Beginner Forex Trading Overview

from web site

For individuals who want diversify their portfolios and benefit from the global economy, trading forex is now a well-known investment option. It can be intimidating and overwhelming for those who are new to trading foreign currencies. This is why we put together a beginner's guide to Forex trading.

This comprehensive guide will explain Forex trading basics, talk about the factors that influence currency prices, and give strategies to ensure your trades are successful. So, whether you're just beginning your journey or have experience investing in the market, this guide will provide you the knowledge and tools necessary to navigate the fascinating world of Forex trading.

The daily trading volume of the Foreign Exchange market is over USD 6 trillion which makes it the biggest market for financial transactions in the world.

Forex trading, often referred to as foreign exchange trading involves the buying and selling of currencies to earn a profit. With an average daily turnover exceeding $5 trillion and a market capitalization of over $5 trillion, the Forex market ranks first among all financial markets. Forex transactions are conducted in pairs. This permits one currency to be bought and another one to be sold unlike stocks or bonds. For instance, you might, buy Euros if you believe the Euro will appreciate against the USdollar.

Investors who want to diversify their portfolios and make a profit from fluctuations in currency need to be aware of the basics of the importance of understanding currency trading. The global economy of today is characterized by fluctuating currency. These currencies fluctuate because of various economic and politically-related variables like interest rates, inflation, geopolitical developments as well as other factors.

Forex trading lets investors take advantage of these fluctuations by purchasing and selling at a low price. This market requires expertise and knowledge. If https://bit.ly/3IVHbKY do not understand the fundamentals of Forex trading and the factors that impact currency prices, investors could be losing more than they earn.

Before investing real money in Forex trading, investors should be well-versed in Forex trading. Investors are able to reap the benefits of this exciting investment through a solid knowledge of Forex trading's workings as well as the strategies used by traders who are successful.

Based on a study conducted by the Bank for International Settlements, the most popular currencies in the Forex markets are EUR/USD, USD/JPY, and GBP/USD. Forex trading is described as the trading of the market for futures.

Chapter 1: The basics of Forex trading

Currency Pairs:

In Forex trading the currencies are traded in pairs, with one currency being purchased while the other is traded. The currency that is the first in the pair is called the base currency, whereas the second currency is known as the quote currency. For example, EUR/USD is a pair where the Euro is used as the base currency while US dollars are used as the quote currency.

Pips:

Pip (percentage-in-point) is a unit used to determine the differences in exchange rates between currencies. It's the smallest change in price a given exchange rates can produce. For instance the pip is 0.0001 or 1/100th of a percent for the majority of currency pairs.

Bid/Ask Spread:

The bid/ask spread relates to the gap between the highest price a buyer is willing to pay for a specific currency (the bid price) and the price that a seller is willing to accept (the asking price). The spread is a way to calculate transaction costs for brokers and traders.

Broker:

A broker is an intermediary between buyers and sellers in Forex trading. He or she executes trades on behalf clients. They may charge commissions or charge fees for transactions they make via their platform.

Leverage:

In borrowing money from their broker, leverage permits traders to manage huge amounts of money, while also making small investment. A trader with an account with $1,000 can use 50:1 leverage to control up to $50,000 worth of currency in their trades. Although leverage may increase the possible profits but it also increases risks since losses could be greater than initial investment amounts due to magnified positions. A high leverage level can cause the loss of Forex trading, which could wipe out your entire account.

What is the function of currency pairs?

Forex trading involves currency pairs. A currency pair simply two currencies that are quoted against each other. The value of one currency will be listed alongside the other.

The first currency in the pair is referred to as the base currency. The second currency is referred to as the quote. One US dollar can be exchanged to 110.50 Japanese currency if there is a quotation for USD/JPY.

Sometimes currencies are abbreviated by three letters. The country code is represented by the initial two letters and the name of the currency by the third letter. For example, USD stands for United States Dollar, and JPY stands for Japanese Yen.

There are three types of currency pairs including major pairs minor pairs, major pairs, and exotic pair. Major pairs consist of major currencies like the US dollar, Euro (EUR), British pounds (GBP), Japanese and Swiss yens (JPY), Swissfranc (CHF) and Canadian dollars (CAD). These currencies account for around 80percent of all Forex transactions.

Some minor pairs refer to lesser-traded currencies like South African rands, Australian dollars (AUD) and New Zealanddollar (NZD), or the Australian dollar. Exotic pairs can be currencies from emerging and developing nations, like the Brazilian real(BRL), Mexican pesososososososososo (MXN) as well as Turkish lire (TRY).

Forex traders trade currency pairs in order to earn a profit on changes in the exchange rates. An investor will buy the pair if they believe that a base currency will appreciate in relation to the quoted currency. They may also trade the pair if they believed that the base currency would decrease relative to its quoted one.

Forex trading can be made easier by understanding the currency pairs.

Chapter 2: The factors influencing Forex prices

Numerous elements have an effect on forex prices. Knowing these factors is crucial to Forex trading because they can affect the currency value.

Economic Indiators:

Values of currency can be significantly affected by economic indicators like Gross Domestic product (GDP) as well as inflation rates, or employment figures. The currency of a country might appreciate if its GDP growth rate is greater than the expectations. This is due to investors' confidence in the country's economy. Central banks could raise rates of interest to stop inflation in the event that the rate of inflation increases. This could also lead to an increase of the value of the currency.

Public Events:

The currency value can also be affected by political events for instance, elections and changes to government policies. For example, suppose a country's political situation changes or becomes uncertain because of an upcoming election or change in government policy. Investors may be less inclined to invest in the currency of the country if that happens and could result in decreasing value. On the other hand positive political developments such as the signing of trade agreements or stimulus programs can increase confidence of investors and increase currency values.

Market Sentiment:

Market sentiment refers to the general state of mind or attitude of investors about a certain market or asset. Market sentiment, for instance is affected by news reports, speculation, and predictions about the future.

For instance, optimism about the prospects for the world economy after the COVID-19 epidemic could increase demand for higher-risk assets such as emerging markets currencies, with the exception of safe-haven currencies.

These factors are crucial for trading success since they allow traders to make informed choices based on the current market conditions.

Chapter 3: Strategies to Forex trading success

Forex trading success requires the use of a variety of strategies, each one suited to the preferences of each trader and their tolerance to risk. The three most used strategies of Forex traders are fundamental analysis, technical analysis, risk management.

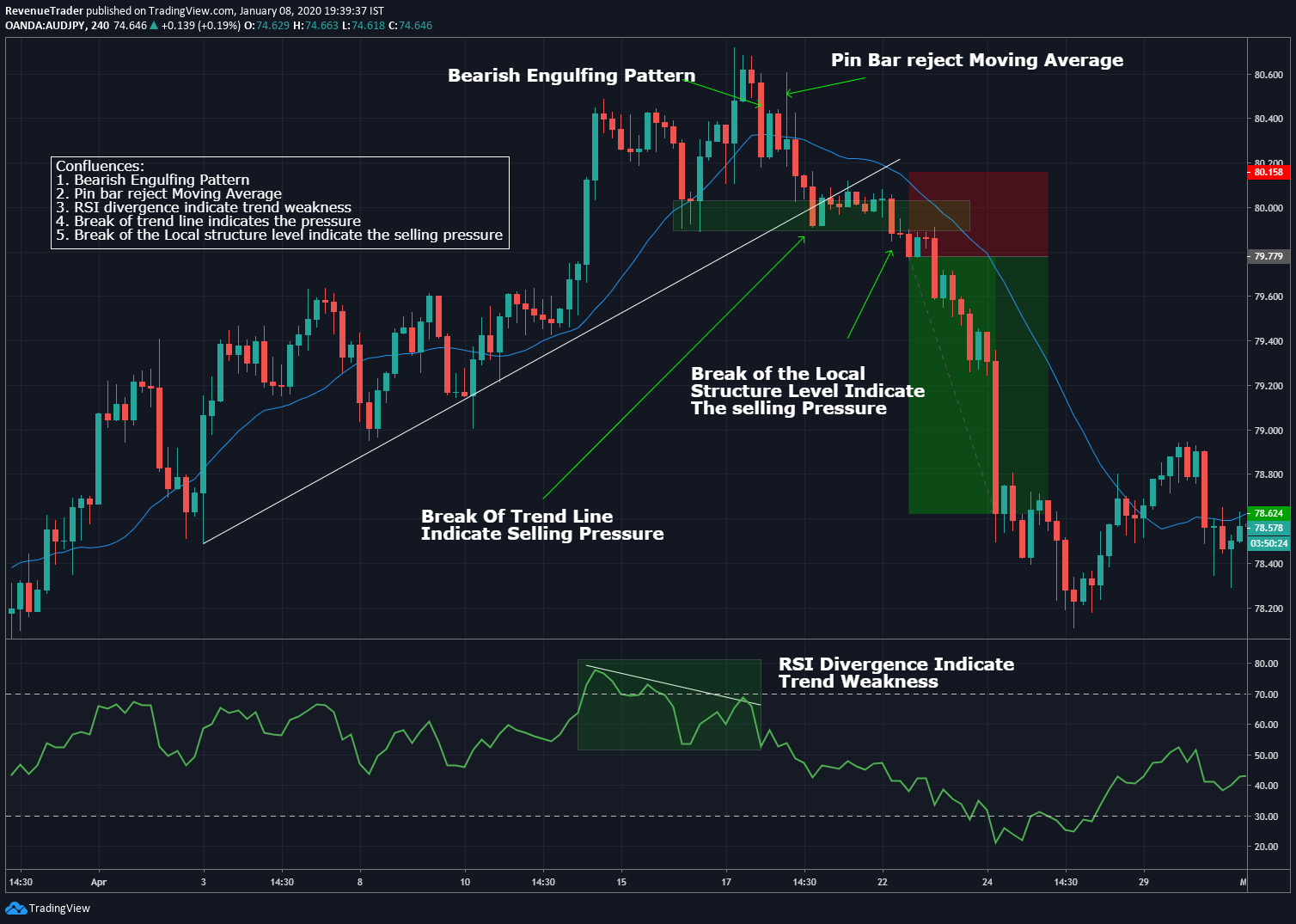

Technical Analysis:

Technical analysis is the study of previous market data, including volume and price, in order to detect patterns and trends which could be used to predict future price changes. Technical analysis is used by traders to find areas of weakness and support as well as trend lines as well as other indicators that help them make informed trading decisions.

Fundamental Analysis:

Fundamental analysis includes analyzing economic indicators such a rate of growth in GDP and inflation rates, central bank policies, political events and other vital elements that affect the value of currencies.

Fundamental analysis is a method used by traders to aim to understand the underlying economic factors driving currency values to make informed trading decisions based on long-term trends instead of short-term market fluctuations.

Risk Management:

Forex trading is only possible by utilizing the management of risk. It allows traders minimize their loss and protect their capital. Standard risk management strategies include setting stop-loss orders to limit losses on transactions that don't go your way, diversifying your portfolio across different currencies or asset classes making use of leverage with care, only taking positions that carry reasonable levels of risk , and ensuring a strict approach to your trading strategies.

Forex traders must have an in-depth understanding of fundamentals and the technical analysis. The use of these strategies and staying up-to with market trends will give you a significant advantage in this complicated arena. You can achieve success in Forex trading by putting in the work and remain committed.

Finance Magnates discovered that 84% of Forex traders are losing capital from their trades and only 16% make money.

Chapter 4: Choosing an Forex broker

The decision of a trader to select the best Forex broker is vital because it will greatly affect the trading experience. These are the most important factors to consider when choosing the right broker.

Base requirements

Regulation:

Choose a regulated broker who is in compliance with the strict rules and guidelines established by government agencies like the National Futures Association or Commodity Futures Trading Commission. These agencies work to ensure that brokers are honest reliable, honest, and reliable.

Fees:

Brokers charge different charges to provide their services, which include spreads, commissions, and other charges. To locate a broker who provides the best price, traders need to examine the fees of several brokers.

Leverage:

It's also known as "retail" or "common" leverage. It is the most well-known type of leverage offered by Forex brokers. It permits traders to manage positions larger than their account balance, with ratios ranging from 50:1 to 400:1.

Customer Care:

A good Forex broker should offer responsive customer support 24/7. This is important because traders could require assistance anytime while trading.

Mobile trading

Forex mobile trading is becoming increasingly important for traders as we near 2023. The trading accounts of traders are accessible from anywhere thanks to the growth of mobile technology as well as the growing usage of smartphones and tablets. This allows them to track market movements, execute trades and monitor their positions without relying on a desktop computer.

Mobile trading apps are increasing in popularity in the Forex business. A survey by Statista found that in 2020 47 percent of Forex traders were using mobile devices for trading purposes.

There are various types of accounts that brokers provide that include:

Demo Accounts:

These accounts let traders test their trading skills using virtual cash before taking on real money.

StandardAccounts:

These accounts are ideal for traders who have only a small amount of capital.

No Swap/Interest/Islamic Accounts:

A zero-interest or swap Forex account, also known as an Islamic Forex account, is one type of account that adheres to the principles of Islamic Finance. This principle applies to Forex trading as well. In Islamic Finance, interest earned on loans or investments is not permitted.

In a zero-swap or no-interest Forex trading account clients are not required to pay or pay fees for overnight swaps if they keep positions for more than 24 hours. Instead the accounts are charged an annual fee to trade Forex which covers the administrative costs of maintaining the account.

These are the tips to steer clear of scams and brokers who are fraudulent:

It is essential to choose a licensed broker that has been endorsed by respected regulatory bodies.

Review sites from traders are an excellent way to verify the credibility of the broker.

Beware of salespeople who promise unrealistic results or using high-pressure sales tactics.

OANDA. TD Ameritrade. FOREX.com Interactive Brokers. Charles Schwab.

You must be aware of important elements like regulation oversight, transaction costs customer service, and account types when searching for the ideal Forex broker. Avoid common mistakes and choose an honest partner to your trading journey by thoroughly investigating potential brokers before you make any commitments.

This will make sure you have the right information to decide when selecting the right Forex broker.

Recent years have seen an increase in the use of automated Forex trading systems. A report from Transparency Market Research estimates that the market for algorithmic trading will reach $27 billion by 2026.

These are some fascinating facts

Automated trading platforms, also known as "bots," are becoming more popular due to their ability to allow traders to execute trades without human intervention based on pre-defined requirements.

The Forex market is dominated by central banks that implement monetary policies that impact currency prices.

Forex trading can be done at any time of the day or night and 24 hours a day.

Forex market is a decentralized platform which allows transactions to be conducted over-the-counter (OTC) without the requirement of an exchange or clearinghouse.

EUR/USD/JPY and GBP/USD are the most frequently traded pairs of currency in Forex. These currencies account for more that half of all transactions. USD is on 80 percent..

Before choosing a broker or deciding on the appropriate leverage level for trading, traders must be aware of their risk tolerances and investment objectives. Furthermore, traders should be informed about current market conditions and levels of volatility to make educated trade decisions.

Demo accounts are highly recommended for people who are brand new to Forex trading and want to try various strategies without the risk of real funds. Numerous brokers offer demo accounts that allow traders to test trading using virtual funds in a simulated market environment. It is a great opportunity to gain experience and confidence before opening a live account.

Forex trading presents exciting opportunities for those who invest the time and effort required to study the market and to develop trading strategies. Understanding leverage is a crucial aspect of Forex trading, it could also have a major impact on the overall performance of a trader. So why not start practicing by opening a demo account right now? It's a great way to get started on your path to becoming an effective Forex trader.