Everything about You Really Can Lower Your Car Insurance Cost - The New ...

from web site

Regularly asked inquiries, That has the most affordable automobile insurance in New york city? According to our study, Main Street America has the most affordable rates in New York state, at $1,033 annually for complete insurance coverage. I have negative credit scores. Does that impact my vehicle insurance coverage rates? Having poor credit score can raise your rates by even more than half with some firms. cheap car insurance.

Prices for driving infractions and also "Poor" credit determined utilizing average rates for a single male 30-year-old driver with a credit history rating under 578. Your real quotes may differ.

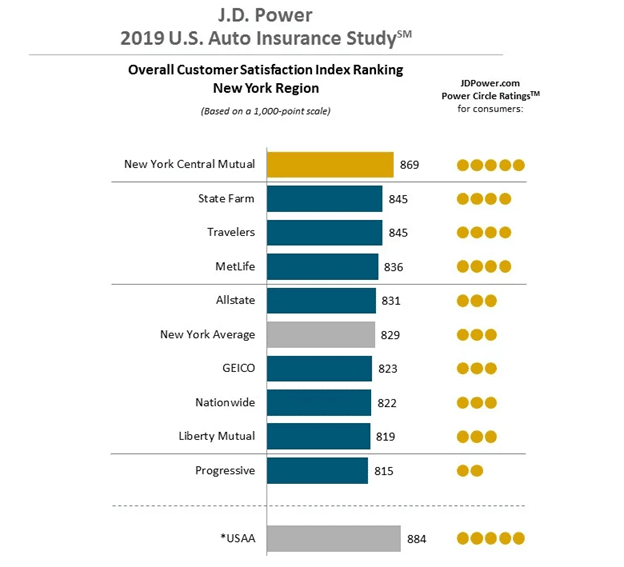

GEICO is the cheapest cars and truck insurance choice for the average New York vehicle driver. However, since your age, driving history and also credit rating also impact premiums, the least expensive alternative for you depends upon your account. As an example, Progressive and also State Ranch have the least expensive annual premiums for vehicle drivers with a DRUNK DRIVING, while is the cheapest insurance provider for seniors.

The General is the costliest insurance firm for minimum insurance coverage, with ordinary yearly prices of $5,352. New York City Central Mutual Fire, Show extra, These rates are only estimates based on prices for a typical New York motorist as well as need to not be made use of to compare insurance prices - cheap. Contrast Vehicle Insurance Policy Fees, Ensure you're obtaining the very best rate for your car insurance policy.

If you get a quote with one insurance provider for $50,000 in bodily obligation insurance coverage per mishap, you should make sure to utilize the same number when acquiring rates from an additional provider. affordable. Usage Money, Nerd's car insurance coverage calculator to get a quote price quote for your car insurance policy. If you desire a personalized quote, you'll need to provide personal details.

1. 3% of New york city chauffeurs report driving after drinking way too much in the previous thirty days. The above table mirrors estimates of what vehicle drivers in New york city can expect to spend for car insurance coverage if they obtain a DWI.In New york city, you might offer prison time for being founded guilty with a DWI.

The Ultimate Guide To Cheapest Car Insurance In New York City (2022) - Quotewizard

Typically, a driver with an at-fault mishap will pay $5,003 per year for vehicle insurance coverage - affordable. One of the most cost effective auto insurance business in New York for vehicle drivers with at-fault crashes are:: $2,695 each year: $2,795 per year is the most inexpensive choice in New york city if you have an at-fault crash, yet it is just offered to participants of the army and also their families.

If you receive a ticket for distracted driving or speeding, that will increase your insurance policy rates, as you can see in the chart below (auto). There are some insurer that will permit you to stay clear of a price boost by taking a secure driving training course, however this isn't a warranty, so examine with your insurance coverage business if you get a ticket while driving.

According to Experian, the average credit history in New york city is 712, which is greater than numerous various other states in the nation. An inadequate credit scores score can lead to greater insurance policy costs due to the fact that insurance coverage firms watch a low rating as a greater danger to guarantee - cheaper. The above price quotes mirror what an individual in New York with a poor credit history might pay for auto insurance policy.

While this might appear unjust, it does imply that improving your credit report rating can reduce your insurance premium (car). Cheapest Vehicle Insurance Coverage in New York City for Senior citizens, Cars and truck insurance provider bill senior drivers greater rates contrasted to middle-aged as well as young adult chauffeurs. An elderly motorist in New york city commonly requires to pay approximately $3,960 per year for their vehicle insurance, contrasted to $3,433 for the ordinary non-senior adult driver.

Most Inexpensive Cars And Truck Insurance in Browse around this site New York City by City, Vehicle insurance prices in New York State can vary widely depending upon where you live. Yonkers, with an ordinary price of $2,588 each year, is one of the most expensive city for vehicle insurance policy in New York, while Rochester is the cheapest with an ordinary price of $1,166 annual. cheaper.

Click on your city to discover even more regarding auto insurance expenses in your area - cheapest. Scroll for even more FAQs About Automobile Insurance Coverage in New York City, Consumers in New York have questions regarding which cars and truck insurance plan to acquire and also just how much it costs. Here are the response to help vehicle drivers make an educated insurance coverage choice.

The smart Trick of How To Save On Car Insurance: A Guide For First Time Nyc Drivers That Nobody is Talking About

Lawrence University, READ ANSWERSCompare Car Insurance Coverage Rates, Ensure you're getting the very best price for your car insurance policy - suvs. Compare quotes from the top insurance policy companies. Regarding the Writer.

You should have $50,000 in coverage. Uninsured vehicle driver physical injury covers medical expenses for you and also your passengers if wounded when struck by a motorist without any insurance policy. You must have 25/50 coverage. This indicates your insurer pays up to $25,000 each and also $50,000 in complete if there are two or even more people harmed. car insured.

Your age, your driving record, the design of vehicle you have, the intensity and frequency of claims in your community as well as other variables are used by insurance provider to find out the cost of your plan. That's why the price for the very same coverage can differ significantly among insurance companies and why you should compare prices. cheap insurance.

You can still save on coverage by comparing prices. You can conserve on car insurance policy prices, however, regardless of where you live. car.

If the difference in between the quote as well as your rate is significant, you can pull out of buying the plan, though usually the price quote will be relatively precise. cheap auto insurance. Once you prepare to buy a policy you will for sure requirement to have helpful details information, such as your motorist's permit number, VIN and also so on.

That's why the price for the same coverage can vary dramatically amongst insurance provider as well as why you should contrast rates. This is true whether you have had recent mishaps or moving violations or not and also whether you have excellent or bad credit score. Listed below we'll enlighten you a lot more on the many various kinds of auto insurance policy are called for to drive in New york city.

More About Best Cheap Car Insurance In New York (2022) - Marketwatch

Filing a mishap case indicates you are most likely to pay more for your cars and truck insurance policy coverage. Just how a lot a lot more you pay depends on a number of factors, and also your car insurance firm plays is one of those considerable elements. Each business assesses risk in a different way, to make sure that's why the rise after a crash will certainly vary amongst insurance firms.

com price information. You'll see in the table below exactly how much it costs, on average, to include a teen motorist in New York, as well as just how major insurers compare on price. Geico had the most affordable automobile insurance cost for including a chauffeur age 16 to a complete coverage family policy, among insurance providers surveyed. cheapest car insurance.

Along with contrasting prices, getting approved for a fully grown driver price cut can likewise cut expenses. In the Empire State's city areas, lots of people do not drive a lot if in all due to the fact that they have the ability to utilize public transport as well as taxis to commute, do errands, reach consultations as well as social activities and also so on.

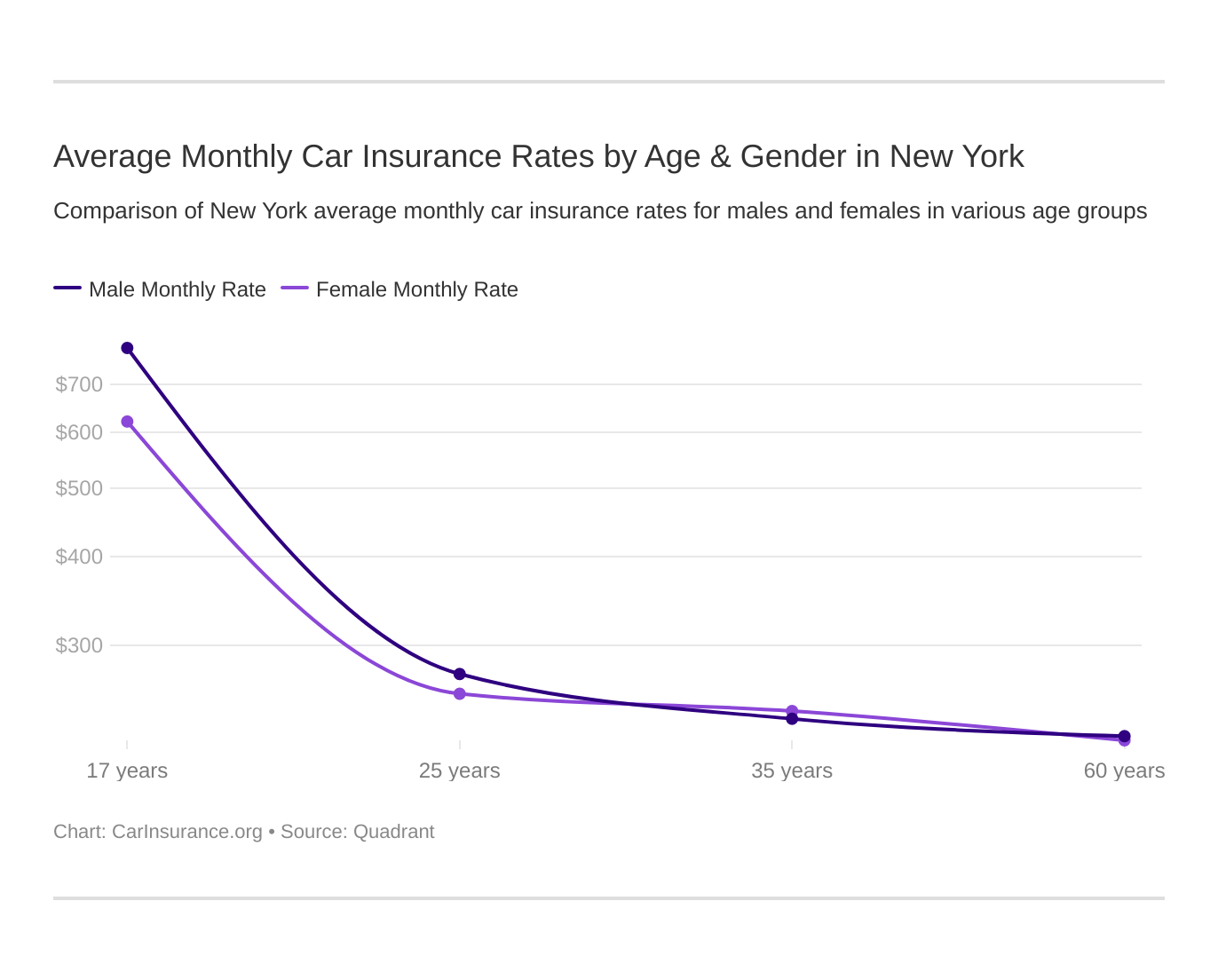

That's why economical automobile insurance coverage in New york city for initial time vehicle drivers differs a little bit from various other states. cheapest car. Prices for teen vehicle drivers are dramatically greater than those for older motorists, since automobile insurance coverage companies regard them as risky motorists as a result of their lack of experience behind the wheel. Prices begin to decrease a little bit as the motorist develops and by age 25 are extra in line with prices for fully grown chauffeurs.

So, the suggestions for locating cheap car insurance coverage as a new driver is the same as though for teenager and young chauffeurs contrast store to discover the least expensive price. An analysis of rates for new motorists in New york city showed that Geico had the cheapest prices, among the firms investigated.

The SR-22 is just a type that your automobile insurance coverage firm submits in your place with the state. It's the company's warranty to the state that you have lawfully mandated vehicle insurance protection. An SR-22 by itself does not elevate your insurance coverage prices. Rather, it's the conviction that caused the need that creates your costs to raise.

How To Save On Car Insurance: A Guide For First Time Nyc Drivers Things To Know Before You Get This

Medication, Pay is optional in New York and also not a must-have insurance coverage, because your PIP defense cares for the very same costs as Med, Pay. Nonetheless, one benefit of Medication, Pay is that there is no insurance deductible and it can help settle health and wellness insurance costs - insure. Med, Pay does the following: Covers you as well as your passengers' medical expenditures, Spends for expenditures after medical insurance limitations are surpassed, Provides added protection to insured motorists that are hit by a vehicle while strolling or cycling, If you and also your passengers: Don't have medical insurance, or have a strategy that doesn't cover vehicle crashes or has low limitations, we recommend that you add medical coverage of at the very least $5,000 to your cars and truck insurance plan.

If you get 11 points in an 18-month duration, your chauffeur certificate may be suspended. Factors stay on your document for 18 months. Factors are counted from the day of your offense, not from the day of your sentence. Automobile insurance coverage business do not utilize the DMV factor system when assessing your rate.

When you finish the class, you will certainly obtain a certification within 45 days that verifies you passed. You need to offer your insurance company a duplicate of the certificate within 90 days after finishing the program to obtain your discount. The NY DMV has a checklist of firms that provide approved on the internet mishap prevention/defensive driving programs at its PIRP website.