Company Capital Funding: Comprehending the Different Types and How to Protect Them

from web site

Not all entrepreneurs have the luxury of having enough individual savings to invest in their organizations, which is where service capital financing comes in. In this short article, we'll explore the different types of company capital funding and how to protect them.

Equity financing is a type of financing in which a financier provides capital to a service in exchange for ownership shares. This suggests that the investor becomes a partial owner of the business and is entitled to a part of its profits. Equity funding is frequently utilized by startups or early-stage businesses that have yet to generate significant profits. The benefit of this type of funding is that the business owner is not required to pay back the financial investment. However, it does imply that the financier has a say in the business's decision-making process.

Financial obligation financing includes obtaining money from a lending institution with the promise of paying it back with interest over time. This type of financing is typically utilized by recognized companies with a tested performance history of revenue and profitability. There are various sources of debt funding, consisting of conventional banks, online lenders, and government-sponsored programs. While financial obligation financing enables business owners to maintain control of their companies, it also suggests that they are responsible for paying back the loan despite the business's success.

Crowdfunding is a relatively new type of organization capital funding that has actually acquired appeal in current years. Crowdfunding can be either equity-based, in which financiers get ownership shares in the service, or reward-based, in which backers get products or services in exchange for their investment.

Prior to looking for funding, it's vital to have a strong service strategy in location. This includes a detailed description of your company, your target audience, your rivals, and your monetary forecasts. Having a well-written service strategy can help encourage loan providers or investors that your business is worth purchasing.

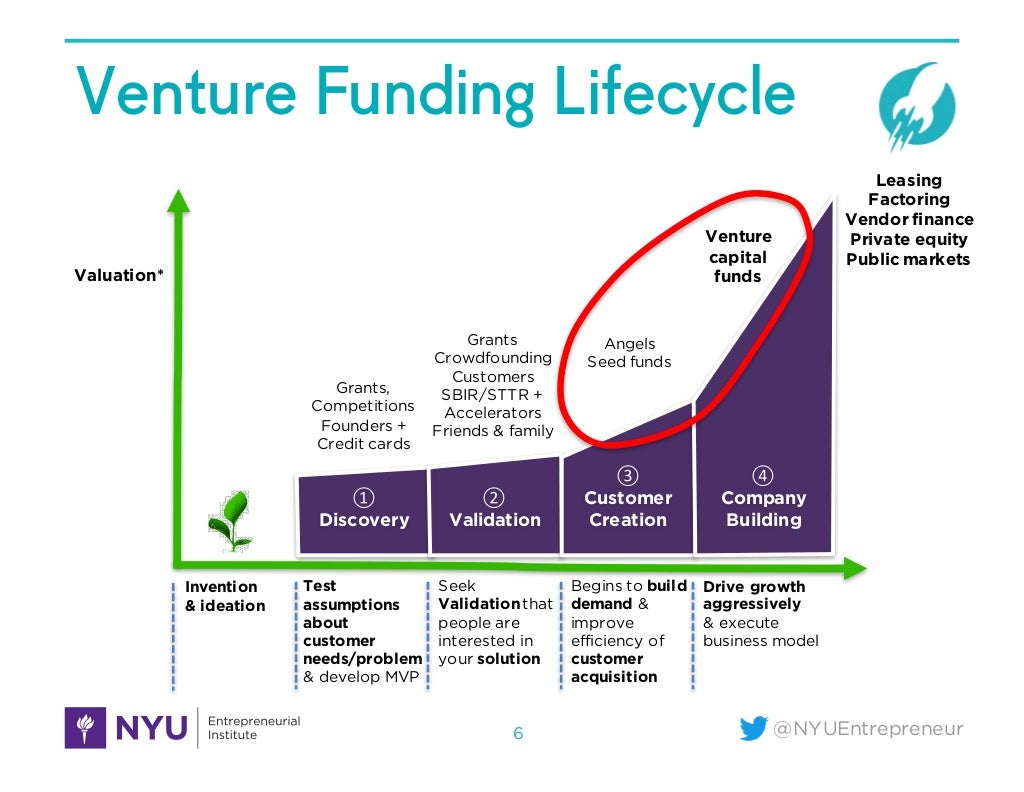

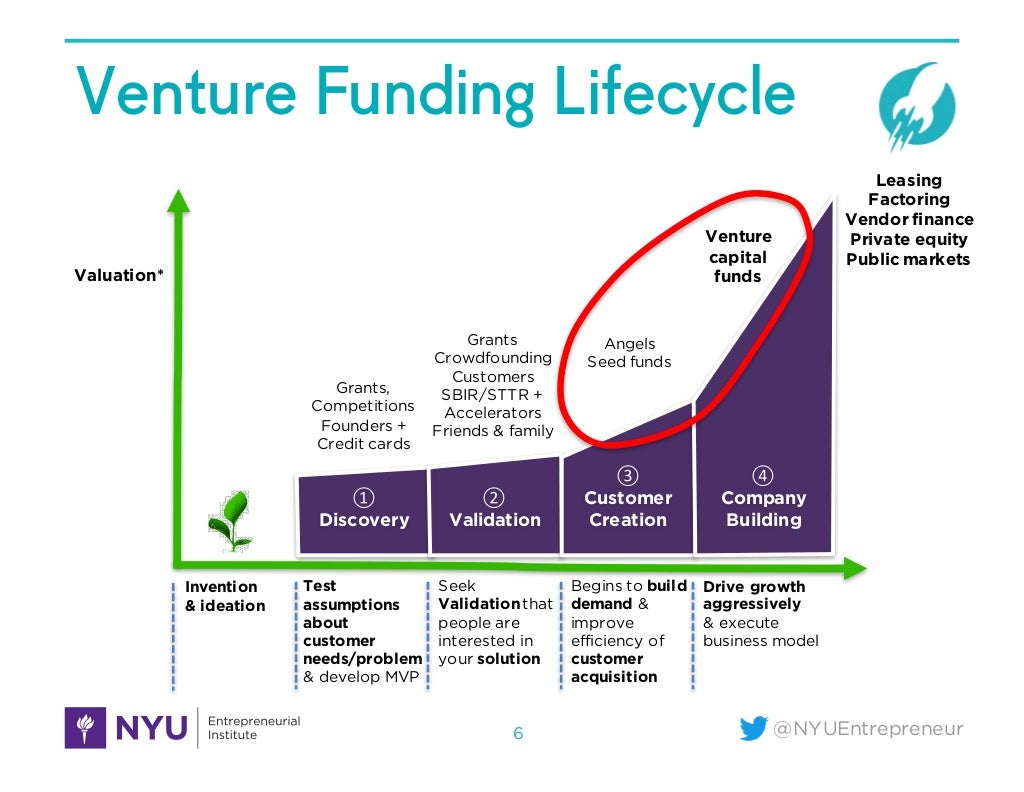

Different kinds of financing sources may be preferable for various organizations depending on their phase of growth, monetary history, and industry. It's crucial to research study and determine the right financing source that aligns with your business's needs and objectives.

Securing funding frequently includes building relationships with prospective investors or lending institutions. Attend networking events and conferences in your market, join organization associations, and look for mentorship from knowledgeable entrepreneurs. Structure these relationships can increase your chances of protecting financing and can likewise offer important guidance for your organization.

When looking for funding, you'll require to prepare a pitch that efficiently interacts your business's worth proposal and financial forecasts. Your pitch needs to be concise, engaging, and customized to your audience. Practice your pitch and be prepared to respond to any concerns that loan providers or financiers may have.

Once you've secured a prospective financing source, you'll likely undergo a due diligence process in which the financier or lender will completely evaluate your organization's financials, operations, and legal documents. It's vital to be gotten ready for this procedure by having all required documents and information easily available.

Protecting service capital financing can be a difficult process, however it's important for the development and success of your company. By comprehending the different kinds of financing and how to secure them, you can place your business for long-lasting success.

Follow https://shamethebanks.org/the-top-business-capital-funding-options-you-need-to-know-about/ for more about small business capital funding.

Not all business owners have the high-end of having enough personal cost savings to invest in their organizations, which is where service capital financing comes in. In this article, we'll explore the various types of service capital funding and how to secure them. Equity funding is a type of financing in which a financier supplies capital to a company in exchange for ownership shares. While financial obligation funding permits business owners to maintain control of their services, it also suggests that they are responsible for paying back the loan regardless of the service's success. Having a well-written organization plan can help encourage loan providers or investors that your business is worth investing in.

Knowledge source: https://www.investopedia.com/terms/c/capital-funding.asp

Types of Business Capital Funding

Equity Financing

Equity financing is a type of financing in which a financier provides capital to a service in exchange for ownership shares. This suggests that the investor becomes a partial owner of the business and is entitled to a part of its profits. Equity funding is frequently utilized by startups or early-stage businesses that have yet to generate significant profits. The benefit of this type of funding is that the business owner is not required to pay back the financial investment. However, it does imply that the financier has a say in the business's decision-making process.

Financial obligation Financing

Financial obligation financing includes obtaining money from a lending institution with the promise of paying it back with interest over time. This type of financing is typically utilized by recognized companies with a tested performance history of revenue and profitability. There are various sources of debt funding, consisting of conventional banks, online lenders, and government-sponsored programs. While financial obligation financing enables business owners to maintain control of their companies, it also suggests that they are responsible for paying back the loan despite the business's success.

Crowdfunding

Crowdfunding is a relatively new type of organization capital funding that has actually acquired appeal in current years. Crowdfunding can be either equity-based, in which financiers get ownership shares in the service, or reward-based, in which backers get products or services in exchange for their investment.

How to Secure Business Capital Funding

Establish a Business Plan

Prior to looking for funding, it's vital to have a strong service strategy in location. This includes a detailed description of your company, your target audience, your rivals, and your monetary forecasts. Having a well-written service strategy can help encourage loan providers or investors that your business is worth purchasing.

Determine the Right Funding Source

Different kinds of financing sources may be preferable for various organizations depending on their phase of growth, monetary history, and industry. It's crucial to research study and determine the right financing source that aligns with your business's needs and objectives.

Construct Relationships

Securing funding frequently includes building relationships with prospective investors or lending institutions. Attend networking events and conferences in your market, join organization associations, and look for mentorship from knowledgeable entrepreneurs. Structure these relationships can increase your chances of protecting financing and can likewise offer important guidance for your organization.

Prepare a Pitch

When looking for funding, you'll require to prepare a pitch that efficiently interacts your business's worth proposal and financial forecasts. Your pitch needs to be concise, engaging, and customized to your audience. Practice your pitch and be prepared to respond to any concerns that loan providers or financiers may have.

Be Prepared for Due Diligence

Once you've secured a prospective financing source, you'll likely undergo a due diligence process in which the financier or lender will completely evaluate your organization's financials, operations, and legal documents. It's vital to be gotten ready for this procedure by having all required documents and information easily available.

Protecting service capital financing can be a difficult process, however it's important for the development and success of your company. By comprehending the different kinds of financing and how to secure them, you can place your business for long-lasting success.

Follow https://shamethebanks.org/the-top-business-capital-funding-options-you-need-to-know-about/ for more about small business capital funding.

Not all business owners have the high-end of having enough personal cost savings to invest in their organizations, which is where service capital financing comes in. In this article, we'll explore the various types of service capital funding and how to secure them. Equity funding is a type of financing in which a financier supplies capital to a company in exchange for ownership shares. While financial obligation funding permits business owners to maintain control of their services, it also suggests that they are responsible for paying back the loan regardless of the service's success. Having a well-written organization plan can help encourage loan providers or investors that your business is worth investing in.

Knowledge source: https://www.investopedia.com/terms/c/capital-funding.asp