What are MetaTrader indicators?

from web site

MetaTrader indicators are tools used in technical evaluation inside the MetaTrader buying and selling platform. MetaTrader is a popular buying and selling platform extensively utilized by merchants within the foreign exchange (Forex) market, in addition to for buying and selling different monetary instruments corresponding to stocks and commodities.

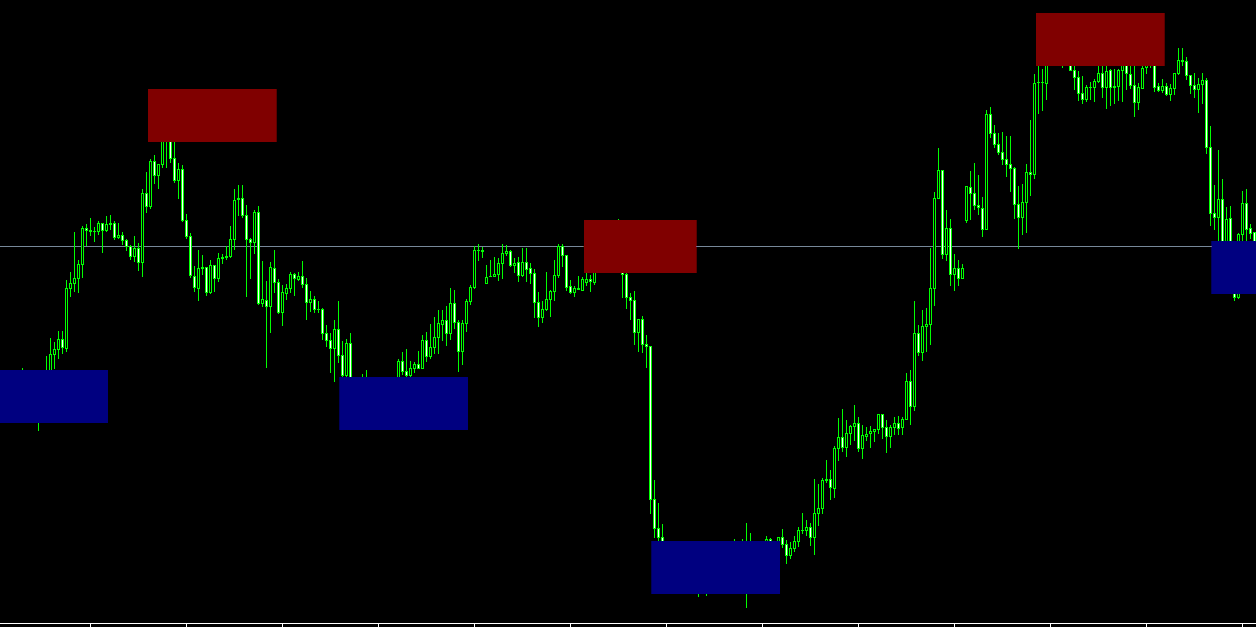

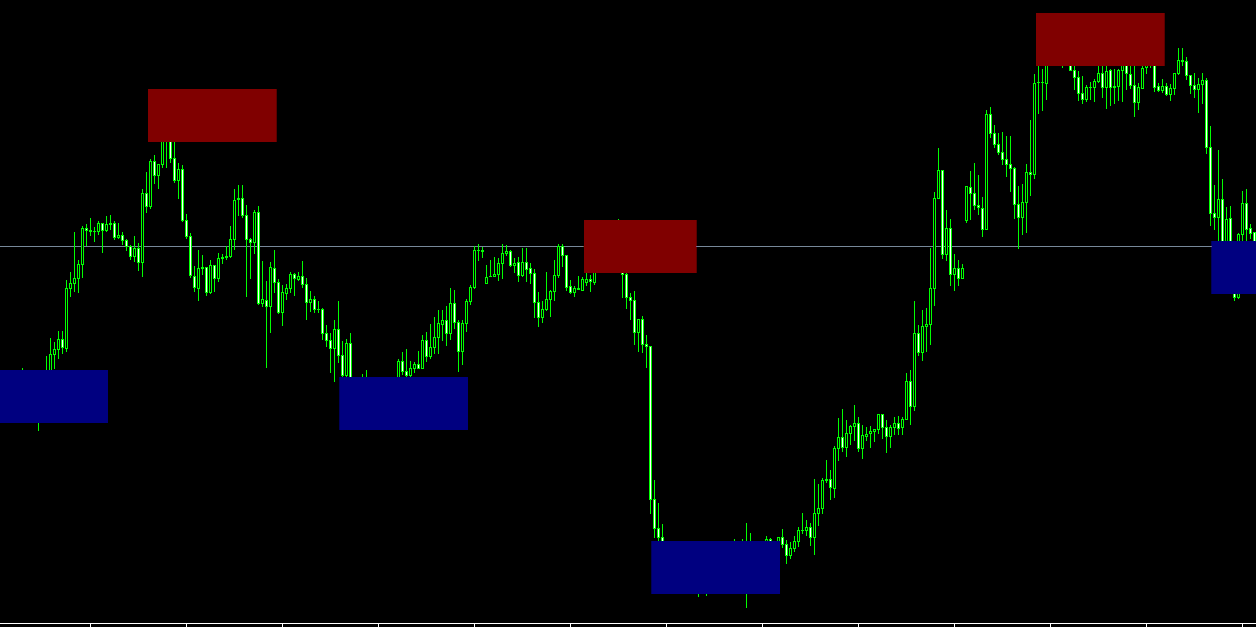

Indicators in MetaTrader are mathematical calculations based mostly on historical price and volume knowledge. They are plotted on value charts and are utilized by traders to investigate previous value movements and predict future worth movements. Check over here might help traders establish tendencies, reversals, overbought or oversold circumstances, and potential entry or exit factors for trades.

Here are a couple of key points about MetaTrader indicators:

Types of Indicators: MetaTrader helps all kinds of indicators, including trend indicators (like transferring averages), oscillators (such as Relative Strength Index or RSI), volume indicators, volatility indicators, and customized indicators created by merchants or developers.

Custom Indicators: Traders can create their very own custom indicators in MetaTrader using the platform's built-in programming language known as MQL (MetaQuotes Language). This permits for the development of distinctive and customized indicators tailored to specific trading methods.

Chart Analysis: Indicators are overlaid on value charts to visually characterize the calculated values. Traders can customise the looks and settings of those indicators based on their preferences.

Trading Signals: MetaTrader indicators can generate buying and selling alerts based mostly on specific circumstances. For occasion, a transferring common crossover (where a short-term moving common crosses above a long-term moving average) can be a sign for a potential pattern change.

Alerts and Notifications: Traders can arrange alerts and notifications inside MetaTrader indicators. When sure conditions are met, the platform can notify merchants through pop-up messages, email, or SMS, allowing them to respond promptly to potential trading opportunities.

Backtesting: Traders can use MetaTrader's Strategy Tester to backtest buying and selling strategies primarily based on historic knowledge. This characteristic allows traders to evaluate the effectiveness of their indicators and techniques earlier than implementing them in live trading.

It's necessary for merchants to understand that while indicators may be useful instruments, they are not foolproof. It's essential to use indicators at the facet of other types of analysis, have a great understanding of the market, and apply proper danger management methods to make informed trading choices..

Indicators in MetaTrader are mathematical calculations based mostly on historical price and volume knowledge. They are plotted on value charts and are utilized by traders to investigate previous value movements and predict future worth movements. Check over here might help traders establish tendencies, reversals, overbought or oversold circumstances, and potential entry or exit factors for trades.

Here are a couple of key points about MetaTrader indicators:

Types of Indicators: MetaTrader helps all kinds of indicators, including trend indicators (like transferring averages), oscillators (such as Relative Strength Index or RSI), volume indicators, volatility indicators, and customized indicators created by merchants or developers.

Custom Indicators: Traders can create their very own custom indicators in MetaTrader using the platform's built-in programming language known as MQL (MetaQuotes Language). This permits for the development of distinctive and customized indicators tailored to specific trading methods.

Chart Analysis: Indicators are overlaid on value charts to visually characterize the calculated values. Traders can customise the looks and settings of those indicators based on their preferences.

Trading Signals: MetaTrader indicators can generate buying and selling alerts based mostly on specific circumstances. For occasion, a transferring common crossover (where a short-term moving common crosses above a long-term moving average) can be a sign for a potential pattern change.

Alerts and Notifications: Traders can arrange alerts and notifications inside MetaTrader indicators. When sure conditions are met, the platform can notify merchants through pop-up messages, email, or SMS, allowing them to respond promptly to potential trading opportunities.

Backtesting: Traders can use MetaTrader's Strategy Tester to backtest buying and selling strategies primarily based on historic knowledge. This characteristic allows traders to evaluate the effectiveness of their indicators and techniques earlier than implementing them in live trading.

It's necessary for merchants to understand that while indicators may be useful instruments, they are not foolproof. It's essential to use indicators at the facet of other types of analysis, have a great understanding of the market, and apply proper danger management methods to make informed trading choices..