurance. Here's how term life compares to 3 types of irreversible life policies.: Frequently 10, 20 or 30 years.: None: Typically lower costs and greater survivor benefit than entire life.: If you outlive your policy, there's no death benefit.: Till death.: Premium is partly invested and develops cash value.: Guaranteed survivor benefit and the policy requires little to no oversight.: Higher premiums with smaller death advantages than term life.: Till death: Premium is partly invested in possession classes that can be changed and will construct cash value based upon market movement.: Least expensive cost for permanent policy with ensured survivor benefit and you can change premiums and coverage level.