Effective Risk Management Strategies in CFD Trading

from web site

Going into cfd trading may appear complicated, but breaking it down step-by-step makes the procedure significantly clearer. That guide supplies a concise overview for new traders anxious to understand Agreements for Huge difference (CFDs). With the proper strategy, newcomers may learn the basics and start trading confidently.

Knowledge CFD Basics

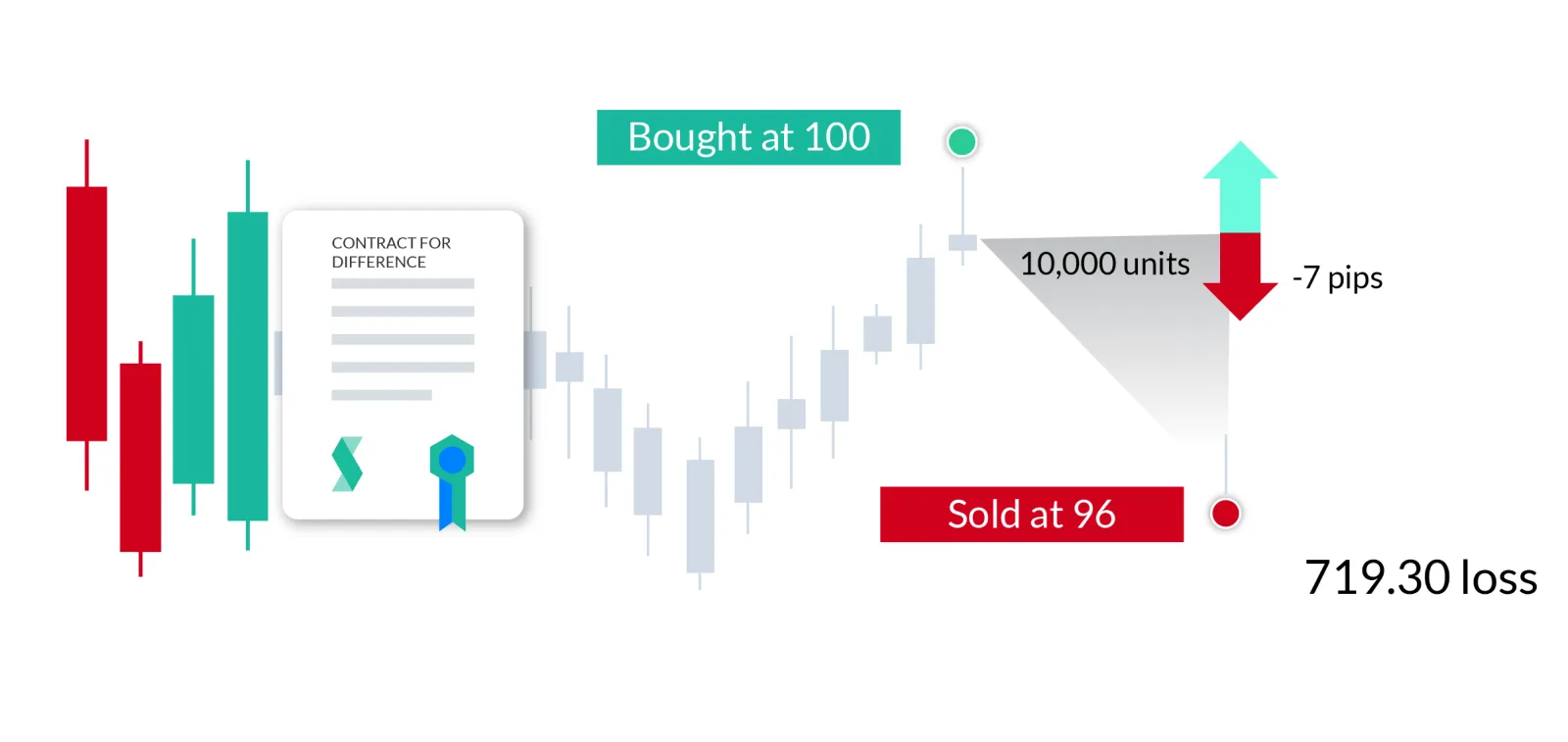

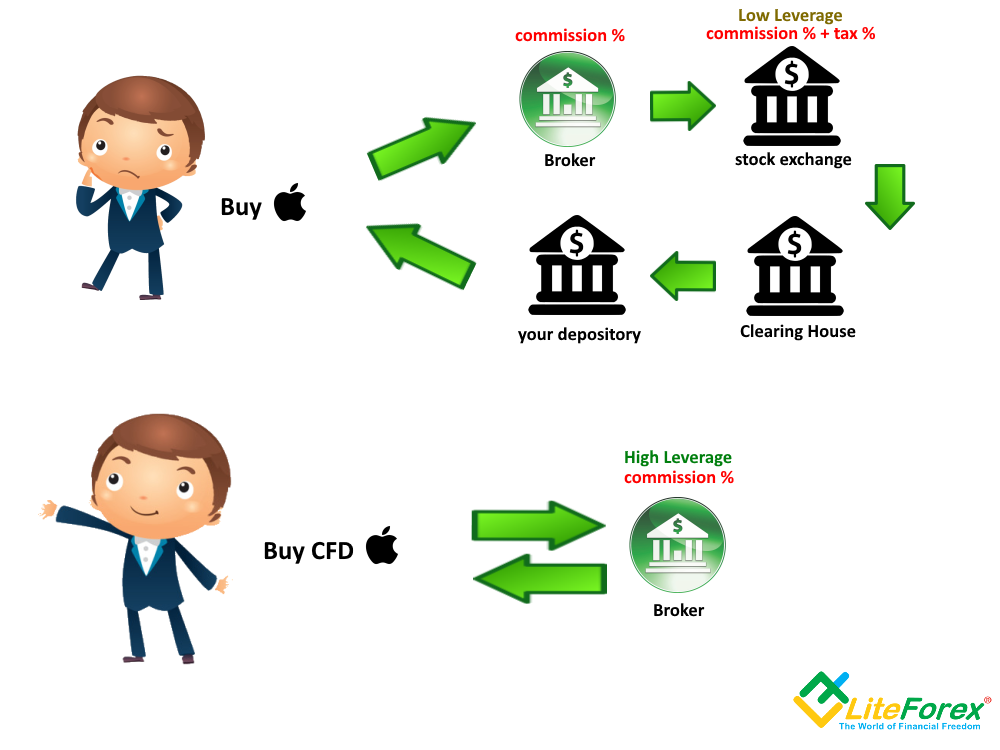

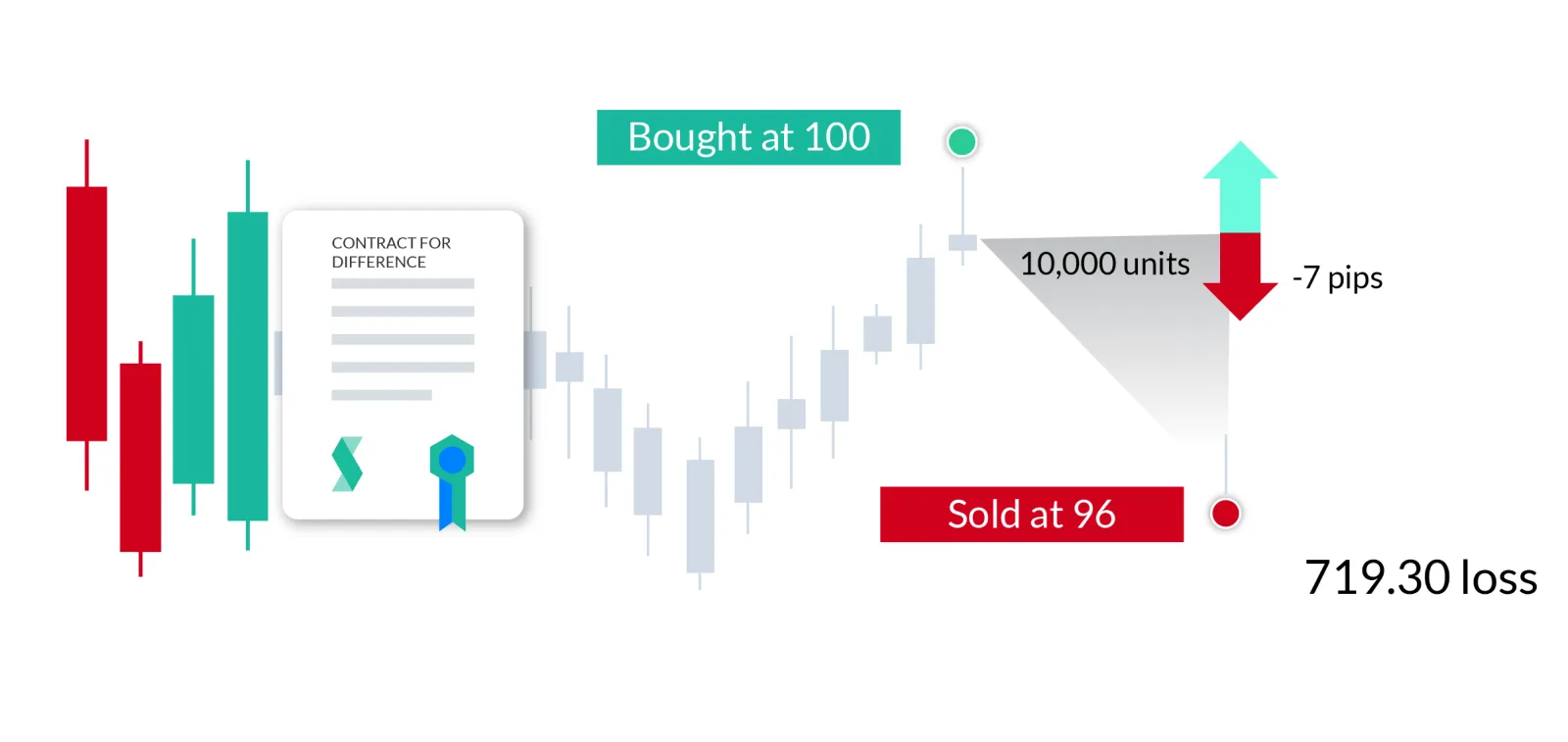

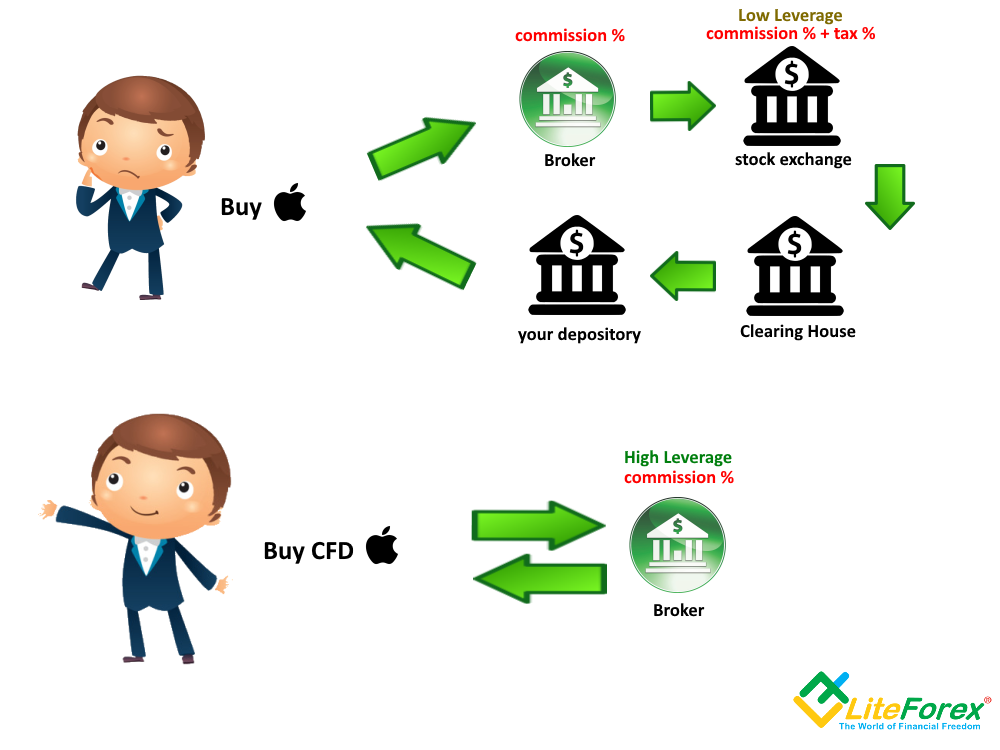

Agreements for Huge difference are economic derivatives that allow traders to imagine on value activities without owning the main asset. When trading CFDs, you're primarily predicting whether the value of a tool will increase or fall. If your prediction is correct, you produce a profit; or even, you incur a loss. That form of trading is common due to its flexibility and the capability to business on margin.

Beginning Your CFD Trading Trip

When you begin, it's important to understand industry thoroughly. Begin by researching various resources you are able to deal through CFDs, such as for example shares, indices, commodities, or currencies. Once you've picked a property, familiarize yourself with its industry situations and how additional factors may influence their price. Knowledge these things can help you produce educated conclusions and reduce risks.

Next, get more comfortable with the trading system you'll be using. Many tools provide trial accounts where you are able to training without endangering actual money. Make use of this function to investigate different strategies and realize the trading process. Focus on how control operates, as it can certainly boost both profits and losses.

Developing a Trading Strategy

A solid trading technique is crucial for achievement in CFD trading. Start with defining your targets and chance tolerance. Determine the quantity you're willing to spend and the amount of risk you're relaxed with. It's also essential to find out your access and exit details for every business, as this will allow you to avoid making impulsive decisions.

Still another critical part is controlling your risk. Implement stop-loss and take-profit orders to secure gets and limit losses. This process guarantees that you keep control over your trades and protect your opportunities, even if the market changes unexpectedly.

Entering the CFD Market

When you're knowledgeable about the basic principles and are suffering from a technique, it's time and energy to enter the market. Begin by making small trades to achieve self-confidence and experience. Check your trades closely and hold learning from each one. As time passes, you'll create a better knowledge of market styles and boost your decision-making skills.

In summary, CFD trading offers interesting options for new traders willing to put in the effort to understand and practice. By knowledge the fundamentals, creating a stable technique, and handling dangers effectively, novices will get achievement in this active market. Stay individual, keep learning, and your trading abilities will grow around time.

Knowledge CFD Basics

Agreements for Huge difference are economic derivatives that allow traders to imagine on value activities without owning the main asset. When trading CFDs, you're primarily predicting whether the value of a tool will increase or fall. If your prediction is correct, you produce a profit; or even, you incur a loss. That form of trading is common due to its flexibility and the capability to business on margin.

Beginning Your CFD Trading Trip

When you begin, it's important to understand industry thoroughly. Begin by researching various resources you are able to deal through CFDs, such as for example shares, indices, commodities, or currencies. Once you've picked a property, familiarize yourself with its industry situations and how additional factors may influence their price. Knowledge these things can help you produce educated conclusions and reduce risks.

Next, get more comfortable with the trading system you'll be using. Many tools provide trial accounts where you are able to training without endangering actual money. Make use of this function to investigate different strategies and realize the trading process. Focus on how control operates, as it can certainly boost both profits and losses.

Developing a Trading Strategy

A solid trading technique is crucial for achievement in CFD trading. Start with defining your targets and chance tolerance. Determine the quantity you're willing to spend and the amount of risk you're relaxed with. It's also essential to find out your access and exit details for every business, as this will allow you to avoid making impulsive decisions.

Still another critical part is controlling your risk. Implement stop-loss and take-profit orders to secure gets and limit losses. This process guarantees that you keep control over your trades and protect your opportunities, even if the market changes unexpectedly.

Entering the CFD Market

When you're knowledgeable about the basic principles and are suffering from a technique, it's time and energy to enter the market. Begin by making small trades to achieve self-confidence and experience. Check your trades closely and hold learning from each one. As time passes, you'll create a better knowledge of market styles and boost your decision-making skills.

In summary, CFD trading offers interesting options for new traders willing to put in the effort to understand and practice. By knowledge the fundamentals, creating a stable technique, and handling dangers effectively, novices will get achievement in this active market. Stay individual, keep learning, and your trading abilities will grow around time.