Top ten Accounting Myths

from web site

So often I am away in a restaurant, store, or outing and someone in our family or party of friends states "You're the accountant, how much is usually this? " and wants me in order to calculate something throughout my head. Let me let you almost all in on a small secret... I am not really a mathematician, I will be an accountant. When my calculator is not near, no longer ask me to calculate anything. My partner and i is going to let you in on a several more secrets as well. Read below to get the top 10 Data processing myths I possess put together.

#1 Accounting Myth

Accounting is about mathematics. This can not be further than the fact. Yes, you work with math, but therefore does an manufacture, salesman, marketing individual, lawn man, curly hair stylist, etc. In the event that you want in order to receive money, you will certainly have to calculate the amount you are usually owed, the switch if paid throughout cash, your commission percentage, and so forth Accountancy firm use math likewise. Accounting is construction for assets, liabilities, income, expenses, and many others... yes; nevertheless , the "meat and potatoes" of true sales is research and even storytelling. Would you enjoy putting a dilemna together? Well, within accounting, when you look through those details you are interested in holes to put that right piece into. A person have to work with those numbers in order to tell who owns a business, shareholder, traditional bank, or manager what they mean; how that they can utilize them; plus what to assume later on. It's stats, not algebra.

#2 Accounting Myth

Scrivener = Tax Preparer or IRS Broker. Oh so incorrect, wrong, wrong. Understand that if you enter into a major taxes franchise or sequence your taxes are most likely being prepared simply by a trained "tax preparer" NOT a documentalist. The true associated with an accountant will be one who may have a new degree in Data processing. Yes, I prepared taxes right from college when I actually worked for a public CPA organization, but the just reason that We were required to do such was because the companion I worked regarding had a couple of tax clients. Primarily, I audited businesses. This does not mean a new tax audit. This means that I actually went in, checked out their books in addition to spot-checked for accuracy and reliability. After this, many of us would provide them with a new report on necessary improvements and regions that looked very good. This is a very brief brief summary of a firm audit. Many accountancy firm work in private companies compiling financial records for the managers in addition to owners, some function in fraud examining where they assist companies detect or perhaps investigate fraud, when others simply check with on various matters.

Be careful whenever someone says these people are a los angeles accountant. My partner and i hear bookkeepers plus secretaries say this kind of all the time and they also don't know the difference among a journal entrance and the coffee pot. Not to be able to undermine secretaries and even bookkeepers. I value them all and I greatly appreciate their particular work as My partner and i have many functioning on my staff, but they are usually NOT accountants. I will not say to my clients that they are such. This will be not a fair explanation of who they are and even their qualifications.

#3 Accounting Myth

Construction is for Adult men only. In every single company where I actually have been applied or worked using, the ratio involving women to guys is either 50% or higher in the can certainly favor. Actually, many are dominated simply by women. Yes, I have seen mostly guys in the business positions, but females are growing rapidly in this area as effectively. As many firms see that women can balance household and work [most times better than you guys], they are without loosing the abilities and qualifications of women in these kinds of fields. Now guys, you are not really being pushed away. It is a great place for both people to show their potential. Just may expect your sex to determine the place in the accounting world.

#4 Data processing Myth

Accountants are introverted or boring and really don't like working with consumers. A tax documentalist must be a people-person. Many of us have to work with consumers, employees, vendors, client's customers, etc. I like this field because of the people interaction. I love to talk [I'm sure my man would agree] and i also love to be able to teach. To take accounting and turn this into understandable dialect for my consumers who range from Funeral Homes in order to Hair Stylists. My partner and i arrive at teach these people how their numbers can tell them typically the stories they need to hear and what their futures may well hold.

My colleagues and friends throughout college were great and we had been all accounting students. We went outside for drinks, went dancing at golf equipment, went to typically the lake swimming in addition to skiing, worked out at local health clubs, etc. A lot more not dull for us in all and seeing that a business person and scrivener now, I could guarantee you that my life is definitely anything but dull. I use 2 small children, a husband (business partner), workers, family, friends, clubs and organization meetings and the checklist goes on. In case I have time to take attention of chores, this kind of is an advantage within the week.

#5 Accounting Myth

Little Businesses don't will need accounting or that can just wait until it's get to be able to be a lot of intended for me to manage myself. Ok, so this signifies that because a small enterprise owner, you would probably state that you no longer need to spending budget, forecast financials, learn about trends in your business, or realize the latest, finest tax advantages. My partner and i have clients that are as small because an one-man support business making just about 20K each year.

Every business requirements an accountant watching their back. Now, this specific person or business needs to be trustworthy and qualified, however you need them, however. A enterprise cannot and may certainly not be run depending on whether or not really there is cash in the bank in that current time. At the conclusion of the season, precisely how do you realize whether you are planning to report a new loss or revenue for the IRS? A person need to record as much reduction as you can to pay as little taxation as you may or you are simply cheating yourself. Numerous tax firms charges you you an provide and a calf in case you go within with a field or in a few cases, a garbage bag, filled with receipts and say, "Here. Please do the taxes. " That they have to fee you the time they will are going to be able to allocate to thumbing through these invoices and most probably they will certainly not take the time to make certain they will put every very little nickel and cent they can in order to losses so an individual pay as low as potential in taxes.

Your current accountant will be right away your financials typically the entire year and even everything should end up being neat and clear come time to data file your taxes. Furthermore, your accountant have to be able to be able to give you month to month financials that let you know where you may improve within a region, have reports ready for possible loan products, help you help to make financial decisions, aid you make typically the most of modern tax advantages, in addition to tell you if your business will craze towards lower or more revenue in selected months based on history. This is most needed information in addition to once my clients come into my services, they usually are amazed that they can were ever capable of run their own business without the services.

#6 Sales Fantasy

An Scrivener will cost us an arm in addition to a leg. Fine, this might be typically the case should you get to a high-dollar firm, but when looking for a lawyer, if you preserve the services associated with Robert Shapiro, that wouldn't be inexpensive either. You have to locate the right company or individual intended for you. Check recommendations, qualifications, and solutions. Be sure the purchase price matches the market standards in your area and become sure they help make you feel great about working along with them. You should be number 1 to them and you should be ready to find a skilled person or firm to work with.

My firm is usually known for decreased rates as this is the particular way I developed it. I wanted in order to create a firm where I can cater to small , and start-up businesses but be affordable for them as well. My partner and i have always priced my services less than the cost of finding a full-time employee and often We have gone very much, much less; based on the customer, their needs, plus their finances. Call me or netmail and we may talk to observe if we are able to assist you or with least help you out.

#7 Accounting Fable

My partner and i pay business costs out of my very own pocket. It's really huge deal. FLAWED. If you own or even operate a company, it is some sort of business, not your current spouse. You have to notice when you include paid an expenses away from your own pocket. It is money that could be delivered to you tax-free.

For instance , I have got a client that we met with lately. She owns a salon. She does not really have an organization bank account and all expenses are paid through your ex own account. Now, she takes typically the income into that will same account. The woman husband is some sort of full-time employee in another company. Very first, there is simply no way to find out if she is usually truly making a new profit or not. 2nd, she is compensated a salary. Her salary is taxable. If her enterprise is breaking actually, she gets been paying double the fees she should have got. She was by no means reimbursed for her out-of-pocket expenses correctly which should have recently been TAX-FREE.

She ought to be able to be able to no less than be refunded for that expenses the lady has purchased out and about of her own pocket [tax-free] before taking a salary which is taxable. Since her accountant, There are advised her to spread out a business financial institution account. At this point your woman will deposit earnings into this account and pay expenses from here. If right now there is not adequate cash to pay out bills, she will pay out them from her own pocket but she will get sure to tell us when she performs this. We record this specific as reimbursements which might be due back to her tax-free plus she will receive this particular money back if the company cash circulation provides for this.

#8 Accounting Myth

I actually terribly lack time plus don't need to set goals for me personally and my service. Every company I actually have ever known, read about, or been involved inside of has used goal-setting while an intricate component of running their own business. Life to be sure it moves with a head-spinning speed. No matter the industry, changing instances can cause mayhem and in many cases put a new company out of business if they do not necessarily stay up-to-date using trends, technology, in addition to consumer information.

Stay down and create out 10 goals for yourself plus your company. As soon as completed, put these goals in goal order from highest to lowest. Set them in a place where you will constantly turn out to be reminded of your current goals. Each 30 days sit down and even review these targets. Write down exactly what you did to be able to come closer in order to each one and in the event that you have arrived at any of these people. As you achieve your goals, mix them off the particular list. Tend not to remove them. This gives you a sense involving accomplishment and exhibits you that your challenging work is paying down.

#9 Accounting Misconception

I really no longer need accounting reviews to know how my personal business is carrying out. If you are busy, this truly does not mean that your organization is doing effectively. You require reports to tell you in the event that your prices are really where they need to be in assessment to expenses a person are incurring. You need to run reports to demonstrate problem areas such as theft, loss, squander, profitable areas, and so on. After you run these kinds of reports, you and then need to learn how to use them. If you run a report that demonstrates you have a main portion of waste throughout your manufacturing procedure, you then need to come up along with a solution to be able to the problem and both discover a way to enjoy income from the particular waste material, discover a way to reuse the fabric, or better the task to lessen typically the amount of waste material.

In the service industries, reports can show how moment is allocated. In case time is allocated poorly, money is being lost so that as 99% of organizations in the land, I feel sure you usually are trying to make a profit. These information can help reveal the condition area plus help to switch employee duties or perhaps activities in a manner that can bring profit again or increase the particular profit of your company quickly and efficiently.

#10 Sales Myth

I will handle my accounting myself personally. read more have QuickBooks. Ha! This 1 actually makes us chuckle a tiny. QuickBooks is surely a wonderful program and one that will I use each and every day, but it really does not make require for an scrivener away. As a new matter of truth, most open QuickBooks only to become overwhelmed and confused. Having this program is very good and can become the awesome tool, however your accountant needs to be able to assist you to set that up, educate a person on the best way to plus should use that, and come in periodically to be sure every thing is in buy, run reports, plus fix problem areas. You could be wonderful within business but except if you know just how to operate the particular accounting side regarding your business perfectly, you should genuinely do yourself a prefer and at least get advice from an accountant on this process.

As We said, this is a great plan, but if an individual don't realize accounting, seeking to figure out there tips on how to book numbers can be misleading and generate an even greater mess. If you don't enter your current large assets correctly and depreciate all of them, you are missing out of expenses that can bring you tax advantages. If you don't book expenses the correct way, you might be using larger deductions than you should and this may cause problems using the IRS. When you don't statement all of the income you are suppose to, you know exactly how the IRS might feel about this. When you don't book discounts or refunds correctly, you overlooked another tax discount. Are you finding a trend involving troublesome areas? You actually need to end up being educated by your own accountant effectively make use of your accounting software before you attempt to dive in.

#1 Accounting Myth

Accounting is about mathematics. This can not be further than the fact. Yes, you work with math, but therefore does an manufacture, salesman, marketing individual, lawn man, curly hair stylist, etc. In the event that you want in order to receive money, you will certainly have to calculate the amount you are usually owed, the switch if paid throughout cash, your commission percentage, and so forth Accountancy firm use math likewise. Accounting is construction for assets, liabilities, income, expenses, and many others... yes; nevertheless , the "meat and potatoes" of true sales is research and even storytelling. Would you enjoy putting a dilemna together? Well, within accounting, when you look through those details you are interested in holes to put that right piece into. A person have to work with those numbers in order to tell who owns a business, shareholder, traditional bank, or manager what they mean; how that they can utilize them; plus what to assume later on. It's stats, not algebra.

#2 Accounting Myth

Scrivener = Tax Preparer or IRS Broker. Oh so incorrect, wrong, wrong. Understand that if you enter into a major taxes franchise or sequence your taxes are most likely being prepared simply by a trained "tax preparer" NOT a documentalist. The true associated with an accountant will be one who may have a new degree in Data processing. Yes, I prepared taxes right from college when I actually worked for a public CPA organization, but the just reason that We were required to do such was because the companion I worked regarding had a couple of tax clients. Primarily, I audited businesses. This does not mean a new tax audit. This means that I actually went in, checked out their books in addition to spot-checked for accuracy and reliability. After this, many of us would provide them with a new report on necessary improvements and regions that looked very good. This is a very brief brief summary of a firm audit. Many accountancy firm work in private companies compiling financial records for the managers in addition to owners, some function in fraud examining where they assist companies detect or perhaps investigate fraud, when others simply check with on various matters.

Be careful whenever someone says these people are a los angeles accountant. My partner and i hear bookkeepers plus secretaries say this kind of all the time and they also don't know the difference among a journal entrance and the coffee pot. Not to be able to undermine secretaries and even bookkeepers. I value them all and I greatly appreciate their particular work as My partner and i have many functioning on my staff, but they are usually NOT accountants. I will not say to my clients that they are such. This will be not a fair explanation of who they are and even their qualifications.

#3 Accounting Myth

Construction is for Adult men only. In every single company where I actually have been applied or worked using, the ratio involving women to guys is either 50% or higher in the can certainly favor. Actually, many are dominated simply by women. Yes, I have seen mostly guys in the business positions, but females are growing rapidly in this area as effectively. As many firms see that women can balance household and work [most times better than you guys], they are without loosing the abilities and qualifications of women in these kinds of fields. Now guys, you are not really being pushed away. It is a great place for both people to show their potential. Just may expect your sex to determine the place in the accounting world.

#4 Data processing Myth

Accountants are introverted or boring and really don't like working with consumers. A tax documentalist must be a people-person. Many of us have to work with consumers, employees, vendors, client's customers, etc. I like this field because of the people interaction. I love to talk [I'm sure my man would agree] and i also love to be able to teach. To take accounting and turn this into understandable dialect for my consumers who range from Funeral Homes in order to Hair Stylists. My partner and i arrive at teach these people how their numbers can tell them typically the stories they need to hear and what their futures may well hold.

My colleagues and friends throughout college were great and we had been all accounting students. We went outside for drinks, went dancing at golf equipment, went to typically the lake swimming in addition to skiing, worked out at local health clubs, etc. A lot more not dull for us in all and seeing that a business person and scrivener now, I could guarantee you that my life is definitely anything but dull. I use 2 small children, a husband (business partner), workers, family, friends, clubs and organization meetings and the checklist goes on. In case I have time to take attention of chores, this kind of is an advantage within the week.

#5 Accounting Myth

Little Businesses don't will need accounting or that can just wait until it's get to be able to be a lot of intended for me to manage myself. Ok, so this signifies that because a small enterprise owner, you would probably state that you no longer need to spending budget, forecast financials, learn about trends in your business, or realize the latest, finest tax advantages. My partner and i have clients that are as small because an one-man support business making just about 20K each year.

Every business requirements an accountant watching their back. Now, this specific person or business needs to be trustworthy and qualified, however you need them, however. A enterprise cannot and may certainly not be run depending on whether or not really there is cash in the bank in that current time. At the conclusion of the season, precisely how do you realize whether you are planning to report a new loss or revenue for the IRS? A person need to record as much reduction as you can to pay as little taxation as you may or you are simply cheating yourself. Numerous tax firms charges you you an provide and a calf in case you go within with a field or in a few cases, a garbage bag, filled with receipts and say, "Here. Please do the taxes. " That they have to fee you the time they will are going to be able to allocate to thumbing through these invoices and most probably they will certainly not take the time to make certain they will put every very little nickel and cent they can in order to losses so an individual pay as low as potential in taxes.

Your current accountant will be right away your financials typically the entire year and even everything should end up being neat and clear come time to data file your taxes. Furthermore, your accountant have to be able to be able to give you month to month financials that let you know where you may improve within a region, have reports ready for possible loan products, help you help to make financial decisions, aid you make typically the most of modern tax advantages, in addition to tell you if your business will craze towards lower or more revenue in selected months based on history. This is most needed information in addition to once my clients come into my services, they usually are amazed that they can were ever capable of run their own business without the services.

#6 Sales Fantasy

An Scrivener will cost us an arm in addition to a leg. Fine, this might be typically the case should you get to a high-dollar firm, but when looking for a lawyer, if you preserve the services associated with Robert Shapiro, that wouldn't be inexpensive either. You have to locate the right company or individual intended for you. Check recommendations, qualifications, and solutions. Be sure the purchase price matches the market standards in your area and become sure they help make you feel great about working along with them. You should be number 1 to them and you should be ready to find a skilled person or firm to work with.

My firm is usually known for decreased rates as this is the particular way I developed it. I wanted in order to create a firm where I can cater to small , and start-up businesses but be affordable for them as well. My partner and i have always priced my services less than the cost of finding a full-time employee and often We have gone very much, much less; based on the customer, their needs, plus their finances. Call me or netmail and we may talk to observe if we are able to assist you or with least help you out.

#7 Accounting Fable

My partner and i pay business costs out of my very own pocket. It's really huge deal. FLAWED. If you own or even operate a company, it is some sort of business, not your current spouse. You have to notice when you include paid an expenses away from your own pocket. It is money that could be delivered to you tax-free.

For instance , I have got a client that we met with lately. She owns a salon. She does not really have an organization bank account and all expenses are paid through your ex own account. Now, she takes typically the income into that will same account. The woman husband is some sort of full-time employee in another company. Very first, there is simply no way to find out if she is usually truly making a new profit or not. 2nd, she is compensated a salary. Her salary is taxable. If her enterprise is breaking actually, she gets been paying double the fees she should have got. She was by no means reimbursed for her out-of-pocket expenses correctly which should have recently been TAX-FREE.

She ought to be able to be able to no less than be refunded for that expenses the lady has purchased out and about of her own pocket [tax-free] before taking a salary which is taxable. Since her accountant, There are advised her to spread out a business financial institution account. At this point your woman will deposit earnings into this account and pay expenses from here. If right now there is not adequate cash to pay out bills, she will pay out them from her own pocket but she will get sure to tell us when she performs this. We record this specific as reimbursements which might be due back to her tax-free plus she will receive this particular money back if the company cash circulation provides for this.

#8 Accounting Myth

I actually terribly lack time plus don't need to set goals for me personally and my service. Every company I actually have ever known, read about, or been involved inside of has used goal-setting while an intricate component of running their own business. Life to be sure it moves with a head-spinning speed. No matter the industry, changing instances can cause mayhem and in many cases put a new company out of business if they do not necessarily stay up-to-date using trends, technology, in addition to consumer information.

Stay down and create out 10 goals for yourself plus your company. As soon as completed, put these goals in goal order from highest to lowest. Set them in a place where you will constantly turn out to be reminded of your current goals. Each 30 days sit down and even review these targets. Write down exactly what you did to be able to come closer in order to each one and in the event that you have arrived at any of these people. As you achieve your goals, mix them off the particular list. Tend not to remove them. This gives you a sense involving accomplishment and exhibits you that your challenging work is paying down.

#9 Accounting Misconception

I really no longer need accounting reviews to know how my personal business is carrying out. If you are busy, this truly does not mean that your organization is doing effectively. You require reports to tell you in the event that your prices are really where they need to be in assessment to expenses a person are incurring. You need to run reports to demonstrate problem areas such as theft, loss, squander, profitable areas, and so on. After you run these kinds of reports, you and then need to learn how to use them. If you run a report that demonstrates you have a main portion of waste throughout your manufacturing procedure, you then need to come up along with a solution to be able to the problem and both discover a way to enjoy income from the particular waste material, discover a way to reuse the fabric, or better the task to lessen typically the amount of waste material.

In the service industries, reports can show how moment is allocated. In case time is allocated poorly, money is being lost so that as 99% of organizations in the land, I feel sure you usually are trying to make a profit. These information can help reveal the condition area plus help to switch employee duties or perhaps activities in a manner that can bring profit again or increase the particular profit of your company quickly and efficiently.

#10 Sales Myth

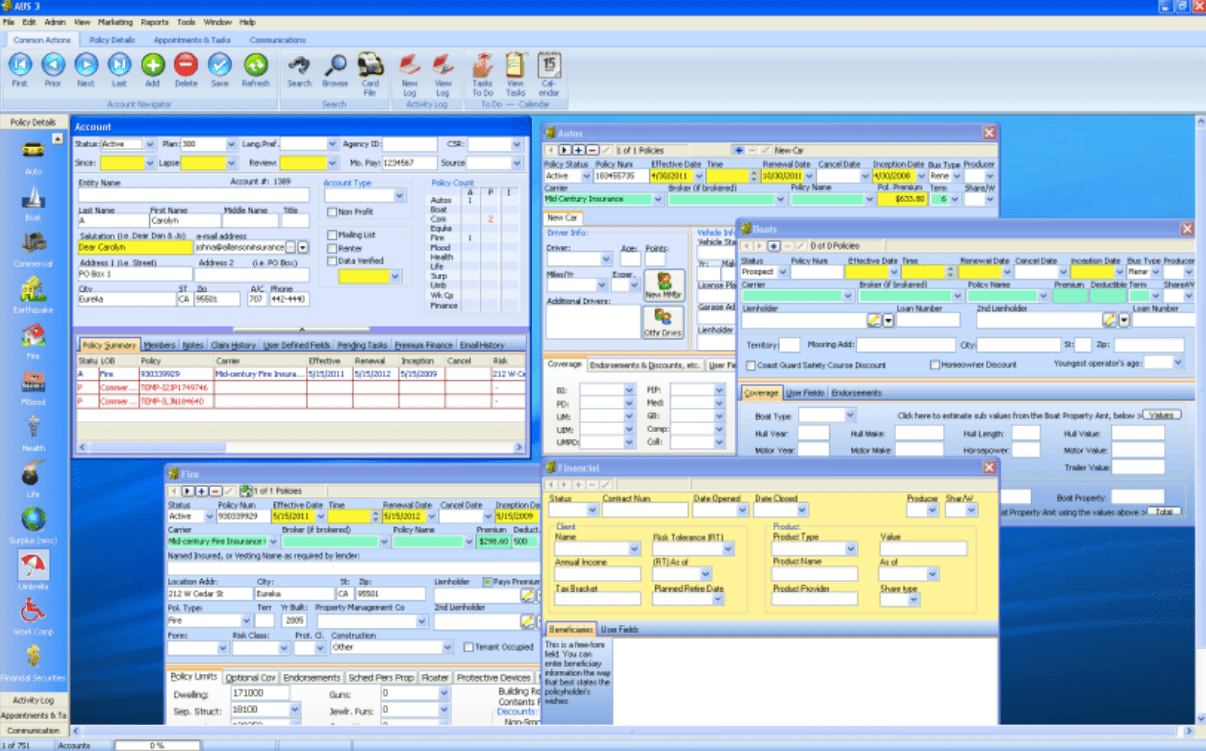

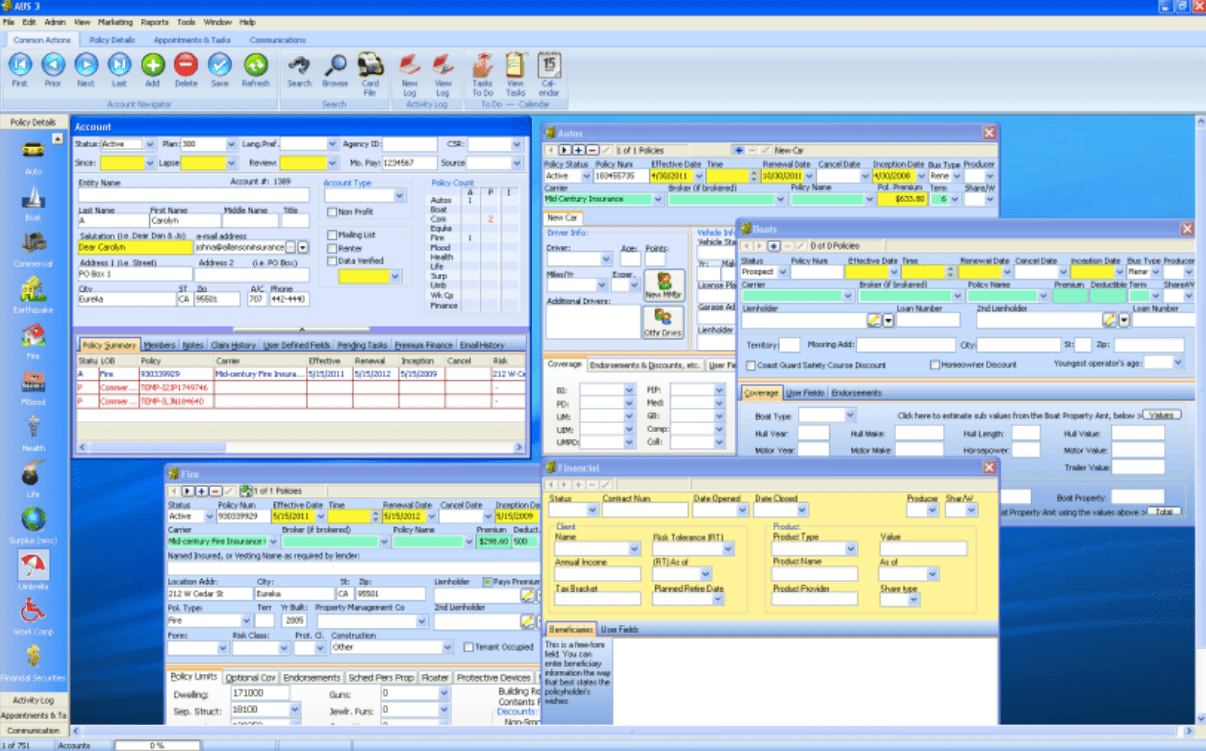

I will handle my accounting myself personally. read more have QuickBooks. Ha! This 1 actually makes us chuckle a tiny. QuickBooks is surely a wonderful program and one that will I use each and every day, but it really does not make require for an scrivener away. As a new matter of truth, most open QuickBooks only to become overwhelmed and confused. Having this program is very good and can become the awesome tool, however your accountant needs to be able to assist you to set that up, educate a person on the best way to plus should use that, and come in periodically to be sure every thing is in buy, run reports, plus fix problem areas. You could be wonderful within business but except if you know just how to operate the particular accounting side regarding your business perfectly, you should genuinely do yourself a prefer and at least get advice from an accountant on this process.

As We said, this is a great plan, but if an individual don't realize accounting, seeking to figure out there tips on how to book numbers can be misleading and generate an even greater mess. If you don't enter your current large assets correctly and depreciate all of them, you are missing out of expenses that can bring you tax advantages. If you don't book expenses the correct way, you might be using larger deductions than you should and this may cause problems using the IRS. When you don't statement all of the income you are suppose to, you know exactly how the IRS might feel about this. When you don't book discounts or refunds correctly, you overlooked another tax discount. Are you finding a trend involving troublesome areas? You actually need to end up being educated by your own accountant effectively make use of your accounting software before you attempt to dive in.