Understanding the Power of an IRR Calculator in Financial Planning

from web site

Creating educated expense decisions is important to maximizing results while minimizing risks. One powerful software that financial analysts and investors use to gauge the profitability of possible investments may be the Internal Rate of Reunite (IRR). An irr calculator is vital in assisting to streamline this process, providing quality and improving decision-making. But just what is IRR, and how can an IRR calculator improve expense choices?

Understanding IRR

The Central Charge of Return (IRR) may be the discount rate at which the internet present price (NPV) of an investment's cash runs means zero. In simpler terms, IRR represents the rate of get back where an investor can get to break even on an expense, contemplating equally preliminary outflows and future inflows. It's usually applied to evaluate and contrast various expense possibilities or jobs, because it helps to recognize which investments will create the best get back over time.

Why IRR is Very important to Investors

IRR is crucial because it gives a single, standardized metric that can be used across various kinds of investments. Investors typically aim for an increased IRR, since it signifies better profitability. It's particularly of use when you compare jobs or opportunities with different timeframes and cash movement structures, as it normalizes differences in size and duration.

But, calculating IRR manually could be time-consuming and complicated, particularly for investments with fluctuating cash moves or number of years horizons. This is wherever an IRR calculator comes into play.

How an IRR Calculator Optimizes Expense Choices

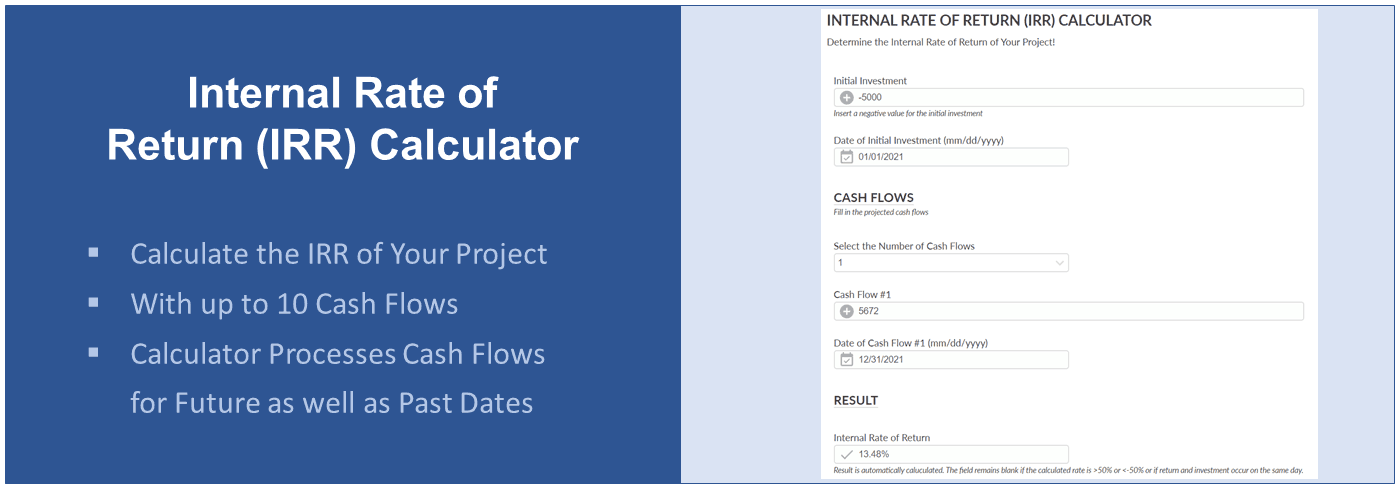

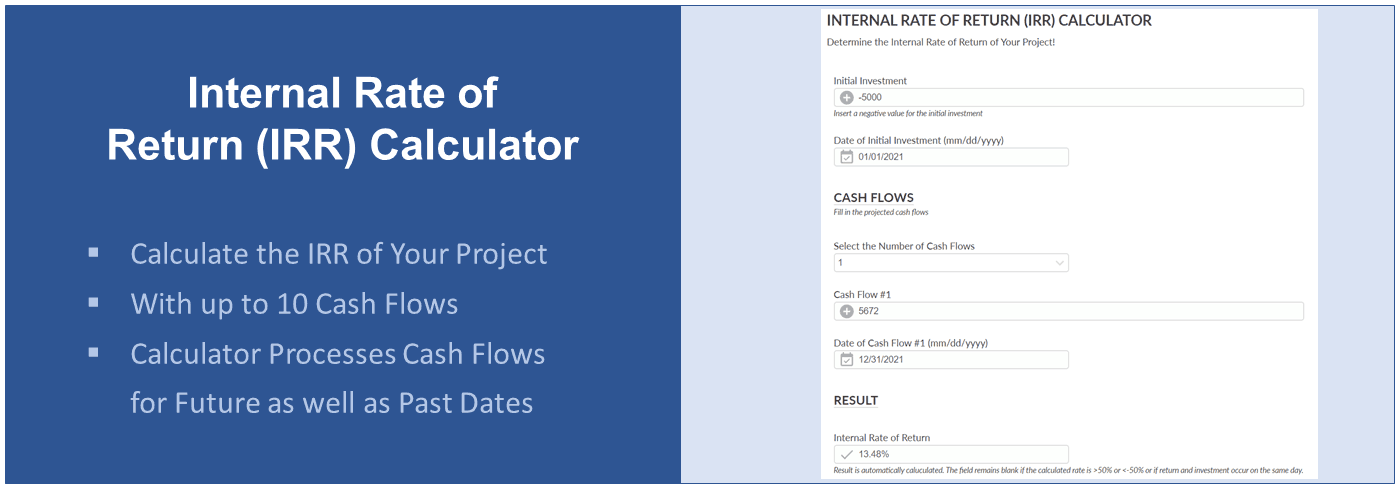

An IRR calculator is definitely an automatic software designed to quickly estimate the IRR of an investment, considering all appropriate cash inflows and outflows. Listed here is how it can improve your expense conclusions:

Simplicity and Pace: An IRR calculator removes the complexity of resolving for IRR manually, creating the process quicker and more accessible. Investors just insight the expected income flows and the software does the rest.

Accuracy: By utilizing advanced algorithms, IRR calculators assure correct results, that is essential for making high-stakes expense decisions. They lower the danger of individual mistake in information calculations.

Contrast: Several IRR calculators provide the capability to feedback numerous expense scenarios, enabling you to compare the IRR of different tasks area by side. This can help you choose the absolute most lucrative expense opportunity.

Situation Examination: Sophisticated IRR calculators permit you to conduct "what-if" analyses, adjusting assumptions like money movement designs, discount costs, or expense durations to observe improvements affect returns.

Realization

In the present fast-paced financial earth, optimizing expense decisions is paramount. The IRR calculator can be an vital software that simplifies complicated calculations and empowers investors to create data-driven decisions. By providing precise, rapid insights into the potential profitability of an expense, it enables investors to confidently allocate sources to probably the most promising options, ensuring greater results and decreased dangers on the extended term.

Understanding IRR

The Central Charge of Return (IRR) may be the discount rate at which the internet present price (NPV) of an investment's cash runs means zero. In simpler terms, IRR represents the rate of get back where an investor can get to break even on an expense, contemplating equally preliminary outflows and future inflows. It's usually applied to evaluate and contrast various expense possibilities or jobs, because it helps to recognize which investments will create the best get back over time.

Why IRR is Very important to Investors

IRR is crucial because it gives a single, standardized metric that can be used across various kinds of investments. Investors typically aim for an increased IRR, since it signifies better profitability. It's particularly of use when you compare jobs or opportunities with different timeframes and cash movement structures, as it normalizes differences in size and duration.

But, calculating IRR manually could be time-consuming and complicated, particularly for investments with fluctuating cash moves or number of years horizons. This is wherever an IRR calculator comes into play.

How an IRR Calculator Optimizes Expense Choices

An IRR calculator is definitely an automatic software designed to quickly estimate the IRR of an investment, considering all appropriate cash inflows and outflows. Listed here is how it can improve your expense conclusions:

Simplicity and Pace: An IRR calculator removes the complexity of resolving for IRR manually, creating the process quicker and more accessible. Investors just insight the expected income flows and the software does the rest.

Accuracy: By utilizing advanced algorithms, IRR calculators assure correct results, that is essential for making high-stakes expense decisions. They lower the danger of individual mistake in information calculations.

Contrast: Several IRR calculators provide the capability to feedback numerous expense scenarios, enabling you to compare the IRR of different tasks area by side. This can help you choose the absolute most lucrative expense opportunity.

Situation Examination: Sophisticated IRR calculators permit you to conduct "what-if" analyses, adjusting assumptions like money movement designs, discount costs, or expense durations to observe improvements affect returns.

Realization

In the present fast-paced financial earth, optimizing expense decisions is paramount. The IRR calculator can be an vital software that simplifies complicated calculations and empowers investors to create data-driven decisions. By providing precise, rapid insights into the potential profitability of an expense, it enables investors to confidently allocate sources to probably the most promising options, ensuring greater results and decreased dangers on the extended term.