Down Payment On A House

from web site

Is a temporary financing that consists of fixed-rate regular monthly repayments for a set number of years complied with by a big "balloon" payment that covers the remainder of the principal. Typically, the balloon repayment schedules at the end of 5, 7 or ten years. Consumers with balloon home mortgages may have the ability to re-finance the funding when the balloon settlement is due, however the right to re-finance is not assured. Escrow Click here for info is a neutral 3rd party that handles the exchange of cash as well as documents between a buyer and a vendor in a property purchase.

- Down payment aid, frequently combined with positive interest rates as well as tax breaks.

- To put it simply, paying 20% down or extra on a conventional home loan is the only means to avoid spending for home loan insurance policy or financing charges.

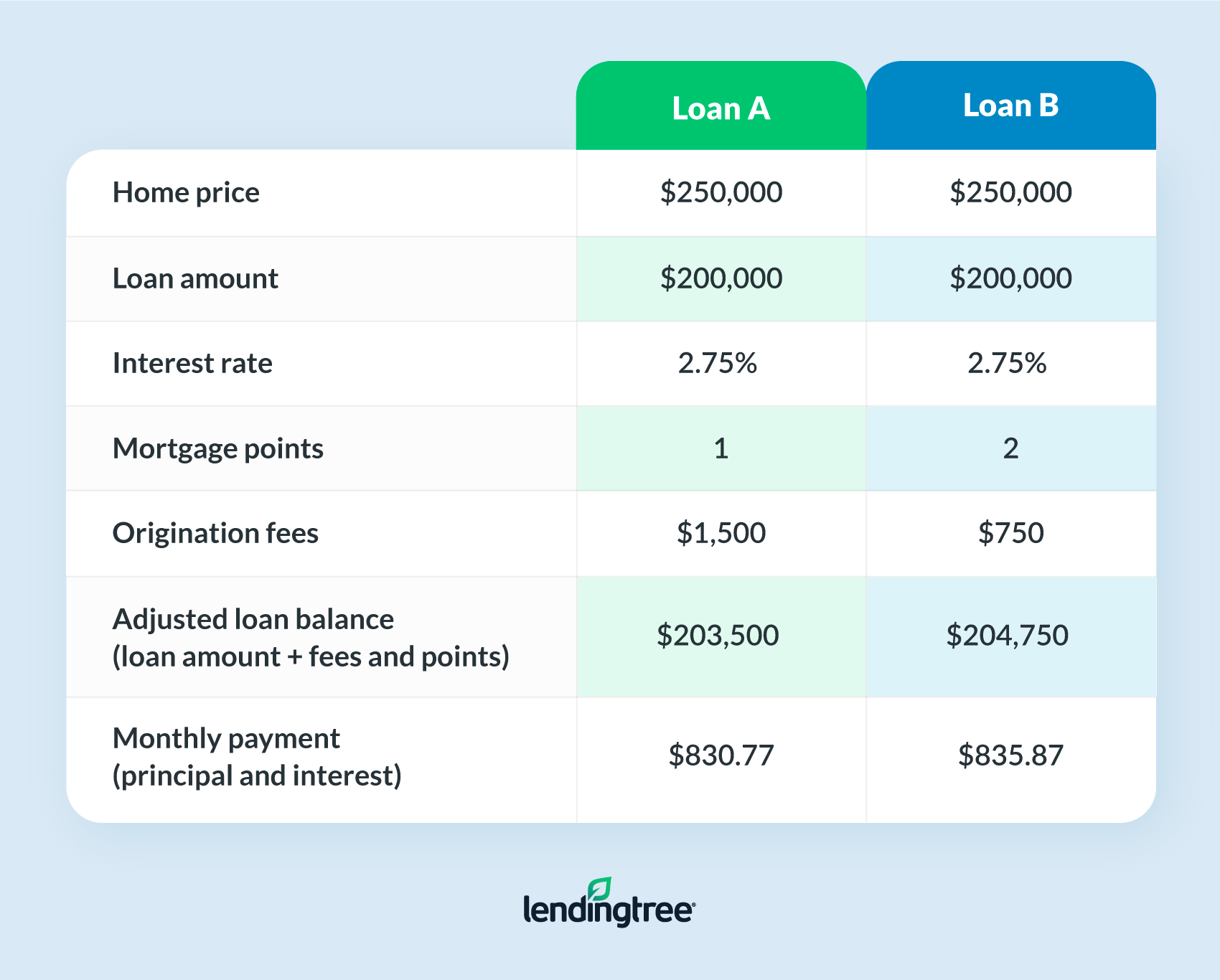

- Another terrific way to reduce your rate of interest and APR is by using home loan or discount rate points.

- Several of these variables consist of the state you close in, the kind of lending you receive, as well as even your loan provider.

- The amount of rate of interest you owe depends upon the rates of interest as well as the car loan quantity-- the reduced the rates of interest, the less you owe in rate of interest.

They take a look at the complete picture and analyze various elements like employment history, income level, debt-to-income ratio, credit rating, as well as down payment. Some lending institutions supply variations on the open or closed home loan, such as enabling additional settlements during a specific time of the year. Borrowers ought to examine their mortgage terms so they recognize the allowances of their details contract. A closed mortgage does not permit any kind of early repayment by the home customer without penalty. The only payments they can make are the scheduled ones described in the contract.

Completely Amortized Finance

In general, a lender will certainly intend to see a work background that stretches back 2 years. Not just do lenders want to know that you have regular income, but they also intend to make sure that your revenue will sustain a mortgage. It's also crucial that you are successfully taking care of any various other outstanding debt. Mortgage financial obligation is a massive economic dedication as well as can substantially alter your regular monthly responsibilities. The underwriter will assess many documents to examine your credit merit to make a determination for finance approval, including tax returns, pay stubs, as well as credit report records.

Funding Home Mortgage For New And Also Repeat Residence Purchasers

Lenders have a motivation to maintain expenses reduced when you're not paying for the fees. " There's no factor for them to pad points due to the fact that it comes out of their pocket," Andrew Pizor, personnel lawyer with the National Consumer Legislation Center in Washington, D.C . A low home loan rate seems appealing when you calculate the financial savings https://neconnected.co.uk/a-guide-to-how-timeshare-cancellation-companies-work/ over three decades. There are a few loan providers that have actually begun programs to resolve the small-dollar finance void. For example, Secret Bank, a Cleveland-based financial institution with branches in 15 states, has no minimal home mortgage amount for its Area Home Mortgage Program.

The margin is a fixed portion point that is determined by the lending institution as well as contributed to the index to calculate the rate of interest. A lender's margin continues to be fixed for the entire term of the car loan. Your lender is required to divulge the index to which your financing is tied, the margin that will certainly be tacked on to your rate and also any type of price or settlement caps that apply. The LIBOR, or London Interbank Offered Price, is a day-to-day referral price based on temporary interest rates charged amongst banks in the international cash market. LIBOR rates are typically utilized as a referral price or index for variable-rate mortgages.